Observations by David Robertson, 8/5/22

Very interesting week by any standard, let alone one in the middle of the summer. As always, let me know if you have questions or comments at drobertson@areteam.com.

Market observations

It was a strange week for market signals. The S&P 500 started the week off in fairly tame fashion though volatility (as indicated by VIX) jumped higher. 10-year Treasury rates crashed on Monday and then leapt on Tuesday. The dollar also weakened on Monday and jumped noticeably on Tuesday. In addition, the trajectory of credit spreads has been towards tightening, though the path has not been smooth.

Also, lest anyone suspect the days of crazy, mindless speculation are behind us, Almost Daily Grant’s (August 2, 2022) informs us: “Western investors have rolled out the red carpet for Hong Kong-based AMTD Digital, Inc. (ticker: HKD), as shares in the financial services cum marketing firm skyrocketed to $742 yesterday from $7.80 on its July 14 New York Stock Exchange IPO price, good for a 9,500% rally over its first dozen sessions as a public company.”

In sum, markets have been getting behind the Fed pivot narrative. The employment situation report which came out this morning was strong though, and will challenge this narrative. It reported job growth as “widespread” and total nonfarm employment returning to its “February 2020 pre-pandemic level”.

Geopolitics

The big geopolitical news this week, of course, was House Speaker Nancy Pelosi’s visit to Taiwan. While China threatened to huff and puff and blow the house down, nothing came of it - at least not yet and not in regards to the US. China did halt a number of food imports from Taiwan as punishment and performed military exercises around the island.

The main market effect was to spawn a rise in the volatility index (VIX) on Monday and Tuesday which quickly dissipated once the trip was over. We’ll have to wait and see what the longer-term effects of the visit are but it is probably safe to say this will not be the last spat between the US and China for the foreseeable future.

Commodities

Two points here. One is traders and investors often extrapolate narratives in one market to other markets. For example, lower oil prices in conjunction with inverted yield curves can be seen as corroborating a narrative of imminent recession.

Another point is very few markets are completely “free” to the point of providing excellent price discovery. That means you need to be careful about the information content in those prices.

For example, in the case of oil, the US government’s steady release of oil from the SPR has been sufficiently large to influence supply and therefore prices. Certainly, the Biden administration has motive to depress oil prices for the purpose of also lowering gasoline prices and therefore reducing one of the most vivid reminders of inflation for consumers.

In short, be careful about reading too much into “market” signals. When a big player like the government has their thumb on the scale, you don’t get very accurate readings.

Credit

Unwanted debt from buyout boom stuck at investment banks ($)

https://www.ft.com/content/3989312e-489b-4cb8-86bf-55b078d96dc9

“The traditional bank financing and high-yield markets are effectively shut at the moment,” Kewsong Lee, chief executive of private equity giant Carlyle Group, said. “It’s why you’re seeing an even higher demand for private credit than ever before.”

“The gumming up of bank balance sheets is basically one of the key factors making the financing of new [takeovers] more difficult,” a top leveraged finance debt banker said. “When you have a problem like Citrix in your backlog, it’s really hard to put more piles on that. The way to dig yourself out is to stop digging the hole deeper.”

This piece provides a good update on credit markets, good insight into how they work, and as a result, some warnings for investors.

One of the key elements of credit markets in times of distress is they do not adjust smoothly and linearly. Rather, the more fragile types of lending start shutting down altogether - and this is happening. Large debt deals that were done at far lower rates are sitting on bank balance sheets presenting unrealized losses. This effectively prevents banks from further lending until the debt is off-loaded.

Because entire channels of lending can shut down, one of the better early warning signals for distress is not the cost of credit but its availability. Clearly, things are getting much harder in credit-land.

In addition, because credit distress is non-linear, it takes time for problems to become fully manifested and then it takes time for credit to open up again. In other words, credit distress is not something that typically comes and goes quickly; it’s a process.

