Arete's Observations 5/7/21

Market observations

The strange case of the ‘$100m deli’ and the universities that own a slice ($)

https://www.ft.com/content/4a6d0864-eb26-4e54-8ab5-ffad2e8166ee

“Hometown ‘has had limited success operating its current delicatessen’, a lawyer for the company told the Securities and Exchange Commission in September … The company has excelled, however, at raising cash.”

“[This] is a self-parody of a Spac,” said John Coffee, a professor at Columbia University’s law school who has written about hostile takeovers. “And that is what I would expect at the end of a bubble.”

By now most people are likely to have heard at least a passing comment about the NJ deli (with only $13,976 in sales last year) that achieved a $100 million stock valuation through a SPAC deal. John Coffee, who is one of the most authoritative voices on corporate governance and regulation, didn’t hide his disdain for the deal in calling it a “self-parody of a Spac”. The Hometown deal, Dogecoin, which is a literal joke of a cryptocurrency, and plenty of other examples just go to show how amped up speculative tendencies are right now. Long-term investors who are valuation sensitive are not missing anything.

The bullishness in stocks continues

https://www.axios.com/stock-market-bullishness-investment-4d8f24c3-d2bd-492a-843a-1e2eca08dd1e.html

“Everyone and their mother is buying stocks, with flows underpinned by record borrowing from hedge funds and big banks, as well as a record level of margin debt being held by retail and institutional investors.”

On one hand, the persistent money flows help explain the strength in stocks and also probably other assets like commodities and cryptocurrencies as well. Interestingly, however, non-profitable tech companies (below) have been exhibiting distinct weakness. Having been beneficiaries of an environment of low growth and low rates, it will be interesting to see if investors have moved on or are just taking a break.

Economy

Contrarian Vs Consensus, May 2021, by David Rosenberg at John Mauldin’s Strategic Investment Conference ($)

One of the main points David Rosenberg made in his presentation was the degree to which fiscal stimulus has boosted GDP growth but only on a temporary basis. Q1 came in at 6.4% and forecasts call for 10.0% in Q2. By Q3, however, forecasts already have growth tapering to 7.5% and in Q4 forecasts are at 5%. Rosenberg highlights that the Fed’s implicit forecast for Q4 is only 2% and his own forecast is 0%.

The bottom line is the boost is entirely temporary and entirely dependent of massive fiscal spending. With the prospect for future spending looking much more fraught, it looks like the sugar high will come and go fairly quickly. His biggest message: Don’t extrapolate the current situation too far into the future.

Politics

Whining Is Winning

https://gfile.thedispatch.com/p/liz-cheney-gop-mccarthy-trump

“Also, when you make loyalty to Trump the defining attribute of the party, you create space for truly horrible politicians to join the coalition. Paul Gosar is a repugnant goon who plays footsie with white supremacists. Matt Gaetz and Marjorie Taylor Greene are national embarrassments and stains on the GOP and conservatism. But they are unflinchingly loyal Trump sycophants, and so Kevin McCarthy and full-blooded MAGA types can make room for them. The same charity is not extended to Liz Cheney or the other Republicans who rightly voted to impeach Trump.”

“This is the double standard that has marked the entire Trump era. He gets to behave however he wants, belch out whatever absurdity or slanderous lie he pleases, and it’s okay because that’s who Trump is. But if you dissent, object, or just point it out, you’re the one who is obsessed. You’re the one who has ‘derangement syndrome.’ You’re the one who can’t move on.”

The death throes of American conservatism ($)

https://www.ft.com/content/a712b836-e9bf-4dfe-8b06-990757134298

“Conservatism used to mean support for strong defence, small government and family values. At its best, conservative political philosophy championed truth-telling and character. Those qualities are now career-killing.”

I admit to having a fair amount of trepidation about addressing a “third rail” political issue, but it is an important issue that has the potential to affect the country’s governance for years to come. The spat over Liz Cheney’s leadership in the House is where the rubber hits the road between a Republican party based on conservative ideology and one based on festering culture wars.

A Republican party based on conservative ideology would present both a formidable check on Democratic spending plans and still allow room to negotiate. If Republican leadership leans toward culture wars instead, there would be virtually no room to compromise. In the short-term the ability to legislate would grind down to nearly zero; in the longer-term a more chaotic political landscape would emerge.

