Observations by David Robertson, 1/13/23

The new year is getting off to a wild and woolly start and promises to be every bit as exciting as last year. It will also be an important marker to indicate whether 2022 was an off, bad year, or whether it was the portent of more challenging times ahead.

As always, if you ever want to follow up on anything, just let me know at drobertson@areteam.com.

Market observations

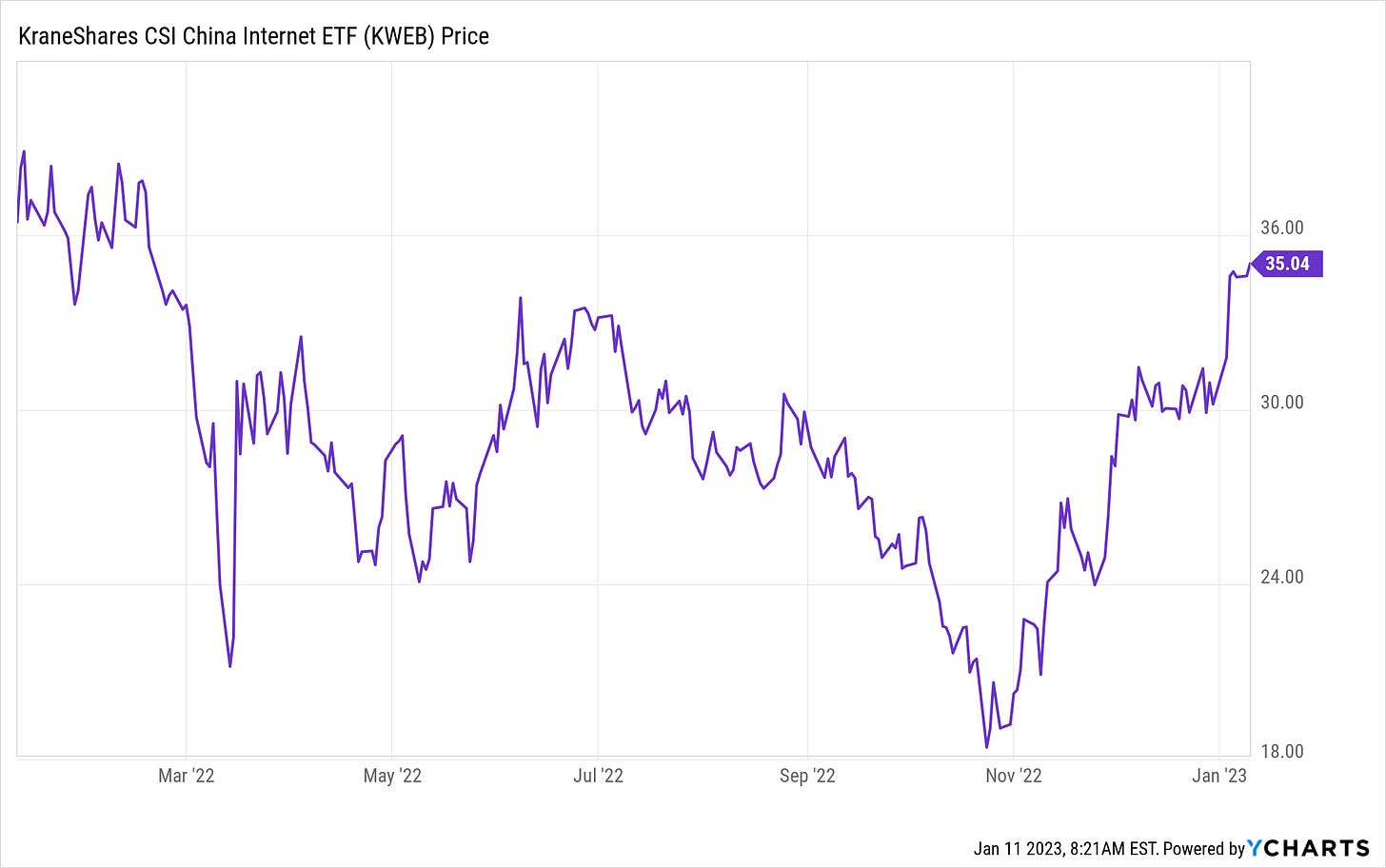

Friday last week was a big up day for stocks on the pretense that slightly lower wage growth was an important hint at rapidly declining inflation. In a summary of speculative activity the FT headlined, “ProShares draws record inflows as investors bet on volatility”. At the same time, China stocks continued to rumble on the basis of imminent re-opening from its Covid conflagration - and this has spilled over to emerging markets in general. The broader phenomenon is it doesn’t take much evidence for a trade idea to gather steam.

