Observations by David Robertson, 9/29/23

As we close the books on another quarter, long-term interest rates are going up and stocks are going down. Fasten your seatbelts, it’s looking like we might be in for a turbulent fourth quarter.

As always, if you want to follow up on anything in more detail, just let me know at drobertson@areteam.com.

Market observations

There was definitely a change in the investment weather this week as VIX (the volatility index) jumped up from its slumbers below 13 just two weeks ago to peak over 19 this week. While this could be just a little market indigestion, my sense is the market is beginning (though, just beginning!) to appreciate the gravity of higher rates.

In addition to volatility going up, long-term interest rates have been going up as well. Higher rates mean higher borrowing costs. They also mean lower prices for fixed income investments. The simple and easy depiction of this phenomenon is the ETF, TLT, which tracks the performance of long-term Treasury bonds.

While a star performer through the 2010s, TLT has been brutalized since 2020. This has happened purely due to rising interest rates since TLT has no credit risk. The most interesting fact about this, though, is investors can’t seem to get enough of it!

As Eric Balchunas posted this week: “People keep piling into $TLT, another $750m this wk, amazing, can't recall an ETF taking in so much money ($16b, #2 overall) while being down so much and so consistently (esp when you can get just as much yield w no duration risk).” Maybe people are betting that past performance is no guarantee of future results?

Snark aside, this does seem to touch on a couple of important characteristics of this market environment. One is the enormous degree of habituation investors developed to low rates. It looks like that will be hard to change - which probably means higher rates for longer. Another characteristic is the degree of righteousness. Relative to history, today’s investors seem unusually inclined to stick with losing positions.

Another observation from the week is that gold stocks have been getting pummeled as rates have pushed higher. In one sense, this is not unusual as gold often trades inversely to real rates. That has not been the case for much of the past three years, but it has been the case over the last six months.

Since the end of June, oil has taken a very different route by running up in parallel with long-term interest rates. This is interesting. Oil prices are signaling inflation while gold is signaling disinflation. It’s like we’re in the Bermuda Triangle for market signals.

Credit

Indication of interest, Almost Daily Grant’s, Tuesday, September 26, 2023

https://www.grantspub.com/resources/commentary.cfm

Investment-grade firms are increasingly turning to the convertible bond market, issuing some $12 billion’s worth so far this year according to Bank of America, accounting for more than 30% of total supply for the category. That’s the highest such share in at least a decade, up from just $2 billion and 7% of total convertible issuance during all of 2022, as the contraptions are typically confined to the purview of junk-rated borrowers.

Convertibles, which can be swapped for stock if the issuer’s share price reaches a predetermined level, allow issuers to borrow more cheaply thanks to that optionality. “Investment-grade companies need to save on coupons as well,” Bank of America strategist Michael Youngworth tells the Financial Times today, adding that convertibles can generally be sold with coupons two to three percentage points lower than conventional bonds. “They’re obviously plagued by the same higher financing cost backdrop that high-yield companies are.”

This is a good update and insight into credit markets. The bottom line is monetary tightening is having its effect, even if not quite so visibly all the time. Convertible bonds provide an opportunity for the issuer to maintain the optics and short-term benefits of lower rates, but at the cost of foregone upside opportunity by way of potential equity dilution.

Companies don’t give away future upside opportunity unless the alternatives are even worse. As a result, this notable uptick in convertible issuance sends a couple of important messages. One is that higher credit costs are starting to hit companies, even investment grade companies. Another is that one way or another, this reduces what the companies are worth.

US Treasuries

One of the popular investment theses out there makes the case for shorting US Treasuries. As one particular strand of the argument goes, the US is losing its hegemony. As other countries migrate away from the US dollar (USD), there will be fewer reasons to hold US Treasuries in reserve accounts. All of this will result in a lower USD and lower Treasury prices (i.e., higher yields).

