Observations by David Robertson, 1/27/23

A lot of ideas bubbled up during the week so I will jump right in. If you want to follow up on anything along the way, just let me know at drobertson@areteam.com.

Market observations

Yes, it has been a crazy start to the year. Take a marginal (at best) fund idea in the form of bitcoin, create a catchy name (WGMI - we’re going to make it, as opposed to NGMI - not going to make it), and voila, double your money in less than a month.

The massive speculative interest was far broader than one offbeat fund, however. A smattering of speculation magnets shows the sentiment is widespread.

Companies

The Staple Singe

https://www.grantspub.com/resources/commentary.cfm, Thursday, January 19, 2023

Yet an instructive dynamic stands out from those seemingly routine results: P&G absorbed a 6% year-over-year decline in organic volume growth during the quarter, more than double Wall Street’s expected 2.6% retrenchment, as each of the household product purveyor’s five segments saw volumes contract. In turn, Procter pulled the pricing lever to the tune of a 10% annual increase, well above the 6.7% consensus. As that unexpected divergence suggests, the current backdrop remains “a very difficult cost and operating environment” CEO Jon Moeller stated in the earnings release, while CFO Andre Schulten added on the conference call that “these macroeconomic and market-level consumer challenges we're facing are not unique to P&G and we won't be immune to the impact."

One important observation from the P&G report is the divergence between price and volume. Namely, organic volume was down 6% while pricing rose 10%.

This outcome lends itself to two very different interpretations. One is the company has already pushed too far with its pricing lever as volume declined far more than expected. Another possible interpretation is the company has such huge pricing power, it can make up even significant volume declines with pricing. Based on my experience, such big price increases rarely work for very long. Initially, consumers are slow to change buying patterns. Once they do, however, the shift to alternatives and substitutes can be permanent.

In other news, 3M reported on Tuesday morning and reflected some similar pressures. Although organic growth remained marginally positive, it fell below expectations of one to three percent. The miss was attributed to “rapid declines in consumer-facing markets – a dynamic that accelerated in December”. Margins also declined year-over-year.

The reports of similar business pressures from two iconic blue-chip companies is revealing, if not conclusive. There are clear signs of consumer weakness and investors should be on the lookout for more.

Social trends

How the young spend their money ($)

https://www.economist.com/business/2023/01/16/how-the-young-spend-their-money

The new world of shopping has also allowed the young to take a more informed view of the companies that they buy from. The attention economy’s information overload has not dulled youngsters’ senses but appears to have made them hypersensitive, especially to any brand that pretends to be something it isn’t. Edelman, a public-relations firm, found that seven in ten Gen Zs across six countries fact-check claims made in adverts.

If you are anything like me, you suspect the "seven in ten” number is high and wonder about the intellectual rigor of the fact-checks. Nonetheless, younger consumers are making the effort and that says something. Namely, by all appearances younger consumers seem to be far more discerning.

In addition, values seem to be creeping into decision-making for others as well. The FT’s Rana Foroohar ($) said of her experience of the World Economic Forum in Davos, “I left last May’s event feeling I needed to take a shower”:

“Maybe it was the Saudi-sponsored café on the promenade, branded with the name of Crown Prince Mohammed bin Salman, the man who, according to declassified US intelligence, was responsible for the murder of exiled Arab journalist Jamal Khashoggi. Or perhaps it was the socialite who told a Ukrainian official addressing her luncheon to “keep it short”. It could have been the conversations about climate change held over beef dinners. Or the massive armed police and security presence, which always makes me wonder if the global elite ever consider why so much protection is needed at these gatherings in the first place.”

I see several noteworthy points emanating from these stories:

Consumers of all types are increasingly insisting values of products and services align with their own values.

This is about more than just consumption, per se; it also encompasses engagement with jobs, community, leadership, etc.

People feel increasingly compelled to do something about it when values do not align with their own.

Inauthentic efforts by companies to create an image of values alignment can backfire. When such efforts are not sincere, consumers feel betrayed and can push back with even greater force.

Marketing means different things to different people. Historically, an important prong of a marketing strategy was creating an attractive brand or image. Increasingly, that is no longer enough - companies (and leaders!) also need to walk the walk by actually adhering to the principles they profess.

Longer-term, I suspect this will be good in that it will facilitate a better matching of wants and needs with economically viable goods and services. Everyone wins. During the interim, however, there are sure to be a lot of dishonest marketing efforts and a lot of unskilled analyses of products and services.

