Observations by David Robertson, 8/30/24

It was a fairly quiet week but there were plenty of “rumblings” that could portend a volatile fall.

Aside from that, I hope you have a great, relaxing Labor Day weekend!

As always, if you want to follow up on anything in more detail, just let me know at drobertson@areteam.com.

Market observations

On Thursday, the revised number for GDP came out at 3.0% which was slightly higher than the original estimate. The increase was attributed primarily to “an upward revision to consumer spending”. Long-term rates edged up on the news.

Friday morning, the Personal Consumption Expenditures came out as expected. Once again, the data provide a Rorschach test. Bulls see inflation settling gently down to target and bears see inflation as remaining stubbornly above target. This gives the Fed a lot of room to do whatever it wants to do on monetary policy.

Economy

Bill Gross made a comment last week that resonated with me and I’m sure with a lot of other people as well:

Hard to measure but I suspect upper middle class and wealthy boomers are funding millennials and younger generational spending by transferring assets/cash and paying bills, and in the process pumping retail sales and the economy. In essence they are liquidating balance sheets to pay for spending. This is likely to continue as long as stocks/housing prices stay elevated.

In a sense this is unsurprising and unremarkable; of course, parents want to help their kids out when they can. Since the parents of many adult kids have benefitted from rising stock and house prices, they have been able to help out quite a bit.

As I mentioned last week though, it is more effective to transmit monetary policy in an income-driven (versus credit-driven) economy by way of Quantitative Tightening than through short rates. Gross’ observation lends additional credence to this notion. To the extent assets are being liquidated to pay for spending, lower asset values presumably would lower spending, at least among those fortunate enough to receive such supplemental income.

It will be interesting to watch if the Fed makes an effort to manage the channel of spending by way of asset values. Most importantly, however, it will be interesting to see if lower short-term rates boost growth or if the Fed is just pushing on a string.

Legal

I am not the kind of person who regales in poring over legal documents looking for important details. As a result, I very much appreciate those who do. On this front, Matt Stoller and Jason Kint have been doing a bang-up job reporting on the litany of corporate misdeeds.

For his part, Matt Stoller provides regular updates on the more prominent antitrust cases. There have been a lot lately. In one post he notes, “The $24 billion Kroger-Albertsons merger is getting ugly. The CEO of Albertsons was caught deleting documents the court ordered preserved.”

In another post, he highlights a finding that reveals “price fixing between large landlords”: “Our tool ensures that [landlords] are driving every possible opportunity to increase price even in the most downward trending or unexpected conditions.”

In yet another, he highlights that billionaire Barry Diller “recently called for Lina Khan [chair of the Federal Trade Commission] to be fired. As it turns out, the FTC revealed just this week that the FTC is suing Diller’s Care.com “for deceiving caregivers and trapping families into paid memberships”. This context makes Diller’s call look a lot more like banal self-interest than business acumen.

Stoller also writes regularly in his Substack, BIG, by Matt Stoller. A recent edition mentioned Google general counsel Kent Walker’s command for “employees to auto-delete documents.” How can this not be blatantly illegal?

Jason Kint tends to focus more on details, but those details can provide extremely useful context, especially for those of us who aren’t lawyers and who don’t have time to follow the trials. This post succinctly captures Google’s current quandary: “So it [Google] has an adtech trial about to start in under three weeks. It has a Court remedy, DOJ and public opinion moving towards structural separation. It has questionable proxies laughably still trying to argue Google’s ad monopolies are pro-consumer because personalization.” In short, Google is in a heap of legal doo doo.

One point is the more you dig into these trials and the more you learn what’s really going on, the more you see blatantly bad, unethical, and outright illegal behavior almost everywhere. This is not just a matter of a few bad apples. It is hard to not see large swaths of corporate America as being deeply corrupt.

Another point is that virtually none of this seems to be discounted in stock prices … yet. This is somewhat understandable given the history of weak/ineffective FTC enforcement in the past. However, the charges are serious, valuations are high, and perhaps most importantly, these actions seem to be fairly popular among voters. If pressure from the FTC continues, it could cause some serious ruptures across corporate America.

Technology

The one big “macro” event this week was Nvidia earnings. The degree to which this ordinary corporate happening has become a cultural phenomenon speaks loudly about the investment landscape. As Alyosha reports, “Nvida watch parties are becoming a bizarre imitation of Super Bowl bacchanalia”.

That said, the numbers were good and the company slightly beat expectations, but growth is clearly slowing and visibility on future growth is falling. Fred Hickey posted a good summary:

Ho hum, despite all the furor beforehand (and watch parties) Nvidia basically did what was expected in the quarter - though technically it was a "beat" of analysts' estimates. Stock trading lower (-4%) after-hours. The big problem for NVDA bulls remains the same - Nvidia's customers haven't come up with many uses (except in niche areas), productivity improvements or revenues from Gen AI. Until that happens, the massive NVDA GPU buying binge is nothing but classic malinvestment spending occurring during a Fed-driven bubble period.

