Areté's Observations 6/4/21

Areté (Pronounced ar-uh-tay) 1. Goodness or excellence of any kind. Fulfillment of purpose or function, the act of living up to one’s potential. 2. Effectiveness, knowledge.

I hope everyone had a nice long holiday weekend and a good week this week! We got solid rain most of Saturday and Sunday here in Philly, but it was actually nice to crack the screen door a bit, listen to the rain coming down, and catch up on a bunch of research. On a scheduling note, I will be away on vacation next week and will resume publication on the 18th.

Market observations

Crypto's momentum problem, May 29 2021 at 17:35 ($)

“One of bitcoin's problems remains momentum chasers. CTA momentum chasers do not care about direction, just momentum, so when it all "snapped" momentum signals reversed sharply lower. This together with bad liquidity in bitcoin, led to the extreme move lower.”

A couple of points here describe what is going on with bitcoin but also more broadly characterize what is going on in market. A key factor is momentum. When leverage is cheap and trending is high, there is money to be made simply following trends on a leveraged basis. Indeed, this can be self-fulfilling as price increases (or decreases) can spur others to jump on the bandwagon.

One key thing to remember is the strength of narrative is often more important than fundamentals in driving momentum. Therefore, when momentum is high, it says more about that narrative than it does about the intrinsic value of the underlying asset. A lot of money can be lost by confusing momentum with price-based valuation signals.

Technology

Stripe and Solid-State Economics ($)

https://diff.substack.com/p/stripe

“Cars, Excel spreadsheets, vacuum tube-based computers, poorly-implemented recursive programs, and attempts to win at real-time strategy games all break for approximately the same reason: they have lots of moving pieces, and the more moving pieces there are, the easier it is for something to stop working. Over the last half-century or more, across a variety of physical products, mechanical products have been replaced by more efficient, more compact, and much more reliable solid-state ones.”

“This is how software eats the world: by taking business functions one at a time, turning them into well-documented API calls with useful error messages (but infrequent errors) that can be chained together with arbitrary complexity and then run with minimal human involvement. The long-term dream is that, when you mouseover the "order now" button on an e-commerce site, a seamless chain of events updates the entire supply chain, and this tiny indication of incremental demand actually affects inventory restocking, hiring, and financial planning all the way down the line.”

One point made here is one I don’t emphasize enough: Technology has an amazing capacity to simplify processes. There are a lot of reasons for that which Byrne Hobart mentions in his piece above. The results are powerful: Tech can produce solutions that are both much cheaper, much more reliable, and often much easier to use. With competition like that it is no wonder “software is eating the world”.

The good news is there is all kinds of opportunity to further automate business functions that are run with “minimal human involvement”. This will act like a tail wind that gradually but persistently makes things faster, cheaper, and more efficient while eliminating a lot of drudgery.

There is a downside, however. The trend of “software eating the world” is not a negotiated one; it is more of an ultimatum. Either run with the trend or be left behind. People who are averse to technology or to change will increasingly become obsolete in the work force. People who do not regularly update their skill sets to operate in an increasingly technology-driven world risk having their expertise and skills become “stranded assets”. While it is insensitive to tell an unemployed coal miner to “learn how to code”, it is also unfair to allow large chunks of the work force to believe that physical human labor has anywhere near the market value it did twenty or forty years ago.

Commercial real estate

What a work-from-home revolution means for commercial property ($)

“Globally, more than 103m square feet of office space has already been vacated since the pandemic began, according to Cushman and Wakeeld, a brokerage. That is 18% more lost floor space than during the financial crisis of 2007-09. Vacancy rates rose steeply over the past year, reaching 18% in the spring in America (see chart 1). The forecasts are gloomy. Roughly one in five offices in America will be empty in 2022, according to Moody’s Analytics, a consultancy. Rents in America are projected to fall 7.5% this year; those in San Francisco, by 15%.”

“The long-term nature of property leases and availability of debt means that losses from the pandemic may not materialise for several years.”

Commercial real estate has been a bit of an enigma; despite suffering high vacancy rates over the last year, little distress is to be found. While it is true rent-collection rates for REITs “remained above 90% for most of last year”, it is also true “a number of obfuscating factors cloud the picture”.

The main factor is timing. Because commercial real estate has long-term leases, it takes a long time for supply/demand impacts to be felt financially. In a sense, this is a financial form of long Covid; severe side effects persist long after the initial infection. On this note, we will also be starting to see the consequences of expiring moratoria on evictions and the end of supplemental pandemic benefits in coming weeks. While the economy is clearly recovering, it is hard to get too excited until it is standing on its own two feet again.