China

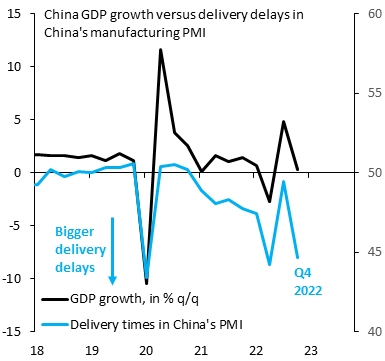

Robin Brooks posted a nice bit of insight on China (above) and provided additional insight here. Jim Bianco is in his usual form in a tweet thread (below). Both arguments point in the same direction: China’s growth remains weak and complete and rapid recovery from Covid appears to be overly optimistic.

Energy

The charts above from @SoberLook tell a story that hasn’t been making headlines lately: US oil inventories, whether measured in absolute quantities or days of supply, are rapidly improving. It’s still early days for sure, but absolutely something to consider in the context of a broader outlook for oil.

Speaking of which, Rory Johnston recently took a close look at two of the major oil forecasts, from EIA and OPEC, to break down the differences. In general, he finds the forecasts point to a fairly balanced market in 2023. Of course, there are caveats:

Certainly, the market still faces a wide range of possible trajectories for 2023 on the back of major variables like Russian production in the face of mounting sanctions pressure, Chinese demand amidst post-COVID reopening, US production in the Permian, and the broader macroeconomic backdrop (i.e., recession).

And those are just the known unknowns! Regardless, it is anything but a slam dunk to bet on oil moving in either direction.

Inflation

The really important point here is inflation does not move in a straight line. Using the inflation of the late 1960s and 1970s as a guide, it is easy to see there were periods of of significantly declining inflation even amid the longer-term trend upward.

A related point is one I made almost two years ago: The volatility of prices is also an important factor. When producers don’t know the magnitude or direction of price changes for cost of goods sold, the uncertainty itself is disruptive and costly. As a result, investors demand a higher return and the cost of capital goes up. Cost of capital goes up and prices need to go up to earn the same returns.

The lesson is inflation is a longer-term process that involves periodic adjustments and re-adjustments - and often involves policy interventions along the way as well. Anyone who thinks they can call “game over” on inflation after a couple consecutive months of moderation is missing the bigger picture.

Geopolitics

Great power conflict puts the dollar’s exorbitant privilege under threat ($)

https://www.ft.com/content/3e05b491-d781-4865-b0f7-777bc95ebf71

Since the end of the cold war, the world has largely enjoyed a unipolar era — the US was the undisputed hegemon, globalisation was the economic order and the dollar was the currency of choice. But today, geopolitics once again poses a formidable set of challenges to the existing world order. That means investors have to discount new risks.

Change is already afoot. The current account surpluses of China, Russia and Saudi Arabia are at a record. Yet these surpluses are largely not being recycled into traditional reserve assets like Treasuries, which offer negative real returns at current inflation rates. Instead we have seen more demand for gold (see China’s recent purchases), commodities (see Saudi Arabia’s planned investments in mining interests) and geopolitical investments such as funding the BRI and helping allies and neighbours in need, like Turkey, Egypt or Pakistan.

The irony is that while Pozsar correctly notes that China's trade surplus is bigger than ever, he doesn't realize that this makes China even more dependent, and not less dependent, on the willingness of China and the rest of the world to hold dollars.

The key to global currency "domination" is not how excited the political elite say they are about having their currency dominate. It is how willing they are to allow clear and transparent foreign ownership of domestic assets and, even more importantly, how willing and able they are to give up control of their capital and trade accounts.

In a macroeconomic “Clash of Titans,” Zoltan Pozsar wrote an editorial in the FT and Michael Pettis quickly responded by rejecting many key points. By my reading, Pozsar is correct in highlighting the importance of geopolitical relationships to the issues of money and exchange rates, the fact that things are changing in these areas, and that they can have important consequences. Pettis is right to argue China’s huge trade surpluses need to be offset by somebody. Simply talking loudly otherwise does not make it so.

Both contributors also misstep. In my opinion … Pozsar underestimates US hegemony and the strength of the position of the US dollar and fails to reconcile this reality with his criticisms. Pettis, in my opinion, overstates Pozsar’s position as one of arguing the “US is about to lose its ‘exorbitant privilege’ to countries like China”. That’s not what I get from Pozsar.

In short, both make good points on a subject that is extremely important. In many ways the financial interaction between China and the US is the nexus of geopolitical conflict. This will take time to play out and there will be a lot of curves along the way. Ultimately, I believe the US will use its strengths to gradually reduce trade with China. We’ll see.

Monetary policy

The element of Fed policy that gets the most attention is when the Fed will pivot and start lowering short-term rates. Many suspect the Fed will be forced to lower rates in the not-too-distant future as the economy quickly slows and inflation quickly declines to a manageable level.

@Stimpyz1 begs to differ. He thinks the Fed is in for a looong pause. Expect language like, “We aren’t even thinking about thinking about lowering rates”.

