Observations by David Robertson, 10/21/22

The volume of market events seems to keep getting turned up louder and louder as we cruise through the fall. If you have questions or just want to get some perspective on the whirlwind of happenings, let me know at drobertson@areteam.com.

Market observations

There are a few important observations in this tweet thread. First, the options market is increasingly being dominated by extremely short-term options (options with less than 24 hours to expiry are often referred to as 0dte, or 0 days to expiry). Of course, these are highly speculative.

In addition, the need for dealers to hedge these options, and the difficulty in doing so, has carryover effects on the underlying securities. This explains a great deal of the crazy ups and downs in stock prices recently.

Finally, the unusual interest in extremely short dated options also means there is unused capacity for longer dated options. This means fewer investors have protection against big market moves. And this means there is more room for really violent moves in the market.

T1 Alpha Sit-Rep: Tuesday October 18th

With positioning low overall, it seems reasonable to expect there will be more interest in buying upside protection rather than downside -- at least relative to recent experience. All else equal, this is likely to push markets modestly higher (potentially in a violent fashion), but we caution our readers not to interpret any of these violent swings as "fundamental information." These are technical moves, nothing more.

This commentary from Tier1Alpha (check out their website at https://tier1alpha.com/ to sign up for the free newsletter) is a nice complement to @PauloMacro’s observations. Bottom line: don’t “interpret any of these violent swings as ‘fundamental information’.”

For the mild-mannered, even-keeled, very rational long-term investor wondering why on earth markets are bouncing around all over the place, this little nugget from @EricBalchunas provides helpful context. Despite (or perhaps because of?) ARKK being down on the order of 60% year-to-date, money continues to flow into the fund. The flows have persisted through the year and have not meaningfully slowed even with the terrible performance record.

This highlights an important phenomenon. There are a lot of investors who are acting with cult-like zeal. They are not making decisions based on fundamentals or valuation or anything else. They buy into a narrative and cling to it, oftentimes even more so in light of disconfirming evidence. It is unfortunate, but we will continue to see wild swings until these types of investors stop playing with money or just run out of it.

Economy

US banks are scary strong ($)

https://www.ft.com/content/78bfb9c8-b19a-41f4-b661-ef88cf7829b4

The short answer to that question is just no. We just don’t see anything that you could realistically describe as a crack in any of our actual credit performance . . . We’ve done some fairly detailed analysis about different cohorts and early delinquency bucket entry rates and stuff like that. And we do see, in some cases, some tiny increases. But generally, in almost all cases, we think that’s normalisation, and it’s even slower than we expected

Banks typically provide good indicators of economic activity because they mediate so much of it. As such, the comments by the CFO of JPMorgan above point to a healthy economy. The question was in regard to whether they were seeing any cracks related to pain from inflation and/or higher rates filtering through. They aren’t.

This raises a tantalizing prospect. What if higher rates re-base the highly financialized parts of the economy, i.e., Wall Street, but leave the core economy largely unscathed? Sure it would take some time to transition, but it is easy to argue a greater focus on real productivity and less focus on financialization would be good things.

Maybe most of the screaming about policy mistakes and a terrible recession are coming mainly from Wall Street? Maybe most other people like being able to get interest on savings again? While banks are better indicators of current conditions than future conditions, these are interesting prospects to consider.

Demographics

Remote work may have fueled a baby boom among U.S. women

https://www.axios.com/2022/10/19/remote-work-baby-boom-america

The findings suggest that workplace flexibility might be one solution to the long-term issue of falling birth rates — a possible driver of declining economic growth — seen across richer countries.

They also discovered that a widely publicized drop in fertility rates in 2020 — agonized over in the press — was largely due to a sharp decline in births to foreign-born women, who were blocked from entering the country.

In the midst of so much bad news, not least of which counts widespread demographic decline, this news immediately jumped out as a pleasant surprise. Apparently, birth rates in the US have risen and apparently more flexible work arrangements have something to do with it. Further, the big drop in fertility rates in 2020 appears to be exaggerated by the “sharp decline in births to foreign-born women.”