Finally, this tweet is a good reminder that non only is credit provision non-linear, increasingly it has been provided through securitization markets. When those markets get squeezed, credit become unavailable. This recalls the problem with shadow banks during the GFC.

Monetary policy

With many traders and investors interpreting the Fed’s comments a week ago Wednesday as dovish, a lot of speculative energy has been unleashed. The dynamic seems to be a return to the “bad economic news is good for the markets” mentality. This also makes at least some sense in the context of financial conditions beginning to ease again as the charts by @SoberLook reveal:

Further, if one were to gauge economic health by financial stress, which is currently at its lowest level in forever, one could be forgiven for wondering if recession concerns are a hoax. One might also be left wondering if the Fed had even started tightening monetary policy yet. It certainly isn’t showing up here yet.

In sum, this creates an enormous problem for the Fed. As much as it continues scolding the markets, they just won’t listen. While there are data indicating a slowdown, there are also data indicating continued health. As such, it is hard to make a case for the Fed taking its foot off the tightening brakes.

It is also hard to make a case for any kind of smooth, relatively painless transition. As much as the Fed may wish that to be the case, the market is going to challenge it every step of the way. Any let up and the Fed will get run over - and inflation will rage. While it is hard to predict which way things will tip, one extreme or/and the other are probably more likely than a smooth path down the middle.

Public policy

Here’s how to solve the productivity paradox ($)

https://www.ft.com/content/1c7bba9f-4e01-4e54-921b-198369f25950

But a closer look at the timing and location of the productivity slump points to an alternative explanation: the expanding role of government.

More active government support has undermined creative destruction, the lifeblood of capitalism. Productivity growth fell further following the global financial crisis of 2008, as bailouts and stimulus grew significantly.

While I certainly wouldn’t propose this as bulletproof economic theory, I do think Ruchir Sharma’s hypothesis deserves consideration. In a time when significant proportions of both major parties like stimulus checks and rely on government to deal with thorny economic and social issues, it is worth considering the cost of doing so.

Of course, the other side of expanding government policy is the expanding uncertainty faced by private companies and consumers trying to navigate a landscape increasingly determined by capricious government decisions. Such uncertainty tends to depress demand and creates a higher hurdle for investment in future capacity. It also sends a signal - who or what might be targeted next? Short-term benefits, long-term costs.

Now, with the surprise emergence of the Inflation Reduction Act, there is a good chance fiscal spending will get dialed up again, even in a fairly hostile partisan environment. It’s a good time to consider the adage: Beware what you wish for.