Commodities

Reports of spiking commodity prices and inflation concerns are becoming increasingly frequent. While there are long-term reasons to believe in better commodity performance, especially relative to stocks, the shorter-term performance seems to be exhibiting a fair amount of momentum.

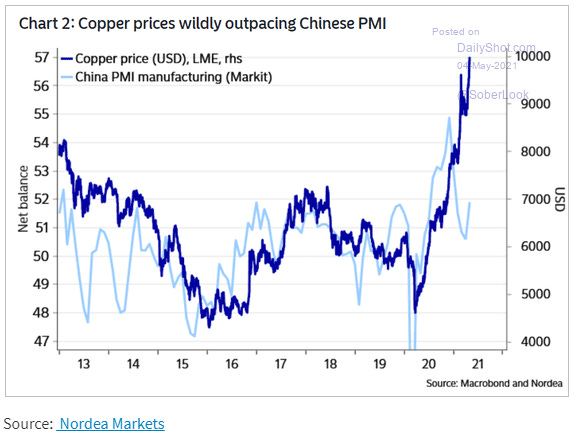

As shown in the graph (below), copper prices have historically tracked China PMI fairly well. With China PMI turning down at the end of 2020, it looks like it is just a matter of time before copper turns around as well.

Inflation

"Inflation Deflation Debate: Does Money Matter Most, When Considering The Outlook For Real Vs Financial Assets Now?", with Russell Napier and Gary Shilling (free to registered advisors)

https://www.eri-c.com/news/685

Russell Napier’s alternative research platform (eri-c.com) is not only a useful platform that improves access to independent research firms, but also creates an ecology by which more interesting conversations can be had. In this presentation, he discusses the issue of inflation with Gary Shilling, who has been a prominent advocate of continued disinflation. Napier himself switched over to the inflation camp last year.

Having a conversation is how interesting ideas come out. Shilling started by making a thorough and compelling case for disinflation, which in his mind is all about supply and demand. After Napier made an equally compelling case for inflation, he asked Shilling a simple question, “Where will debt/GDP be in 10 years?” While Shilling conveyed that he didn’t know what would change current trends of deficit spending and increasing debt, he did acknowledge inflation (specifically nominal GDP being higher than interest rates) is “the only way government debt has ever been controlled”.

So, this is pretty interesting. One of the foremost economists sees all the data pointing to disinflation and knows the endgame has to be inflation but doesn’t know how we get from point “A” to point “B”. At very least, that should make a lot of investors feel better that they don’t know either! The main lesson is inflation is likely to happen eventually because that is what has to happen. Just because we can’t necessarily imagine how the path develops on the way there doesn’t change the final destination.

Capital markets

Liquidity Tsunami Ends With A Bang: Treasury Expects Just $100BN In Cash Injections Next 2 Months

“In summary, instead of dropping by $929BN through March 31 as it had expected in February, the Treasury cash balance declined by ‘only’ $607BN, a difference of $322BN. And in the current quarter, the Treasury now expects a similar decline in cash as last quarter, a drop of $322BN (vs $300BN previously), although since it is starting from a higher base, the June 30 cash balance will be $800BN instead of $500BN.”

“but for now the TL/DR is that the liquidity tsunami is over, and the Treasury now expects to release just $100BN in cash for the next two months, from the $903BN currently to $800BN at the end of June, and then just another $50BN lower three months later, or $750BN at the end of Sept.”

Like the wind at your back on a bike ride, the Treasury’s reduction of its cash account has provided a nice steady tailwind of liquidity for investors. As Zerohedge points out, however, the beneficial effect of that tailwind is likely to diminish substantially in coming months. While there are lots of moving parts that make it hard to predict the effect with a high degree of confidence, it is fair to expect a tougher slog ahead for stocks.

Investment advisory

Re-Imagining ETFs with Simplify (podcast with Eric Balchunas, Paul Kim, and Mike Green)

https://www.podbean.com/media/share/dir-qiyk6-e095d26

“What you often find with those products [like XIV] is they were created without a significant amount of thought behind, ‘Should we do this?’, ‘Is this appropriate for investors?’, ‘Is this the right degree of leverage?’ … we can do better than that.”