Lots more work to do to fully grasp what’s going on, but if a strong link can be established between workplace flexibility and higher birth rates, we’re going to see a lot more of it addressed in public policy. Maybe solving the demographic challenge is easier than anyone thought?

Commercial real estate

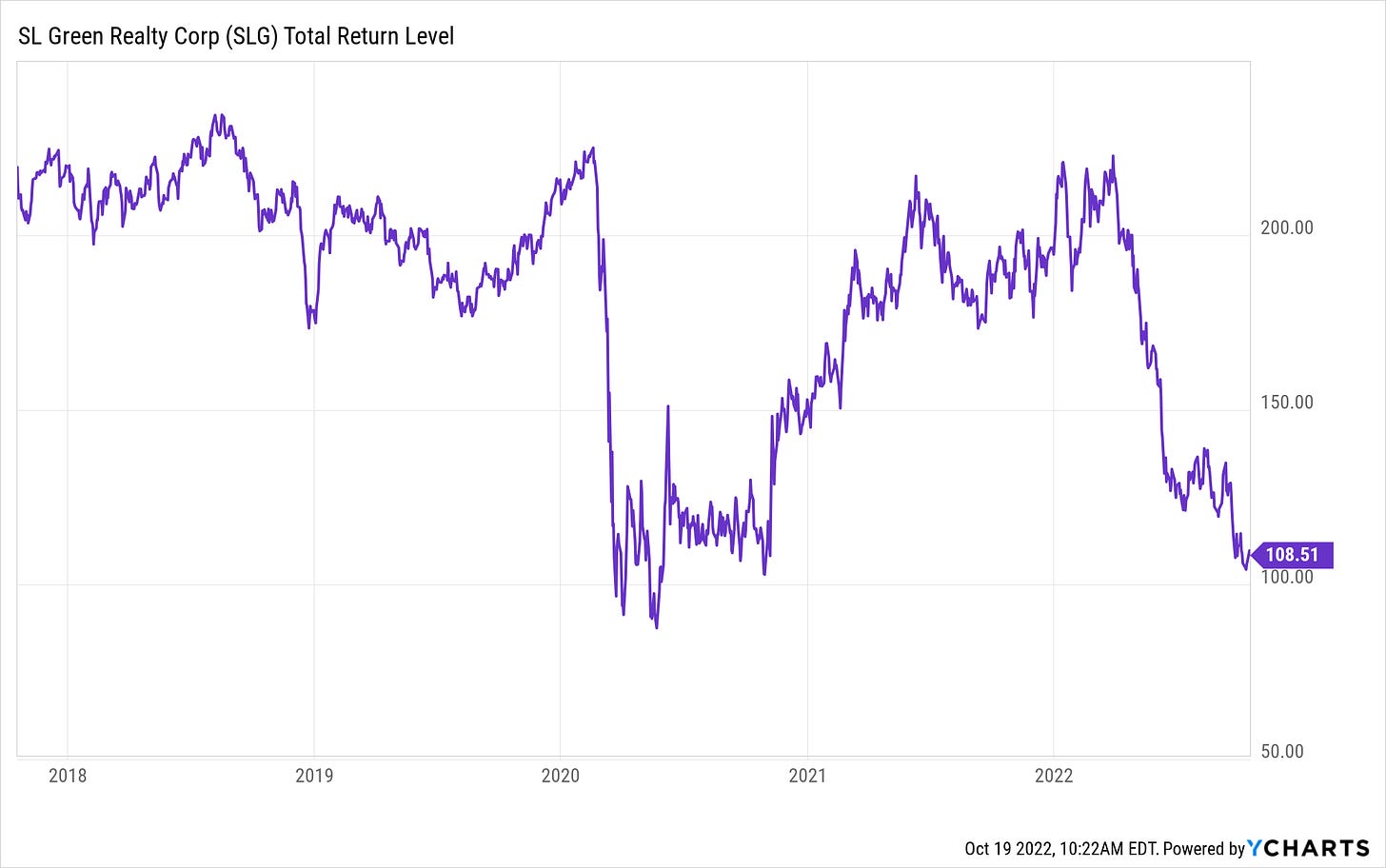

Residential houses have stolen the spotlight in the real estate market as mortgage rates have skyrocketed this year. As relevant as this is to current and would-be home-owners, it has overshadowed what has been going on in the commercial real estate (CRE) market. While CRE has been affected just as much by rapidly rising rates, the chart above from @SoberLook indicates it is suffering the double-whammy of obsolescence as well.