The thing I’m watching most is the US dollar. Weakness going into the end of 2022 didn’t surprise me too much as I interpreted it as an effort to prevent any financial accidents from happening at year-end. The dollar popped when markets opened in the new year and jumped again later in the week. Since the jobs report on Friday, however, the dollar has hit new lows for the new year. While I don’t read too much into this move … yet … it is an important marker regarding US geopolitical strategy and therefore deserves attention.

Finally, it appears it’s not just me who observes a certain unruliness in this early January market behavior. As @SantiagoAuFund points out, it is not unusual for opening weeks to experience unusual trading patterns. Best to not treat it too seriously.

Labor

The FTC proposes banning noncompete agreements

https://www.axios.com/2023/01/05/ftc-noncompete-agreement-ban-rule-change

The Federal Trade Commission on Thursday proposed banning employers from requiring employees to sign noncompete agreements, which prevent workers from taking positions at competitors for a period of time after they leave a job.

While President Biden addressed the issue of noncompetes a year ago, this move by the FTC constitutes a much more tangible and meaningful effort. Yes, there are legal hurdles to clear, but as Axios assesses, this is “One of the broadest and most pro-worker initiatives to come out of the Biden administration.” Further, “If enacted, the ban could radically shift the balance of power between employers and workers across just about every industry and pay level — from fast-food jockeys to doctors to CEOs.”

The broader importance, then, is how the outcome of this effort reflects on the economic contest of labor versus capital. If labor makes significant gains, it would be a sign the dominance of capital the last forty years is waning. It would also be an indication of higher inflationary pressures ahead.

Credit

Credit Boom

https://fedguy.com/credit-boom/

A tremendous credit boom took place in 2022 and it may not even be over. The combination of healthy banks, financially strong households, and attractive rates appears to have to led to a surge in bank lending.

It is true bank lending increased last year, and by a whopping amount according to Fedguy, Joseph Wang: “Around $1.2t in loans were made in 2022, a level around three times higher than that of recent years.” Wang highlights relatively healthy consumer balance sheets and rising wages as some of the causes of higher borrowing. He also highlights increased money supply (though the act of lending) as one of the effects.

This paints a much brighter picture of the economy and its potential than the one painted by economists focused intently on inverted yield curves. So, one point is increased lending is a positive force, and an underrated one at that. Another point, however, is the credit picture is not universally bright …

While it may be that household lending is off to the races while business lending is getting crimped, another possible explanation is small business lending is transitioning back to the banks. After the GFC, banks shunned risky lending and effectively drove many small businesses to seek credit from nonbank providers. Now, higher rates are putting disproportionate pressure on those lenders.

Insofar as this is the case, Wang’s optimism about money supply growth is overstated: Loans created in the unregulated nonbank sector are simply migrating back to the regulated bank sector. If true, it would also be positive for the Federal Reserve and other regulators since it would effectively increase the Fed’s control over money supply.

Regardless, credit is serving as a good metaphor for the broader economy: Lots of cross currents and lots of moving parts makes it hard to characterize simplistically.

Oil

$100 a barrel oil looms again, analysts say ($)

https://www.ft.com/content/55e3c21f-9421-4e91-b8b6-c0ed8ed3a876

Wall Street’s top analysts see the makings of another price leap lurking in just about every important corner of the oil market. A run past $100 a barrel is likely in the coming months, they say, which would threaten a weak global economy anew and put energy prices back at the top of the agenda of many governments.

This article from the FT provides a good summary of the arguments for oil prices going higher. These aren’t new arguments, but perhaps more imminent, especially with China starting to re-open from Covid lockdowns.

Of course, there are also arguments against oil prices rising substantially. I pointed out, for example, China may well have a great deal of flexibility to calibrate demand relative to oil prices in the 9/23/22 edition of Observations. Mike Green also focuses on the demand side of the argument (here and here), but in a much broader way.