Politics

Designing democracy on Mars can improve how it works on Earth ($)

https://www.ft.com/content/f0d95e10-ca83-47f4-9c06-3eab19261ab4

“Unsurprisingly, with its focus on universal values, the imaginary Martian bill of rights echoed the US constitution and the Universal Declaration of Human Rights. But the students’ 31-page constitution also reflected more contemporary concerns, enshrining the rights of bodily and psychological integrity, of privacy and non-interference by government and of sole ownership of personal data, for example. Moreover, it explicitly extended constitutional protections to animals and the environment.”

“But its most distinctive feature was that it implicitly rejected the electoral model of democratic politics, establishing six standing “mini-publics” of 250 randomly selected Martian citizens to legislate in areas of economic, social and environmental policy, civil rights, government oversight and interstellar relations.”

A rebounding economy won’t mean a return to the status quo ($)

https://www.ft.com/content/08191411-4097-4bd3-be93-cbfd4ad7888a

“Roughly two-thirds of respondents in France and half of those in the US, UK and Germany said they wanted either a ‘major overhaul’ or ‘complete reform’ of economic structures’.”

In Gold We Trust report, May 27, 2021

https://www.incrementum.li/en/ingoldwetrust-report/

“[Millennials] have a sense of great injustice in a system rigged against them, with little hope for betterment in the future as asset price inflation runs amuck and ruins the American Dream. These are the forces that shape a generation of soon to be leaders. The same forces are therefore destined to shape society at large.”

“The Millennial generation will come to power soon, with their pragmatic, borderline authoritarian view of good government. They feel there is little to lose from implementing radical change, as the status quo has not been helpful to them.”

Three different sources on Millennials and Gen Zers all point to the same place: Younger generations are not happy at all with the status quo of politics and public policy. As a result, it is fair to expect some pretty dramatic changes in coming years. To older eyes, some of these will seem misguided and some will seem like overreach. Nonetheless, there is plenty of room to improve participation in politics and to strengthen democracy. Regardless, we had better start preparing for change because it is coming.

Social trends

QAnon infects churches

“QAnon conspiracy theories have burrowed so deeply into American churches that pastors are expressing alarm — and a new poll shows the bogus teachings have become as widespread as some denominations.”

There has not been a lot of media mentions of QAnon since the election last November, so it was interesting to get an update. Number one, it hasn’t gone away. Number two, it involves a significant portion of the population. And, number three, it matters because “The problem with misinformation and disinformation is that people — lots of people — believe it.”

Following misinformation is bad enough on its own, but the negative consequences extend even further. As George Orwell said, “Truth is treason in an empire of lies.” As a result, efforts to reason with or provide facts to QAnon believers is worse than unproductive; it is viewed as treasonous. This is just one more hint at how ungovernable this country is becoming.

Geopolitics

Mobster transfixes Turkey with video tirade against political elite ($)

https://www.ft.com/content/a968c2c5-2001-4ae8-9339-58e27bcd7495

“The Peker tapes expose that it’s about self-enrichment, nepotism and ties to the mafia. Erdogan runs Turkey but he doesn’t lead it, and the aura of stability is gone. Turkey looks like a house of cards.”

As I have mentioned several times over the past year, Turkey is one of the top candidates for tipping over the geopolitical apple cart. Not only is there abundant potential for conflict with any number of other countries, but the weakening currency also has potential to spill over to other emerging markets. The “revelations” in the Peker tapes heighten uncertainty at the worst possible time.

Cryptocurrencies

The rise of crypto laundries: how criminals cash out of bitcoin ($)

https://www.ft.com/content/4169ea4b-d6d7-4a2e-bc91-480550c2f539

“In the world of online crime, anonymous cryptocurrencies are the payment method of choice. But at some point, virtual hauls need to be turned into hard cash. Enter the ‘Treasure Men’.”

While I certainly have my druthers about the utility of most cryptocurrencies, there are absolutely very interesting aspects of the technology and the social values that champion them. The best way to pursue such a nuance position is through a careful balance of objective inquiry and healthy skepticism. Unfortunately, the FT account above fails on both counts.

Nowhere is any evidence provided that cryptocurrencies are the payment method of choice for online crime. Further, the way in which criminals cash out of bitcoin is of modest interest but is hardly the headline story for cryptocurrencies. By contrast, the story could just as easily have started out, “In a world of ruthlessly debased fiat currency …” in which case cryptocurrencies would be viewed as necessary experiments to combat devaluation. The bottom line is reporting pure narratives doesn’t help; keeping minds open and asking questions does.

My Adventures in CryptoLand

https://www.netinterest.co/p/my-adventures-in-cryptoland

“For those who don’t know, decentralised finance (or DeFi) is an emerging ecosystem of applications seeking to rebuild financial services from the ground up. Its roots lie in crypto, where it sits on top of Ethereum blockchain technology.”