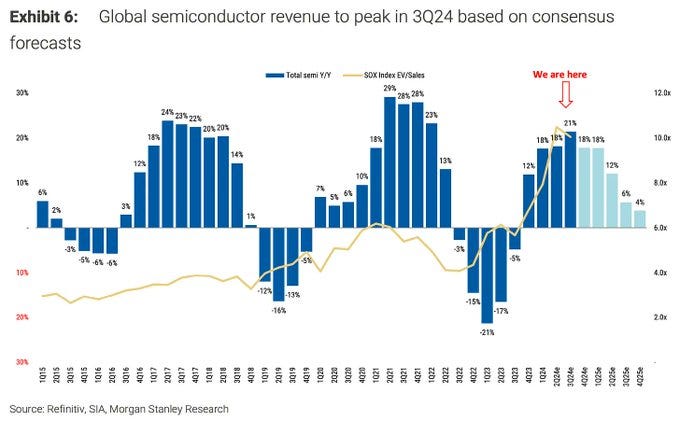

While investors don’t seem overly concerned with Nvidia’s growth prospects currently, those prospects look a lot more troubling in the context of historical semiconductor cycles. To this point, Jesse Felder put out a timely post indicating: “A fundamental 'true' peak of the semiconductor cycle based on YoY sales/pricing growth is nearing."

One of the great lessons from the tech boom and bust in 2000, for those of us who lived through it, was that cyclical industries rarely lose their cyclicality, regardless of how “different” things are this time. Buyer beware.

Monetary policy

While the Fed’s Jackson Hole symposium always presents a platform for the Fed chair to make a proclamation about monetary policy direction, it is also a gathering to discuss monetary policy research and ideas. As Michael Pettis points out, one of the papers presented this year was especially interesting:

Very interesting paper [Government Debt in Mature Economies. Safe or Risky"?]. The government can choose to protect either taxpayers or bondholders from unexpected fiscal spending shocks, but not both: "Largescale asset purchases by central banks in response to a large government spending increase have undesirable public finance implications. These purchases, which provide temporary price support, destroy value for taxpayers but subsidize bondholders."

This sounds an awful lot like the conclusions reached by the European Central Bank and conveyed earlier in the summer by ECB Executive Board member Isabel Schnabel [Observations 6/14/24]:

The experience over the past 15 years suggests, however, that the effectiveness of QE [Quantitative Easing, aka, largescale asset purchases] in stimulating aggregate demand is state dependent and that QE can come with costs that might be higher than those of other policy instruments....

As I suggested at the time, “given the central banking community is a fairly close-knit one, it’s fair to assume the ECB’s new rejection of QE has been discussed and is widely accepted as a new direction for monetary policy globally". In light of the new Fed research, this certainly seems to be the case.

One takeaway from the report is the recognition of the intensely political consequences of QE: The benefits of QE accrue to bondholders, but come at the expense of taxpayers. This constitutes redistribution of wealth and is clearly outside the jurisdiction of unelected monetary authorities.

Not only does QE constitute redistribution, but it does so in a way that favors capital over labor. At a time when the political winds are blowing away from capital and towards labor, this is not a place where central banks want to be.

The open question is: Will central banks take the lesson and become more careful about avoiding redistribution issues? Or will they take the lesson and simply become more discreet about consistently favoring capital over labor?

Investment landscape

Jerome Powell’s speech at Jackson Hole last week made it clear the Fed is ready to start cutting rates. What isn’t clear is how much rates will be cut or how long it will take to get there. While the change in direction is clear, there are still a wide range of possible outcomes.

Bob Elliott addressed this in a nice thread and offered his opinion:

Markets pricing and pundit euphoria about a soft landing reached a fevered pitch following JP's JH speech on Friday.

While a cut is the next step, it is very unlikely that 200bps of cuts and mid-double digit earnings growth will come together in the next 12m.

In other words, all the upside from rate cuts is already fully priced in. The chance of upside surprises from here is extremely small.

Andy Constan also chimed in with with a similar prognosis:

So after Friday let's sum up

The economy has soft landed

The Fed will "do everything we can to support a strong labor market as we make further progress on price stability".

The cutting cycle that was already more than fully priced by markets has begun

What more good news for asset prices at large and individual assets like stocks, bonds and gold can we get?

Here at dampedspring.com for the first time our net position in beta and alpha is 100% in cash.

Our alpha positions short fully hedge our beta longs. We are literally on the sidelines.

Cash is king. Assets suck

Finally, Craig Shapiro highlighted the importance of currency in the assessment of the landscape:

When does the market narrative shift from "US$ weak = buy risk assets" to "Oh shit, US$ weak = sell risk assets" as foreign capital goes home?

Two themes stand out. First, all the good news is already fully discounted in prices. Second, the declining value of the US dollar is only helpful up to a point. Beyond that, capital flows reverse and start moving out of the US - and that would present a major risk to asset prices. As a result, cash does look pretty darn good for the time being.

Investment strategy

Financial assets look risky. All the good news is priced in. Cash looks good. How does one incorporate these observations into portfolio strategy?