One of the observations that is often touted as evidence of this claim is the declining balance of US Treasuries (USTs) at China’s central bank. For example, Michael Pettis highlights a claim made in the South China Morning Post that “Beijing has been continuously cutting China’s US debt holdings since early 2022.”

As Pettis goes on to clarify, however, things are not quite so simple. To justify such a claim, for example, he explains, “we'd need to know the extent of PBoC holdings of T-bills in street names, and we'd need to know what they used to replace the T-bills. If they simply swapped them for agency paper, or other US bonds, there'd obviously be no shift out of USD.” Further, “we'd also need to know what the state-banks have purchased in their amassing of ‘hidden reserves’.” Pettis concludes it is “very unlikely” that “Beijing is actually reducing its exposure to the US dollar”.

Brad Setser also posted a thread on the same subject. Specifically, Setser addresses the claim “that China is ‘De-dollarizing’ its reserves” based on the steady decline of China’s reported USTs in the US Treasury International Capital (TIC) data. This data, however, has significant limitations.

Without getting into too much detail, Chinese ownership of US dollar reserves has evolved in ways that are not captured by the TIC data. Partly, more Chinese-owned USTs have migrated to offshore custodians. Partly, “There has been a modest shift to Agencies” for the purpose of picking up yield.

As a result, important changes in Chinese holdings are not captured in the data - and therefore the analysis is not nearly so straightforward. Indeed, as with anything regarding China, one should always question the quality of the data.

The bigger story, however, is the demand and potential demand for USTs. On the China front, at least, when all of the inputs are properly accounted for, there does not seem to be any major effort to “de-dollarize”. That is a fiction borne from a naive (mis)interpretation of data.

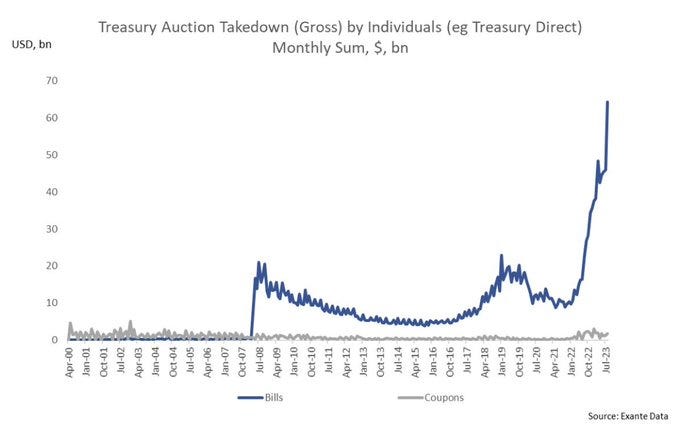

In addition, rates also affect demand. When rates are in the very low single digits, there is very little reward. That has changed, however, and 5% rates look a lot more attractive to everyone. Further, with the Fed appearing ready to hold rates higher for longer, US rates are likely to be competitive for the foreseeable future. Indeed, as AnilVohra1962 posted, USTs are also increasingly being absorbed by individual Americans.

So, the main point is the sentiment against US Treasuries seems to be significantly overdone. At least part of this is due to a bad read on foreign owners such as China.

Part of it also seems to be due to a bad read on other sources, or potential sources, of buying. For example, Eric Balchunas described “nervous Boomers” as an important market segment at Simplify’s “Entering the Fall” conference on Tuesday. These are people who have made a lot of money in the markets over the years and don’t want to lose it. US Treasuries are looking increasingly attractive to them, and will become even more so if stocks start looking wobbly.

Finally, none of this is to say there aren’t good arguments for Treasury prices to go down. I have argued consistently that significantly increased supply will put pressure on prices to go down and yields to go up. That’s happening. Understanding the real causes, however, is really important for understanding where things might go next.

Inflation

This image (from msn.com) speaks a thousand words about inflation. Fed Chair Powell made the connection between the labor market and inflation just last week: “Job gains … remain strong, and the unemployment rate has remained low. Inflation remains elevated.” This week, President Biden was standing next to the head of the UAW saying workers deserve higher wages.