“Having placed my funds in the market I can log on to Compound and see interest accrue to my balance every time a new Ethereum block is added – at the current rate, every thirteen seconds. There’s something hypnotic about seeing funds compound continuously in real time; now I get how bankers feel.”

To the point of keeping minds open, the notion of decentralized finance is an offshoot of cryptocurrencies and is rapidly gaining mindshare. This piece by Marc Rubinstein is an excellent introduction into this new eco-system. The kind of mind-blowing part is individuals really can set up accounts and function like a small bank. It is not hard to imagine how massively disruptive this could be.

That there are still glitches with this eco-system is understandable since it is still in development. That said, it is true there are some shady characters and ploys to rip people off. However, there is proof of concept (i.e., it works). Further, and this is the main point, if it scales significantly, it will completely transform the financial system. As a result, it makes sense to pay attention.

Gold

In Gold We Trust report, May 27, 2021

https://www.incrementum.li/en/ingoldwetrust-report/

“The current monetary world order, established after the Bretton Woods system collapsed in the 1970s, has outlived its usefulness.”

“To rebuild confidence in a new monetary system, policymakers will be forced to anchor an international currency to something tangible, most likely gold.”

These two short quotes capture the “endgame” as eloquently as any. In short, the current monetary system is no longer fit for purpose and any replacement will need to have a solid foundation for trust. By far the most likely candidate for that foundation is gold.

This raises a couple of points. One is a currency system linked to gold does not have to be a strict gold standard in which currency is linked to gold at a fixed rate. Another is the vast majority of governments would prefer gold over cryptocurrencies because much greater control can be exercised. Finally, any kind of universal standard for money would require broad international consensus – and gold is the most likely to satisfy that condition.

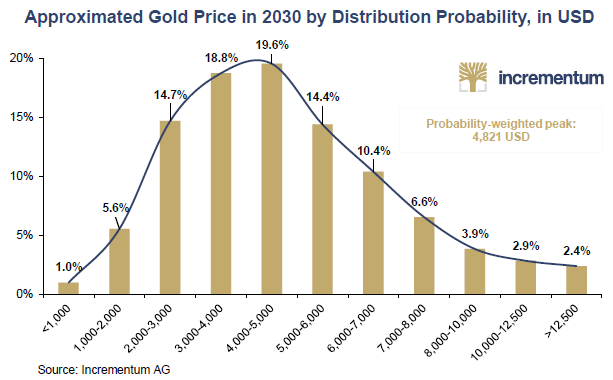

When a new system is devised, existing fiat currencies like the US dollar will get repriced relative to a standard like gold. When that happens, the dollar will be devaluedin a step function change. In essence, all of the devaluation that has been occurring gradually but implicitly will be realized explicitly in one fell swoop. This is effectively what is reflected in the distribution of gold prices by Incrementum in the chart below.

Banks

Lee Adler: Banks Are As Fragile As Ever

https://www.theinstitutionalriskanalyst.com/post/lee-adler-banks-are-as-fragile-as-ever

“The bottom line is that the system remains extremely vulnerable to a decline in Treasury prices that is probably coming in the second half. Likewise, the return of optimism in commercial real estate is problematic. The banks are taking no precautions. There’s no sign of recognition of the looming losses.”

“It means that the entire banking system could be destabilized in the second half of this year. The Fed will have to act, massively. History shows that the Fed won’t act in time to prevent a breach of the system. History also shows that the Fed has the power to ultimately make its actions give the appearance of stabilization, leading to the return of animal spirits.”

With banks being huge beneficiaries of the reflation trade, these comments by Lee Adler on Chris Whalen’s blog provide a fresh dose of skepticism. Once again, there is a clear path for trouble to develop, banks are cavalierly ignoring the risks, and so far, the market is too.

Monetary policy

Monetary finance, ahoy! ($)

Grant’s Interest Rate Observer, May 28, 2021

“We envision a grand plan to end-run the familiar institutions of public finance, not least market-determined interest rates. It will start with tinkering—tweaks to the role of the primary dealers, an enlarged reverse repo facility—but culminate in the restoration of overdraft privileges for the Treasury, privileges that were part and parcel of the original Federal Reserve Act and that were still on the books as recently as 1981.”

“As first conceived, the overdraft technique was a cash-management convenience. If resurrected today, it would likely be something else. A return to the founding Fed protocols would allow Uncle Sam to write checks without having to tap the financial markets, cultivate the primary dealers or infuse those dealers with liquidity when the superabundant supply of government securities overwhelms investor demand.”

The ongoing assessment of the potential for inflation versus deflation is a challenging task but one almost tailor-made for Jim Grant. His expertise in monetary policy, experience in markets, unparalleled command of history on the subject, and unconstrained imagination combine to illuminate the possibilities. The scary scenario he lays out is a plan that “starts with tinkering” but culminates with “overdraft privileges for the Treasury”.