Investment landscape part 1

Decision Time

https://www.russell-clark.com/p/decision-time

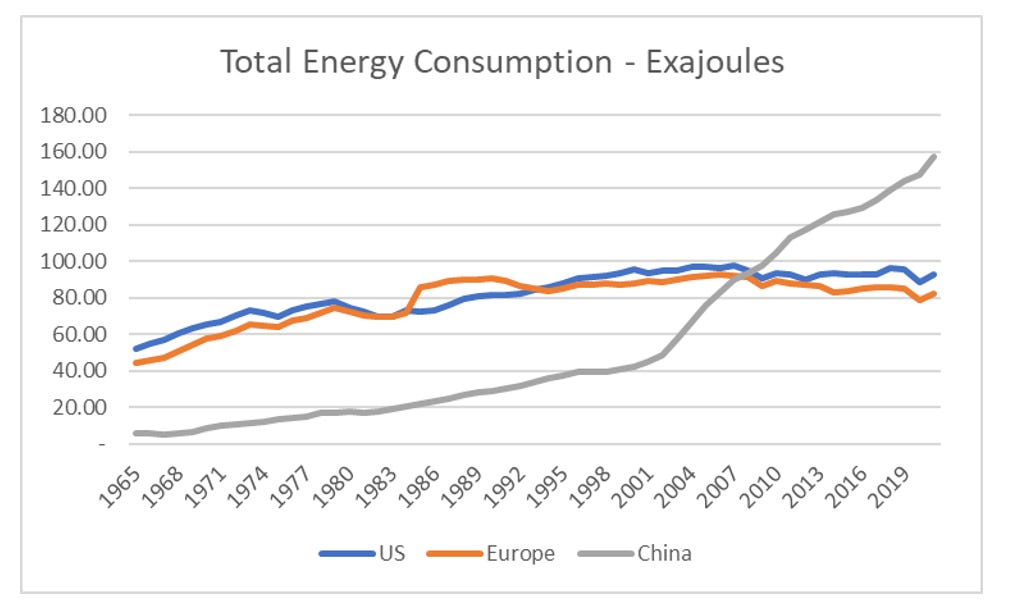

The problem with this view [the idea that deflation is returning] is that is conflates commodity demand with US or Western financial conditions. Using the BP statistical report, if we look at total energy consumption, the days that the rise and falls in western demand affected commodity demand are long gone.

It is hard to overstate the importance of the message: “the days that the rise and falls in western demand affected commodity demand are long gone.” Most media accounts implicitly link commodity demand with US economic health. The numbers say something else: China is the marginal demand that matters.

To that point, as Clark shows, China has clearly been the key demand driver for energy for the last twenty years. Currently, however, it looks like China is more likely to be putting downward pressure on commodity prices as the chart below from @SoberLook illustrates.

Short Collateral & Long Tantrums

https://www.theinstitutionalriskanalyst.com/post/short-collateral-long-tantrums

For some time now, we have tried to focus the attention of our readers on the growing influence of foreign investors when it comes to the dollar and also the rate of interest in the dollar system. The growing number of disturbances to the offshore dollar system, including the financial implosion of China’s “Belt & Road” effort, the default of HNA and other corporate failures, and the related carnage in the Chinese property market, were early signs of stress. The war in Ukraine, inflation and the rising rates have thrown the non-dollar world into another debt crisis.

All of this is part of the exceptional American perspective that our domestic debt does not matter and the impact of the dollar on other nations, most of whom are short dollars, is of no consequence.

Very important point here about the US dollar and interest rates. Namely, once again, it is foreign investors who often play the key role of marginal investor. Those who analyze rates and currencies without this perspective are likely to miss extremely important influences.

Investment landscape part 2

Generation moonshot: why young investors are not ready to give up on risk ($)

https://www.ft.com/content/bce2ef2a-77d8-485e-ba69-92579f8fceb6

Zettler is part of a generation of investors who came of age around the 2008 financial crisis and in its aftermath. Having struggled to accumulate wealth through traditional means over the past decade, many have turned to speculating in the riskier corners of financial markets.

Stagnant wages, rock bottom interest rates, soaring house prices — and now, corrosive inflation — have cut away at the idea that the under-40s can follow the well-trodden path to financial security that their parents took. Younger investors report feeling like the game is rigged and that playing by the old rules is a losing strategy.

It is useful to understand there are two sides to the “growing appetite for speculative assets such as cryptocurrencies, NFTs and ‘meme stocks’.” Certainly, there is an element of “get rich quick” that is nothing more than pure greed and can easily be dismissed as not serious.

However, there is also an element that reflects the unusually poor opportunities for a generation of investors. After all, it is not unusual or unhealthy for younger investors to take on risk. Historically, people often did this by buying a house. Unfortunately, houses are a lot less affordable than they used to be.

The problem is not so much with the people as with the situation. While clearly there is an excessive amount of speculative behavior, it is not very useful to focus on the people. It is more useful to focus on the dearth of attractive long-term investment opportunities and what would cause that situation to change.

Investment landscape part 3

The Importance of Pelosi and Taiwan on Bond Swings ($)

John Authers raises a good point about investment strategy here. One of the conditions that enables stock pickers to outperform is that of low correlations. When securities move in largely independent directions, it is easier to create a diversified portfolio and it also creates opportunities for skilled practitioners to display their talents.