“My view [Mike Green’s] on bitcoin is that it is distracting people from participating in a robust discussion around how to fix the system.”

While part of the pretense for the podcast is undoubtedly PR for the relatively new ETF firm, Simplify, part of it is also PR for the endeavor of creating better tools for investors and advisors in general. One of the (still) hugely underappreciated aspects of the fund industry is that it is about marketing and asset gathering first, and only incidentally about improving investment results.

Many products are just bad (like XIV) and should never have been created. This message resonates with me because it is the same reason I founded Areté; I felt very strongly (and still do) that it is possible to provide something much better than what most of the industry does.

Another point is that with the investment landscape changing, there are important tools that are needed that are not currently easily accessible for most investors. For example, bonds provide virtually no protection when yields are so low but there aren’t good substitutes. In addition, the prospect for inflation not only reduces the attractiveness of stocks and bonds but also increases the need for protection from devaluation and exposure to long volatility. There truly is an opportunity to provide better tools.

Finally, while cryptocurrencies often elicit impassioned and militant responses, Mike Green highlights the bigger issue is “how to fix the system”. This is right and reveals a couple of key points. One is it is not easy to establish a new financial system and it can’t be done unilaterally. As he says, “You can’t separate yourself from authoritarianism by changing your bank account.”

Another point is there are a lot of people who are sympathetic to the cause of establishing a better financial system. I’m one of them. There are plenty of others who know that current arrangements are unsustainable. Name-calling and infighting are not the best way to enlist support for a common cause though.

Currencies

FFTT “Tree Rings”, April 30, 2021, by Luke Gromen ($)

“So, to win, the US must change the structure of the USD’s reserve status, toward a system where the USD is still global reserve currency (GRC), but where the UST is no longer the primary reserve asset (PRA.) What other nation is in a position to have their sovereign debt replace USTs as the PRA? Only the EU and China, and neither of them want that ‘honor’ (‘honor’ is in quotes because it is actually a burden that requires hollowing out their domestic manufacturing and working- and middle- classes, which is politically unpalatable for both the EU and China.)”

“So, if there are no sovereigns willing to should [sic] this burden, then if the US wishes to win by ending the UST’s 50-year reign as PRA, we must replace the UST with a neutral PRA. In our view, the only two assets that could function as PRA’s are gold and BTC, and if either or both of them are to function, they would need to be made big enough relative to global trade to serve that role. We don’t know how big is ‘big enough’, but $50,000 gold and $1m BTC are probably not that far off.”

The main point Gromen makes here is a good one: There are very limited options for reimagining the global financial system and they anchor on the challenge of establishing a different primary reserve asset. While I disagree with Gromen’s inclusion of bitcoin as a serious possibility, mainly because it is outside of government control, it is correct that either gold or BTC would have to be repriced much higher to serve the new role. While this makes a strong case for owning gold, the time horizon for such an event is extremely uncertain.

Implications for investment strategy

The Rise of Carry, by Tim Lee, Jamie Lee, and Kevin Coldiron

“the absolute end of the carry regime is likely to be marked by either systemic collapse that ends the dominant role of central banks or galloping inflation—or both. If a crash results in neither of these two things happening, then the likelihood is that the carry regime continues and there will be a new carry bubble.”

“Realistically, 2007–2009 was the last opportunity for the authorities to lean against carry by allowing carry traders to suffer catastrophic losses, thereby helping to unwind some of the economically damaging structural effects of carry that we have discussed in this book. That opportunity was lost, and the … result is that the next 20 years are guaranteed to be tumultuous.”

I mentioned this book in prior newsletters [here] and [here] because it provides such useful context for understanding the markets and their embedded risk. In short, a giant carry trade dominates market behavior, increases fragility, and is ultimately unsustainable. The big question, and the core question of “endgame” discussions, is, “When does it all break down?”

The discussion very much relates to the inflation debate. Since carry regimes are inherently deflationary, it is fair to expect a “deflationary implosion of the carry bubble, somewhat similar to what already nearly occurred in 2008”. If central banks were unable to “engineer a recovery”, the carry regime would end.

However, in such an event, it is also likely central banks and governments would feel compelled to implement “extreme measures that would be outside the bounds of current law but would be deemed imperative to ‘save the world’.” Given the policy response in March 2020 this possibility seems quite likely.