Russell Napier, for one, is concerned “the risk of deflation will soon outweigh the risk of steady or higher inflation” (Solid Ground newsletter, 8/23/24 ($)). By his measures, financial repression is failing in that debt/GDP burdens are no longer falling. While lower inflation is good news for consumers, it’s bad news for overly indebted governments. He believes deflation is the key risk until financial repression is ratcheted back up (i.e., higher inflation).

Russell Clark ($) has been banking on longer-term inflation, but is always checking for disconfirming evidence. In particular, he looked at China and more broadly around Asia for evidence deflation is spreading. He reported, “When I see surging gold, and surging Asian banks, then I am pretty sure the inflation trade remains good.” He doesn’t seem so concerned about deflation, at least right at the moment.

Finally, PauloMacro ($) is getting downright excited in what he sees as a burgeoning market for inflation in commodities:

Bottom line: the Fed has established a clear direction whereby they plan to loosen financial conditions even more than they already have so far this year, except this time I think the USD and commodities will feel the brunt of the policy shift as real rates fall and rate differentials narrow (especially against the yen).

There is a potential tidal wave of global savings parked in “exceptional” US Mag7 and Treasury assets that could begin to dishoard …if Big Money found another parking spot big enough.

Who’s right? To an important extent, the three views demonstrate more similarity than difference. Each envisions higher inflation over the long-term as a function of financial repression.

The differences are really in timing and probability. Napier seems more concerned deflation will actually take hold for some time. Clark acknowledges the threat, but just doesn’t see the thesis confirmed by the market at this time. PauloMacro views the deflation threat more as a consensus view that is getting overly crowded. As he puts it, “I am waiting for the recession boat to get reaaaally crowded”.

How crowded might that boat get? If China’s economy continues to flounder and rate cuts in the US fail to jumpstart growth and bad debt in both countries continues to pile up, that boat could get pretty full next year.

It is certainly possible, however, that commodities could start moving without the help of strong economic growth. As the FT ($) highlighted just this week, “Chinese export controls on crucial semiconductor materials are hitting supply chains and stoking fears of shortfalls in western production of advanced chips and military optical hardware.”

The bottom line is the foundation is getting set for a nice, long run in commodities. It’s a good time to get prepared.

Implications

The potential for both crippling deflation and rising inflation characterize a good environment for traders with lightening quick reflexes and disciplined risk management. For long-term investors, however, it presents some challenges.

One of those challenges is it also creates the potential for whiplash. Just as one gets comfortably positioned for recession, the public policy firehoses get turned on and the portfolio needs to get radically repositioned - and quickly. Alternatively, if one sticks with inflationary bets for too long and deflation sets in, pain will be experienced that way too.

That said, a longer-term perspective has its advantages as well. Short-term selloffs also present opportunities to add or add to positions at more attractive prices. Of course, this is only true if one has the cash to do so, or can comfortably pare other positions to produce the cash.

While there is far too much uncertainty to predict any particular path for markets through the end of the year, I continue to maintain a baseline expectation that the election is having an outsized impact on market timing. More specifically, with inflation being such a hot political topic, the Biden administration has been keen to try to keep price pressures down through the summer.

However, going into the fall in a full-blown recession is not a great way to win an election either. As a result, I expect growth will pick up through the end of the year. That will be enough to make the economy look pretty solid at election time in November.

The big question mark is how self-sustaining that growth will be. If we see wages and employment pick back up and credit begin to grow at a pretty healthy clip, these would be strong signs growth is becoming sustainable.

On the other hand, if employment continues to weaken, wages fail to keep pace with inflation, and bad debts begin to pile up, then stronger measures will be needed to re-ignite growth. Those stronger measures will come, but it may take the fright of some deflation to get them implemented.

As a result, I still view gold and cash as very important positions and will be looking to opportunistically add to commodities and industrial companies and perhaps emerging markets. I also still think large cap stocks, especially big tech stocks, are about to start a painful descent.

Note

Sources marked with ($) are restricted by a paywall or in some other way. Sources not marked are not restricted and therefore widely accessible.

Disclosures

This commentary is designed to provide information which may be useful to investors in general and should not be taken as investment advice. It has been prepared without regard to any individual’s or organization's particular financial circumstances. As a result, any action you may take as a result of information contained on this commentary is ultimately your own responsibility. Areté will not accept liability for any loss or damage, including without limitation to any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

Some statements may be forward-looking. Forward-looking statements and other views expressed herein are as of the date such information was originally posted. Actual future results or occurrences may differ significantly from those anticipated in any forward-looking statements, and there is no guarantee that any predictions will come to pass. The views expressed herein are subject to change at any time, due to numerous market and other factors. Areté disclaims any obligation to update publicly or revise any forward-looking statements or views expressed herein.

This information is neither an offer to sell nor a solicitation of any offer to buy any securities. Past performance is not a guarantee of future results. Areté is not responsible for any third-party content that may be accessed through this commentary.

This material may not be reproduced in whole or in part without the express written permission of Areté Asset Management.