The story can be seen in this chart for SL Green, a REIT focused on New York City office buildings. After the initial Covid panic in 2020, shares rebounded. As company plans for return to office attendance largely failed to materialize this year, however, the stock got crushed again.

Partly, this is a story about a fundamentally different work environment post-pandemic. Indeed, the desire and ability of many workers to do more work from home is indicative of a broader trend favoring labor over capital.

Another important point though is CRE cycles can take a long time. Since leases tend to be longer term, it takes many years for them to roll over to more market-based rates when there are big changes. As I mentioned in Observations a couple years ago already, “The value of commercial properties will get hit and it will take time to resolve the problems.” Indeed.

China

One piece of news that came out last week was in regard to new export controls for semiconductors and semiconductor capital equipment. This isn’t normally the kind of stuff that lights up the risk radar, but in this case, the ramifications look to be significant:

In case one may be inclined to believe Schneider’s assessment is hyperbole, George Magnus chimes in that “China’s chip industry [is] set for deep pain”. He also adds that these moves represent an escalation and are well past mere rhetorical tit for tat. Rather, the footing established by these policies is looking more and more like economic war.

Other news from China featured updates from its Party Congress this week. A number of comments came out of Xi’s speech last weekend. As @PeterZeihan notes, one of the important threads revealed was a relative shift away from economic growth and toward national security.

Another insight proffered by @Halsrethink is that signs are pointing to “greater centralization of economic decisionmaking” in China. While this is understandably about control, it colors expectations about future policy. For one, Covid policies have been disastrous and shouldn’t be expected to get a lot better. For another, in the absence of robust policy discussions, it is fair to expect what Malmgren calls “greater fragility” and others have described as capricious.

Finally, as @michaelxpettis points out, the “clampdown on local-government spending will be even worse for the economy than the clampdown on real estate” due to its “very important role … in generating economic activity”. As such, the policy response to slowing growth of slowing local-government spending is likely to be “highly pro-cyclical” and therefore, counterproductive.

There are no easy answers for the situation China is in, but the evidence thus far suggests Beijing is not setting itself up well for success either.

Market structure

Clearing Is Not A Harmless Bunny

There are a lot of issues here and I don’t want to dive too far into the weeds, but suffice it to say, clearinghouses are the locus of many of today’s problems in the market. This was certainly highlighted in the UK gilts market the last couple of weeks.

The problem is that regulators pushed more activity onto clearinghouses after the GFC ostensibly to reduce risk, but instead just transferred risk to different parties. Maturity and liquidity mismatches still exist but more so with pensions and asset owners.

Further, clearinghouses are for-profit entities and therefore have economic incentives to increase trading and reduce the friction of margin requirements. Other parties (namely central banks) are left to clean up the mess when rapid changes in margin requirements induce severe liquidity problems.

The long and the short of it is that all of the problems from the GFC still exist in the financial system, it’s just that some of the names have changed. This creates a monster public policy problem. How it gets resolved will be an important factor in dictating the trajectory of markets.

Monetary policy

This is a good thread about the “business” of running a central bank for those interested in learning more about the details. It is absolutely true the Fed is earning less on its assets than it pays on liabilities and it is also true that a negative equity position could be a problem for the Fed.

Where I disagree is with regard to the seriousness of these constraints. Every other major central bank is dealing with similar issues. When push comes to shove, the demand for US dollars will offset much of the credibility lost due to the Fed’s technically precarious financial position.

That said, no entity can survive losing money for extended periods of time and this is just as true of the Fed. The clock is ticking on its program to restore order. If/when it fails, the dollar will have to be re-evaluated by investors.