So, markets could either tip over into deflation if central banks don’t intervene (and do so successfully), or they could tip over into inflation if central banks overreact. Meanwhile, investors will contend with periodic carry crashes such as those in 2008, 2018, and 2020 and wonder which one will be the final one. As this transpires, signs of the end of the carry regime “will occur gradually as part of a process that will involve severe market dislocations”.

This environment creates enormous challenges for investors. If another carry crash happens but the regime stays intact, investors can benefit from increasing exposure to risk assets at the bottom even though the assets aren’t cheap. When the carry regime finally ends, however, risk assets will get crushed.

The main lesson is that a carry regime is unsustainable. As a result, the worst thing to do is to “set and forget” a portfolio dominated by risk assets. Investors must be ready to significantly pare holdings. Another lesson, however, is that carry regimes can persist for a long time. As a result, there are opportunities and risks associated with speculation during intervening carry crashes.

Yet another lesson is there is no easy and effective way to hedge a carry crash. There are tail risk vehicles but those often become prohibitively expensive when the carry regime remains intact for long periods of time. Further, the true end of a carry regime would probably blow up most of the financial system and a good chunk of the counterparties that could provide such insurance. The best way to weather such a crisis is to have stores of value that don’t depend on the financial system.

Fed framework holds central bank hostage ($)

https://www.ft.com/content/d4b53d27-59b8-4b16-b59b-ef2fe4c0289e

“It’s not just time for the Fed to start thinking about less monetary stimulus. It’s time for it to taper its markets interventions for the longer-term wellbeing of the economy and the structural health of financial markets.”

The main argument Mohamed El-Erian makes is the Fed policy of moving slowly but surely was appropriate for an environment in which incremental fiscal spending was negligible. In an environment now with fiscal spending spigots wide open, however, that passive response is wholly inappropriate.

El-Erian’s assessment that “policy risk is now one of the major challenges investors will be navigating this year” just puts us that much closer to the ultimate end of the carry regime.

Principles for Areté’s Observations

All the research I reference is curated in the sense that it comes from what I consider to be reliable sources and to provide meaningful contributions to understanding what is going on. The goal here is to figure things out, not to advocate.

One objective is to simply share some of the interesting tidbits of information that I come across every day from reading and doing research. Many of these do not make big headlines individually, but often shed light on something important.

One of the big problems with investing is that most investment theses are one-sided. This creates a number of problems for investors trying to make good decisions. Whenever there are multiple sides to an issue, I try to present each side with its pros and cons.

Because most investment theses tend to be one-sided, it can be very difficult to determine which is the better argument. Each may be plausible, and even entirely correct, but still have a fatal flaw or miss a higher point. For important debates that have more than one side, I try to represent both sides of an argument and to express my opinion as to which side has the stronger case, and why.

With the high volume of investment-related information available, the bigger issue today is not acquiring information, but being able to make sense of all of it and keep it in perspective. As a result, I describe news stories in the context of bodies of financial knowledge, my studies of financial history, and over thirty years of investment experience.

Note on references

The links provided above refer to several sources that are free but also refer to sources that are behind paywalls. All of these are designed to help you corroborate and investigate on your own. For the paywall sites, it is fair to assume that I subscribe because I derive a great deal of value from the subscription.

Comments

Please direct comments or feedback to drobertson@areteam.com.

Disclosures

This commentary is designed to provide information which may be useful to investors in general and should not be taken as investment advice. It has been prepared without regard to any individual’s or organization's particular financial circumstances. As a result, any action you may take as a result of information contained on this commentary is ultimately your own responsibility. Areté will not accept liability for any loss or damage, including without limitation to any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

Some statements may be forward-looking. Forward-looking statements and other views expressed herein are as of the date such information was originally posted. Actual future results or occurrences may differ significantly from those anticipated in any forward-looking statements, and there is no guarantee that any predictions will come to pass. The views expressed herein are subject to change at any time, due to numerous market and other factors. Areté disclaims any obligation to update publicly or revise any forward-looking statements or views expressed herein.

This information is neither an offer to sell nor a solicitation of any offer to buy any securities. Past performance is not a guarantee of future results. Areté is not responsible for any third-party content that may be accessed through this commentary.

This material may not be reproduced in whole or in part without the express written permission of Areté Asset Management.