One point is that correlations are well above their historical averages which makes stock picking harder than usual. Often this happens when macro events come to dominate stock performance over company-specific financial performance.

While this is bad news for stock pickers, the other side of the coin is the conditions are good for macro analysts and managers. When it is macro factors that dominate investment performance, then having diversified exposure to those macro variables can provide differentiated performance.

Implications for investment strategy

Week 23: Bear markets are hard to trade, even when you're bearish

https://50in50.substack.com/p/week-23-bear-markets-are-hard-to

Bear markets are hard to trade for a bunch of reasons:

Volatility is higher in bear markets.

Quite often, the exact moment you want to add to your shorts is the moment you should be taking profit.

Bear market rallies are fast and soul-destroying and go farther than most people think is possible.

Because the main audience for Observations is long-term investors, I tend to focus on longer-term opportunities and highlight the risks of chasing short-term phenomena. Lest this be considered overly cautious by more aggressive investors, this piece by Brent Donnelly, a trader himself, also highlights the pitfalls of trading in a bear market.

That said, bear markets can also amplify temptation. Aggressive investors are always looking for ways to make money and risk-averse investors often start getting nervous when their portfolios fall in value.

Either way, it is easy to get sucked into trading. One point is, if you are going to do it, you should be well aware of what you are getting yourself into. Another point is, identifying and learning about trading opportunities can be extremely educational even if you do not act on them. Every trade involves two sides so it is good to understand what the other side might be motivated by.

Trading also ties in to several of the other characteristics of the “Investment landscape”. For one, it is especially alluring to many “Generation moonshot” investors. Dissatisfied with the meager returns available through more conventional investments, these younger investors are willing to take enormous risks for the chance of attaining life-changing wealth.

The problem with this is it is a “bad game” in game theory lingo. It is hard enough to consistently make money trading anyway, and even more so in a bear market. This is a point that was highlighted in the Michael Lewis book, Moneyball. The best hitters only swing at pitches they know they can hit; they don’t swing at others even if they are strikes. The lesson is you shouldn’t be tempted to swing at anything and everything that comes your way.

Another point is the widespread temptation to trade seems to be infecting many parts of the market. Sure it is obvious with crypto and “meme'“ stocks, but it also seems to be affecting areas such as commodities and rates. If you combine over-eager and inexperienced traders with leverage, and then suddenly add volatility and reduce availability of credit, all kinds of bad things can happen regardless of longer-term fundamentals.

This is exactly why I have been extremely cautious with commodities this year. I think there will be a time to have meaningful exposure but I am also leery of buying in when prices are getting bid up by people chasing stories and when government has an opposing objective. Of course this is true with any investment: The best time to buy is when interest has collapsed.

Thanks for reading this edition of Observations by David Robertson!

Note

Sources marked with ($) are restricted by a paywall or in some other way. Sources not marked are not restricted and therefore widely accessible.

Disclosures

This commentary is designed to provide information which may be useful to investors in general and should not be taken as investment advice. It has been prepared without regard to any individual’s or organization's particular financial circumstances. As a result, any action you may take as a result of information contained on this commentary is ultimately your own responsibility. Areté will not accept liability for any loss or damage, including without limitation to any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

Some statements may be forward-looking. Forward-looking statements and other views expressed herein are as of the date such information was originally posted. Actual future results or occurrences may differ significantly from those anticipated in any forward-looking statements, and there is no guarantee that any predictions will come to pass. The views expressed herein are subject to change at any time, due to numerous market and other factors. Areté disclaims any obligation to update publicly or revise any forward-looking statements or views expressed herein.

This information is neither an offer to sell nor a solicitation of any offer to buy any securities. Past performance is not a guarantee of future results. Areté is not responsible for any third-party content that may be accessed through this commentary.

This material may not be reproduced in whole or in part without the express written permission of Areté Asset Management.