One could be forgiven for observing some conflicting signals here. In fact, this is completely consistent with the landscape I described last December: “What the Fed takes away through tight monetary policy, fiscal spending and other public policy measures often give right back.”

The fact is, it was always thus. The President has a political agenda and the Fed has a relatively narrow administrative agenda. The difference can be used strategically to manage the message. So, Biden can argue he is lobbying to get workers higher wages AND he has the Fed on the job of keeping inflation down to minimize that political liability.

Of course, this duplicitous behavior is inconsistent from a policy perspective, but it is also how politics works. It is also how common knowledge works. When everybody knows that everybody knows the President is pushing for higher wages, it’s a pretty good bet inflation is not going to quietly fade away.

Monetary policy

The graph below from @SoberLook illustrates the “long and variable lags” of monetary policy. As the St. Louis Fed describes, “It can take changes in interest rates some time to affect the macroeconomy (the lag is long), and that time can differ unpredictably across episodes (the lag is variable).

The phrase “long and variable lags” has become so overused, and the news cycle so quick, that investors often tune out the risks of monetary policy tightening before it even hits full stride. Here’s your reminder: The next two quarters are set to impose the greatest negative impact on the economy from monetary policy.

This isn’t to say the economy is going to crash into a wall in the next couple of quarters. For one, fiscal policy is still infusing money into the economy. For another, the post-Covid economy is unusual. There just aren’t a lot of precedents - which means it is especially hard to forecast. Finally, all models are only imperfect representations of reality. It is distinctly possible the impact felt from monetary tightening will be less severe than forecast.

Nonetheless, the base case is for monetary policy to hit hardest over the next couple of quarters. At very least, it makes sense to anticipate more turbulence than usual over this period. Further, as markets have become progressively more dissociated from fundamental economic reality, it may just be that the economy ticks along decently but the markets start giving up ground.

Investment landscape

I very much believe you can’t tell someone’s true colors until you observe them in a bout of adversity. I also believe that of markets. With volatility picking up this week and tighter monetary policy beginning to bite, the coming weeks will be a great time to get a read on how companies are doing, how the economy is doing, and how investors are responding in the markets.

One area I’m watching in particular is commodities. On one hand, oil has been strong jumping from the low 70s to the mid 90s in the last three months. On the other hand, this price performance has come on the back of substantial OPEC production cuts, heavy speculative positioning, and in the face of slowing economic growth in many parts of the world.

With stocks selling off this week, I am very curious to see how commodity stocks react. If investors need to sell something in order to make way for new Treasury supply, it stands to reason that commodity stocks will be right in line with other stocks. There certainly has not been patience with gold stocks but oil and energy stocks have been holding up fairly well so far.

I’ll also be watching the UAW strike for indications of labor market pressures. Will the autoworkers get most of their demands? Have the tables really turned to favor labor over capital? Also, I will be watching for the government shutdown. Does the can get kicked down the road and then get quietly disposed of at a later date? Or does it turn into Round one of an extended knock down, drag out election fight? What will be the intended and unintended consequences?

Amidst all this, I’ll be very curious to see if bigger problems start emerging. Will there be more bank problems? Will an important company have to radically change its outlook? In general, I’ll be looking for situations that might produce non-linear outcomes from small, incremental changes. To this point, I will be especially interested to see what the Fed does, and does not, do in response to economic news and events.

Those are the major items, but there are plenty of others. As usual, I will be watching to see if credit problems are getting worse, to track the health of US consumers, and to track bank credit growth. I’ll also be watching to see how companies are dealing with cost pressures - primarily to see if they still have pricing power or if margins are starting to get hit.

The sense I get is that we are at an important inflection point in the market. While the first three quarters of 2022 were tough for a lot of investors, the stock market bounced right back. I think the markets are still in a state of disbelief that asset prices can go down and stay down. It should be a very interesting quarter!