Come Hell or High Water

https://fedguy.com/come-hell-or-high-water/

Fedguy, Joseph Wang, comes through with some really key insights in this piece. He highlights two potential policy changes. One is to group reverse repo (RRP) balances with bank reserves. Another is to maintain Quantitative Tightening (QT) even if policy rates are cut.

One major consequence of such policy changes would be to effectively remove “all obstacles to an extended QT”. In other words, expect liquidity to continue to be reduced. Further, it can be inferred the Fed will prioritize real economic growth through rate management, but will de-emphasize financial asset appreciate through liquidity withdrawal.

My opinion is these comments represent more than just a trial balloon; they are a playbook for future Fed actions and a warning for investors. The comments are also consistent with those from @Stimpyz1 regarding an extended rate pause and also consistent with new geopolitical goals. Indeed, I warned about a “tougher for longer” Fed stance last fall in a blog post, “QT on the QT”. The bottom line is the mission of the Fed today is a very different one that it was prior to last year.

Investment landscape

As noted in the “Market Observations” section, the year-to-date has been marked with some pretty crazy speculative action. Tier1 Alpha does a nice job assessing the situation: “we are NOT seeing fundamentals at work... we are seeing flows into inelastic markets.” The concept of inelastic markets addresses the influence of regular flows into passive investment vehicles (i.e., ETFs, target date funds, etc.). It is also hugely underappreciated. Bottom line: don’t read strong market performance early in the year as any kind of indication of fundamental improvement.

Another way in which speculative appetite is being manifested is by way of inflation expectations. As John Hussman notes, “As for inflation, my impression is that investors have gotten far ahead of themselves by extrapolating modest improvement in the data. It may be that inflation improves progressively from here, but the problem is that investors have taken it for granted and embedded it into prices, which means that they now rely on that improvement.” He warns if that improvement does not transpire, it could be “strikingly disruptive to both bonds and stocks”.

Finally, Jeremy Grantham was out with a piece this week entitled, “BACK TO THE MEAT GRINDER!” Perhaps the most important aspect of his outlook is not the downside risk per se, but the wide range of possible outcomes: “The real risk from here is in the unusually wide range of possibilities around this central point. I would suggest wide and asymmetric error bars around any such forecast. Regrettably there are more downside potentials than upside.”

All in all, the landscape for stocks remains extremely difficult.

Implications

Arguably, the dominant market narrative is that inflation is waning and the Fed will soon react to deteriorating economic conditions by loosening monetary policy. In short, a return to normalcy. To this, I would channel HL Mencken by saying, “For every complex problem there is an answer that is clear, simple and wrong.”

As I mentioned in the Outlook edition at the beginning of the year, I gauge the usefulness of narratives by their explanatory power. By this measure, there is no good reason why the Fed would have the same motivations in the context of rising prices and a bloated balance sheet as when inflation was low. It’s a very different problem. Nor does it make sense why government, which learned during Covid it has enormous power to implement policy and redistribute earnings, would voluntarily cede that power for no good reason at all.

These differences mattered last year and they are going to matter a lot going forward. Investors who continue to view policymakers as reactive, rather than proactive, will repeatedly be surprised by events. They will be surprised that emergencies take longer than expected to happen, that the worst scenarios fail to materialize, and that public officials actually seem to be ready with a plan when they do happen.

None of this is to say I have inordinate faith in the skill and competence of public officials. Nor is it to say my base-case narrative can’t or won’t change if disconfirming evidence arises. It is a result of my reading of the political winds, however. I think people want leadership, i.e., they want somebody to do something about their problems. It just so happens that these sentiments are absolute music to a politician’s ear.

Insofar as this is right, I expect increasingly muscular foreign policy to propagate into more muscular industrial policy and labor policy, among others, and these policies will be critical drivers as to where capital gets allocated.

Note

Sources marked with ($) are restricted by a paywall or in some other way. Sources not marked are not restricted and therefore widely accessible.

Disclosures

This commentary is designed to provide information which may be useful to investors in general and should not be taken as investment advice. It has been prepared without regard to any individual’s or organization's particular financial circumstances. As a result, any action you may take as a result of information contained on this commentary is ultimately your own responsibility. Areté will not accept liability for any loss or damage, including without limitation to any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

Some statements may be forward-looking. Forward-looking statements and other views expressed herein are as of the date such information was originally posted. Actual future results or occurrences may differ significantly from those anticipated in any forward-looking statements, and there is no guarantee that any predictions will come to pass. The views expressed herein are subject to change at any time, due to numerous market and other factors. Areté disclaims any obligation to update publicly or revise any forward-looking statements or views expressed herein.

This information is neither an offer to sell nor a solicitation of any offer to buy any securities. Past performance is not a guarantee of future results. Areté is not responsible for any third-party content that may be accessed through this commentary.

This material may not be reproduced in whole or in part without the express written permission of Areté Asset Management.