Investment landscape

One of the important trends in the landscape right now is the increasing primacy of political drivers as opposed to economic ones. This is a point Russell Clark makes clearly in a recent post ($). He cites the example of the Great Depression in the 1930s which “destroyed the political support of free market capitalism” which in turn compelled voters to want “something different”.

His general point is that “voters drive political change”. As it regards the politics of today, he assesses, “And voters are tired of pro-capital policies”. In other words, the message to all the investors who evaluate the sensibility of policy based on its adherence to free market principles, is that voters just aren’t that into you any more.

While the political path is being paved for ever-greater government intervention, history provides examples of what to expect. One representative, albeit extreme example, comes from Daniel Yergin’s classic book on the oil industry, The Prize.

In January 1918, the Fuel Administration ordered almost all industrial plants east of the Mississippi to close for a week in order to free fuel for hundreds of ships filled with war materials for Europe that were immobilized in East Coast harbors for want of coal. Thereafter, the factories were ordered to remain closed on Mondays to conserve coal.

It’s not hard to imagine the howls of protest from industrialists that arose to the policy. From the government’s perspective, however, the decision to inconvenience business people for the purpose of advancing the war effort was a no-brainer. The point is, when governments are pushed, they will go to great lengths to ensure their survival. Sometimes that means other interests get trampled. It can be very dangerous to assume otherwise.

Implications for investment strategy

In the swirl of geopolitical events, macroeconomic pyrotechnics, and persistent inflation, there has been a smorgasbord of public policy ideas to address the challenges. Many of these seem myopic at best, and massively counterproductive at worst. It’s not hard to believe the world is being led by a cabal of clowns as many on social media suggest.

One point is while much of the effort seems unserious, and it may well be, it does reveal a changing political dynamic away from free markets and pro-capital policies and towards government intervention and pro-labor policies. The trajectory is unlikely to be a straight line, but that is where things are headed - because that’s what people want.

Rather than complaining about the outrageousness of such ideas, however, investors will be better served to anticipate how this shapes investment opportunities. It is fair to expect an upward trajectory of labor costs which will pressure margins for labor-intensive businesses. On the other hand, however, it will also (eventually) increase real wages which will increase consumer spending power. I wouldn’t be surprised to see demand for homes and household goods increase over the next several years.

Conversely, the gains for labor will come at the expense of capital, which will make for tougher sledding for retirees and others living off capital returns. This doesn’t necessarily mean the end of the world. As assets get cheaper, better returns will be available. Greater gains for labor are also highly likely to be recycled into growth in consumer spending and therefore economic growth.

It does mean, however, it will be much harder for investors to simply ride passive investments to retirement nirvana and it means inflation will be a nearly constant battle.

Finally, a great point by Jim Bianco. It is absolutely true that one’s investment horizon is a critical factor in determining risk. The longer your investment horizon, the better you are able to withstand the vicissitudes of market swings during the interim.

Note

Sources marked with ($) are restricted by a paywall or in some other way. Sources not marked are not restricted and therefore widely accessible.

Disclosures

This commentary is designed to provide information which may be useful to investors in general and should not be taken as investment advice. It has been prepared without regard to any individual’s or organization's particular financial circumstances. As a result, any action you may take as a result of information contained on this commentary is ultimately your own responsibility. Areté will not accept liability for any loss or damage, including without limitation to any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

Some statements may be forward-looking. Forward-looking statements and other views expressed herein are as of the date such information was originally posted. Actual future results or occurrences may differ significantly from those anticipated in any forward-looking statements, and there is no guarantee that any predictions will come to pass. The views expressed herein are subject to change at any time, due to numerous market and other factors. Areté disclaims any obligation to update publicly or revise any forward-looking statements or views expressed herein.

This information is neither an offer to sell nor a solicitation of any offer to buy any securities. Past performance is not a guarantee of future results. Areté is not responsible for any third-party content that may be accessed through this commentary.

This material may not be reproduced in whole or in part without the express written permission of Areté Asset Management.