This scenario is scary partly because it is an “end-run”, partly because there is precedent that creates a clear path, and partly because it all sounds so innocent. There will be no trumpets blaring or publicized political battles to forewarn of the change.

Grant’s scenario sends shivers down my spine more than any other because it is so eminently plausible. The “tinkering” absolutely jibes with comments from Chris Whalen I highlighted in last week’s note in the “Monetary policy” section. It also strikes me as more plausible than Russell Napier’s scenario, at least in the US, which depends heavily on banks as a transmission vehicle and on increasing money velocity.

Further, Grant’s scenario provides a plausible counter to the claim by prominent deflationist, Lacy Hunt, that inflation can only arise if the Fed monetizes its liabilities. While that is true enough, it need not be done so directly or explicitly or with any great deal of accountability. Grant shows the sneaky, political way to accomplish the same thing. Creepy.

Implications for investment strategy

Howard Marks on the low return world

https://www.ft.com/content/d13e2c2e-5267-41d7-b4da-155892d39efe

“[Howard] Marks says, you have to be in the market. Successfully avoiding a bubble requires two decisions: to get out and to get back in, and most people blow one or the other.”

I have a great deal of respect for Howard Marks as an investor and as a person willing to share many of his insights over the years through his widely read investor letters. That said, Marks has done exceedingly well during a period of time that stands out as incredibly anomalous relative to any other period in history. As a result, I can’t help but to believe his advice, “you have to be in the market”, is more a function of his great good fortune than a historically informed assessment.

The assumption Marks makes is downturns are merely cyclical. Implicitly, by contrast, downturns are never secular. The experience of Japan in the 1990s and 2000s is just one very relevant example where that assumption was wrong. Further, given excessive levels of debt and increasing deficits, and elevated valuations, there are good reasons to believe US markets cannot go up forever without a significant or lasting setback. As I have mentioned several times before, the mental model of a “carry regime” seems to fit the US much better. It works right up to the point when it fails spectacularly.

Nonetheless, Marks’ views also capture those of many millions of other investors. I believe these investors will be disabused of the dogmatic position that “you have to be in the market” gradually, persistently, and painfully.

Principles for Areté’s Observations

All the research I reference is curated in the sense that it comes from what I consider to be reliable sources and to provide meaningful contributions to understanding what is going on. The goal here is to figure things out, not to advocate.

One objective is to simply share some of the interesting tidbits of information that I come across every day from reading and doing research. Many of these do not make big headlines individually, but often shed light on something important.

One of the big problems with investing is that most investment theses are one-sided. This creates a number of problems for investors trying to make good decisions. Whenever there are multiple sides to an issue, I try to present each side with its pros and cons.

Because most investment theses tend to be one-sided, it can be very difficult to determine which is the better argument. Each may be plausible, and even entirely correct, but still have a fatal flaw or miss a higher point. For important debates that have more than one side, I try to represent both sides of an argument and to express my opinion as to which side has the stronger case, and why.

With the high volume of investment-related information available, the bigger issue today is not acquiring information, but being able to make sense of all of it and keep it in perspective. As a result, I describe news stories in the context of bodies of financial knowledge, my studies of financial history, and over thirty years of investment experience.

Note on references

The links provided above refer to several sources that are free but also refer to sources that are behind paywalls. All of these are designed to help you corroborate and investigate on your own. For the paywall sites, it is fair to assume that I subscribe because I derive a great deal of value from the subscription.

Comments

One goal of this letter is to provide fairly dense information content – so you don’t waste your time filtering through a lot of fluffy verbiage. A consequence of that decision, however, is sometimes things may not be as understandable as they could be.

If you have a general question that may also be useful for others to know the answer to, please make a comment in the newsletter and I will do my best to answer the question or make a clarification. If you have a more specific question, please send it to drobertson@areteam.com.

Disclosures

This commentary is designed to provide information which may be useful to investors in general and should not be taken as investment advice. It has been prepared without regard to any individual’s or organization's particular financial circumstances. As a result, any action you may take as a result of information contained on this commentary is ultimately your own responsibility. Areté will not accept liability for any loss or damage, including without limitation to any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

Some statements may be forward-looking. Forward-looking statements and other views expressed herein are as of the date such information was originally posted. Actual future results or occurrences may differ significantly from those anticipated in any forward-looking statements, and there is no guarantee that any predictions will come to pass. The views expressed herein are subject to change at any time, due to numerous market and other factors. Areté disclaims any obligation to update publicly or revise any forward-looking statements or views expressed herein.

This information is neither an offer to sell nor a solicitation of any offer to buy any securities. Past performance is not a guarantee of future results. Areté is not responsible for any third-party content that may be accessed through this commentary.

This material may not be reproduced in whole or in part without the express written permission of Areté Asset Management.