He challenges the historical trajectory of oil demand on two counts: One, oil demand per capital has been falling in OECD countries since the GFC, and two, oil demand is elastic to price over time (i.e., high prices cause lower demand). He concludes, “This would suggest we are permanently below the oil demand trend that Pierre [Andurand] highlights, and, in fact, we are rapidly approaching peak oil demand.”

Green’s analysis dovetails nicely with my own suspicions that oil analysts are much better at modeling supply than demand and that consumers do adjust oil demand relative to price, at least above certain thresholds.

Insofar as this is right, it implies two things. One is oil is unlikely to be a huge convex bet that many analysts are making it out to be. There are alternatives to traveling with oil-based fuels - traveling less, using alternative energy sources (such as electricity), using public transportation, riding a bike, etc. Cost determines the optimal mix.

Second, this being the case, it is fair to expect much more strategic consumption of oil. We have already witnessed strategic prioritization in Europe in regard to energy consumption and it is very fair to expect the same from China as it re-opens. This doesn’t mean oil won’t go up, but it does lower the chances of an explosive rise.

Monetary policy

The much-anticipated CPI report came out on Thursday and confirmed expectations of incremental progress on the inflation front. Month-to-month prices dropped 0.1% and year-over-year CPI dropped to 6.5%. While the year-over-year increase is still much higher than target, the series of monthly changes since last summer has moderated considerably.

With stocks running up most of the last week, this result was widely expected. The details contained mixed news, however. On one hand, energy was the single biggest contributor to easing prices. On the other hand, services inflation increased again and remains at an uncomfortably high level, though that includes lagging shelter prices as well. Can energy continue declining? Can services continue increasing?

As many of the pandemic-induced bottlenecks resolve and continue to ease pressure on goods prices, attention is shifting to the increasingly problematic services front. Not only are services prices continuing to rise, but services are also comprised mainly of wages - which suggests services wages may need to rise as well. The main lesson, which I have highlighted several times before, is inflation does not typically move in a smooth, linear fashion. The Fed knows this which means the duration of it tight policy stance is more important than the size of the next rate hike.

Investment landscape

The jobs report last Friday sent analysts and journalists scurrying to parse every last detail and in the meantime sent the S&P 500 rocketing higher by 2.3%. In the context of significant recent revisions, Matt Klein ($) commented, “Anyone looking at these data in real time has gotten whiplash.” Robert Armstrong at the FT described, “The economic data remains equivocal, ambiguous, and confusing.”

For better and worse, this is the economic and investment landscape in which we operate so it is best to acknowledge it as such. There are a lot of moving parts and cross currents. There is also a lot of noise.

Prior to the pandemic, noise was almost a good thing. In the context of a Fed put and regular liquidity injections, investors could count on an upward trajectory in markets. Noise provided the building material for stories and narratives to make it sound more sophisticated (and compensation-worthy) than that.

Now, however, noise is an obstacle that distracts analysts and investors from capturing important trends and even from understanding current conditions very well. As Michael Mauboussin rightly points out, being able to reduce noise is one of the most effective things an analyst can do to improve outcomes:

BIN There, Done That: How to Reduce the Sources of Forecasting Error

This leads to the most striking finding the data revealed: the difference between superforecasters and regular forecasters is “due more to noise than bias or lack of information.” The researchers conclude that “reducing noise is roughly twice as effective as reducing bias or increasing information.”

Reducing noise is an especially appropriate goal for 2023 as it looks to be another year of rife with “equivocal, ambiguous, and confusing” data points.

Investment landscape II

Hodor

https://www.epsilontheory.com/hodor/

There are a lot of ways to steer a story.

If you are a central banker who wants to influence how investors process current and future monetary policy into risk-taking decisions, you embrace communications policy as your primary policy tool.

If you are a CEO who wants to train investors to value your stock on a multiple of a number you periodically pull out of your ass, you goon CNBC to tell the story every time you announce earnings.

If you are a journalist who wants to make sure that readers come away from an article with the Correct Interpretation, you look for ways to present your opinions as facts.

If you are a fund manager who wants to keep investors from worrying about the liquidity of your massive non-traded REIT and BDC franchise, well, sometimes words just aren’t going to cut it.

As Rusty Guinn at Epsilon Theory highlights, markets - “are built on stories”. This piece is about Blackstone’s BREIT, in particular, but provides much broader insight. Namely, stories are extremely important in guiding investors. Those stories are even more important when the facts point in a different direction than one would like.