Investment strategy

Bad correlation redux ($)

https://www.ft.com/content/ffa5b79c-4892-4a0d-abbc-1eccc031629b

But it does not explain why owning a 60/40 portfolio felt so great during the two decades up to early 2020. The reason for that is that bonds were still in a rip-roaring bull market. As Jim Caron, a portfolio manager at Morgan Stanley investment management, told me last week, bonds went up when stocks were down, up, or sideways. That is what we are really going to miss in the next 20 years. After the bond bull market, Caron proposes that investors who are keen to avoid big drawdowns will have to start targeting portfolio volatility by actively adjusting equity allocations as the risk environment changes.

For all the talk in the investment industry of the virtues of diversification, the even bigger phenomenon over the last 40 years was the bull market for bonds. It didn’t even matter what stocks did; “bonds went up when stocks were down, up, or sideways”. In short, bonds weren’t useful so for their diversifying benefits as for the fact their prices kept going up.

This is an especially important point now that interest rates are higher and likely to stay higher. It will result in bond prices not rising continuously. The long-time tailwinds that bonds provided for portfolios are almost certainly over. Further, there is no small chance those tailwinds may turn into headwinds.

In such an environment, diversification and portfolio construction takes on a bigger role. If bonds pose a risk to returns and don’t provide much diversification benefit, investors will need fresh ways to manage risk. That can include a number of different methods but just sticking with the old 60/40 stock/bond mix is not one of them.

Implications

One of the comments Boaz Weinstein made at Simplify’s “Entering the Fall” conference on Tuesday resonated with me because I have observed the same phenomenon. He said many investors, and especially professional investors, feel a need to be fully invested. They are uncomfortable being in cash.

He likened the situation to blackjack. A good chunk of the time, one should not bet on a blackjack hand, or should only make the minimum bet, because there is no edge. The odds are not in the player’s favor. The lesson: You don’t have to play.

In this investing environment, with credit spreads tight and stock valuations high, there just aren’t a lot of areas so overwhelmingly attractive as to attract large chunks of capital. Weinstein has been doing a lot of work on closed-end funds that sell well below net asset value (NAV), but that is a fairly small pool for an institutional player. Mainly, cash is relatively attractive right now. You don’t have to play.

Interestingly, and once again, it is probably easier for individual investors to sit in cash than professional investors. Pros feel compelled to show off their investment chops by “doing something” and are also compelled to do something in order to earn their fees. Another interesting element Mike Green added is that many portfolios have rigid asset allocations. In other words, they can’t raise cash even if stocks and bonds look terrible. This is why dynamic allocation can also be useful, by the way.

All this amounts to the probability that investors who have both the ability and wherewithal to adapt dynamically to a changing environment will do much better than those who don’t. It will not be a great time to be stuck in static, passive strategies.

Note

Sources marked with ($) are restricted by a paywall or in some other way. Sources not marked are not restricted and therefore widely accessible.

Disclosures

This commentary is designed to provide information which may be useful to investors in general and should not be taken as investment advice. It has been prepared without regard to any individual’s or organization's particular financial circumstances. As a result, any action you may take as a result of information contained on this commentary is ultimately your own responsibility. Areté will not accept liability for any loss or damage, including without limitation to any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

Some statements may be forward-looking. Forward-looking statements and other views expressed herein are as of the date such information was originally posted. Actual future results or occurrences may differ significantly from those anticipated in any forward-looking statements, and there is no guarantee that any predictions will come to pass. The views expressed herein are subject to change at any time, due to numerous market and other factors. Areté disclaims any obligation to update publicly or revise any forward-looking statements or views expressed herein.

This information is neither an offer to sell nor a solicitation of any offer to buy any securities. Past performance is not a guarantee of future results. Areté is not responsible for any third-party content that may be accessed through this commentary.

This material may not be reproduced in whole or in part without the express written permission of Areté Asset Management.