This struck me as I have been contemplating why so many investors continue to stick with 60/40-type portfolios even when the evidence, and objective evidence at that (see Observations 1/6/23, Outlook edition) points to cash as the better option right now. Of course, people are reluctant to make changes. Of course, people are busy with other things. But it’s their investments - and they are at risk!

I think the main reason for such inertia is probably narrative. The thing everybody knows that everybody knows is stocks and bonds outperform cash over the long-term. They know this because almost every advisor, manager, marketer, and university professor says so. It’s a strong belief system … and it’s mostly right.

Mostly, but not completely. The glitch is there can be fairly long periods during which returns from stocks and bonds fail to outperform cash. Those periods can wreak havoc on investment portfolios. The risk of those periods can also be identified fairly objectively … and there is a very good chance we’re in one of those periods now.

So, why don’t more providers try to steer their clients towards safety when the evidence points in that direction? Partly, because it is less profitable to do so and partly because it is hard. So instead they “steer the story”. If investors want to avoid the risk of being overexposed to overvalued assets, they need to be proactive and they need to find providers who prefer reporting objective analysis to spinning stories.

Implications

Mauboussin’s lesson regarding noise is positive for long-term investors. Investors with longer time horizons generally have the luxury of looking past short-term fluctuations and instead making decisions based on broader trends and patterns. As a result, they are less vulnerable to being unduly influenced by noise.

By contrast, short-term traders are much more likely to be compelled to parse every last detail of economic reports despite the fact that those numbers are often subject to significant revision. Not only are such efforts frequently unproductive, too often they are actually counterproductive.

The problem is, if a narrative takes hold, even if from the flightiest of sources, prices can run far enough to undermine the logic of even longer-term ideas. As nice as it sounds to constrain oneself to the more civilized trappings of long-term analysis, excessive money and the speculative energy it engenders are persistently working to foil any efforts at judiciousness.

If you wait to see some “green shoots” of evidence to support your thesis, the chances are traders will have run prices up so much by then as to obviate the projected benefit. Jump too early and it looks a lot like a short-term trade. Hit it just right, and there is a good chance you will want to sell in a relatively short time frame. Oil was a good example of this last year.

Part of the challenge is determining, “What types of surges should long-term investors consider participating in?” Another part is deciding, “In what types of situations should longer-term investors consider making a move sooner than they would like?”

One decent guideline is to not get too cute. If you have a good idea of what you want to accomplish longer-term, and have a good sense there is an attractive risk/reward opportunity, it doesn’t help to try to get the trade timing exactly right. That doesn’t mean being insensitive to price; just not hyper-sensitive. It also means not waiting around for a “catalyst”.

Another decent guideline, and one that pushes in the opposite direction, is to be patient on the margin. If you are watching a trade idea and the price keeps moving away from you, it’s probably best to wait. With current Treasury bill rates, the immediate threat of inflation is not so great as to make it worth the risk of jumping in to an investment at a bad price.

It’s also important to remember the speculative fervor and hair-trigger trading in this environment is a function of too much money being in the financial system. All that money compels some people to do something riskier with it - so they chase unprofitable tech companies, or SPACs, or some other trade du jour. This is a major reason why the Fed continues to pull liquidity through its Quantitate Tightening (QT) program. It also means at some point, the excess money will be mopped up and the days of rampant speculation may be coming to a close.

Note

Sources marked with ($) are restricted by a paywall or in some other way. Sources not marked are not restricted and therefore widely accessible.

Disclosures

This commentary is designed to provide information which may be useful to investors in general and should not be taken as investment advice. It has been prepared without regard to any individual’s or organization's particular financial circumstances. As a result, any action you may take as a result of information contained on this commentary is ultimately your own responsibility. Areté will not accept liability for any loss or damage, including without limitation to any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

Some statements may be forward-looking. Forward-looking statements and other views expressed herein are as of the date such information was originally posted. Actual future results or occurrences may differ significantly from those anticipated in any forward-looking statements, and there is no guarantee that any predictions will come to pass. The views expressed herein are subject to change at any time, due to numerous market and other factors. Areté disclaims any obligation to update publicly or revise any forward-looking statements or views expressed herein.

This information is neither an offer to sell nor a solicitation of any offer to buy any securities. Past performance is not a guarantee of future results. Areté is not responsible for any third-party content that may be accessed through this commentary.

This material may not be reproduced in whole or in part without the express written permission of Areté Asset Management.