Observations by David Robertson, 12/8/23

Interest rates continued to get clobbered, oil was clobbered, cryptocurrencies are up huge, and stocks have leveled off. Let’s try to make some sense of it all …

As always, if you want to follow up on anything in more detail, just let me know at drobertson@areteam.com.

Market observations

If there was any doubt about what has been driving stocks lately, themarketear.com clears things up: It’s been meme stocks and the most shorted stocks. Not exactly stalwarts of economic progress.

Themarketear.com went a step further by graphically depicting what it called “The perfect flow tsunami”. This tsunami was comprised of CTAs (commodity trading advisors) buying stocks on the way up, volatility control funds buying as volatility went down, peak volume of corporate share repurchases, unusually high inflows into stocks, and hedge funds increasing gross exposure.

One might call it a perfect storm of buying pressure. While nothing says stocks can’t continue going higher, the big impetus is over for now.

All that said, euphoria is still boiling over in cryptocurrency-land. Since the middle of October, bitcoin is up on the order of 60%. Almost Daily Grant’s reported on Tuesday:

Crypto-focused investment products have taken in net inflows for 10 straight weeks to the tune of $1.76 billion according to CoinShares, the best such stretch since the introduction of bitcoin futures ETFs in October 2021 … That dynamic has spurred some less prominent digital players to eye-watering heights. As the Financial Times relays today [Monday], the Grayscale Filecoin Trust (ticker: FILG) settled yesterday at $34 per share, a near-700% premium to its net asset value

Economy

It’s a good time to be Rick Rieder ($)

https://www.ft.com/content/6a3bc28f-f612-4d31-87f6-f1bb39764778

Meanwhile, growth has been surprisingly high. I’ve been pretty out there about my view that the US economy is much more resilient than people give it credit for. We have a 70 per cent service-sector economy. Historically, there’s only been 13 quarters of negative growth in 100 years of the service sector.

I think markets underestimate the amount of supply of duration and Treasuries coming to the market. While we’re doing this interview [on Tuesday], there’s $626bn of Treasuries coming this week. We got $252bn on Monday. Today at 11:30 in the morning, we got $122bn and then another $130bn at 1:00. It’s unbelievable.

Rick Rieder makes some useful points in this interview with the FT’s Unhedged team of Rob Armstrong and Ethan Wu. It is fair to depict the economy as being buoyed by a relatively stable service economy. It is also fair to commercial real estate is not a structural threat to the economy. As a result, “without a residential [housing] crisis and assuming consumption growth stays around 2 per cent, you’d have to really crush business spending to get a recession”.

Fair enough. To label the economy as “resilient” though, is a bit of a stretch. What is really keeping the economy humming along is deficit spending. Deficits (as a percentage of GDP) have been worsening (as a general trend) for twenty-five years and now exceed the levels of every economic mishap since World War II. While it is true the deficits are sustaining economic growth, it’s a bit of storytelling to call that growth “resilient”.

This leads to Rieder’s second point that the quantity of Treasury debt being issued to pay for all the deficit spending is “unbelievable”, even for a thirty-year veteran of the business. Sooner or later, this is quite likely to put pressure on risk assets as more longer duration Treasuries will need to be issued to plug the gap.

These are both points highlighted recently by Harald Malmgren: “investors seemingly unaware that rising fiscal deficits are the primary fuel [for economic growth] ...which will entail rising long duration bond rates to absorb surging Treasury borrowing”. Copy that.

China

As I discussed last week, the meeting between Xi Jinping of China and President Biden begs the question of, “Why?” Is this the beginning of easing tensions between the two countries? While that geopolitical question remains, the outlook for investors in China is less clouded.

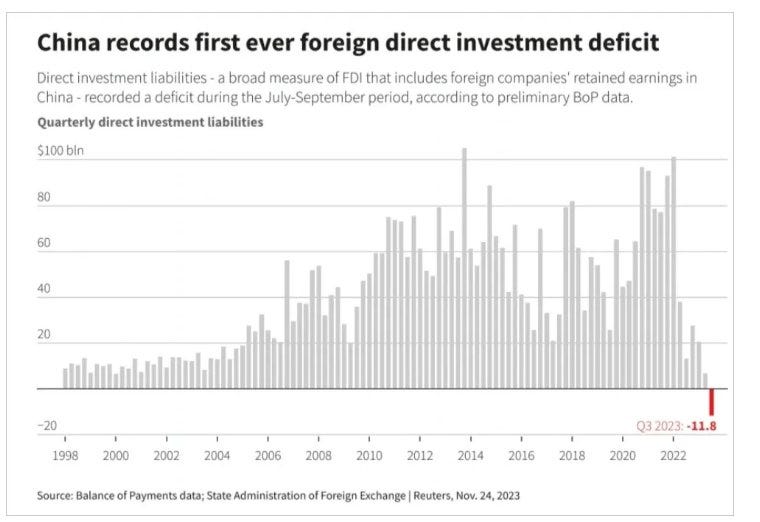

For example, investment strategist, Russell Napier, advises that the terminal value of any external investment in China is zero. If you stay there much longer, you won’t be able to get your money out. The same position was largely corroborated in a post by KKGB Kitty which displayed the following graphic:

So, it appears as if the people who have actually been investing in China and ostensibly have the best view of the prospects are now voting with their feet. Good to know.

Gold

Gold is a monetary hedge par excellence. Looking ahead our huge debt burden requires a sizeable monetary inflation to keep pace. The prospects for gold look attractive. Momentum is building for a breakout.

First, gold is always more of a monetary hedge than a hedge against consumer inflation, and monetary inflation looks set to increase significantly. Second, Central banks outside of the G7 are buying gold.

This is a good explainer piece by Michael Howell on gold. As such, it also reveals why gold is such an important consideration for long-term investors. Since it is a “monetary hedge par excellence”, and since our “huge debt burden requires a sizeable monetary inflation to keep pace”, it is highly likely gold will be an important means of preserving wealth. This, of course, is a primary objective of long-term investors.

Other investors, however, seem far more interested in the minute-by-minute readings on consumer inflation. It is true inflation is slowing down right now and it is also true that the economy appears to be slowing down as well. As a result, the narrative that the Fed will soon be slashing rates is gaining steam. This has led to a number of assets going up, but notably gold and bitcoin.

Right up until Monday, that is, when a strange thing happened. After rocketing overnight, gold got pounded early Monday morning and kept sliding through the day. It’s possible this was just a massive reversal on low volume. It’s also possible someone, as in an official someone, got nervous the gold price was spinning out of control. This is bad because it reflects poorly on the US dollar.

So, let’s consider the possibility there was an official intervention to impede gold’s run away rise. What can also be observed is that bitcoin did not suffer from a similar intervention and continued its ascent smoothly. As such, it is fair to deduce that gold prices do matter to monetary officials and bitcoin does not. By extension, if monetary officials don’t care about bitcoin going up, they won’t care about it going down either. Double edged sword I would say.

Monetary policy

I’ve mentioned John Comiskey’s work before. He has provided valuable insight on the Fed’s Quantitative Tightening (QT) program and US Treasury issuance among others. In this post he explains how Treasury auctions work. This is useful because as the US issues ever-vaster sums of debt to underwrite ever-increasing deficit spending, the outcomes of auctions provide important information about the demand for that debt and, therefore, its cost.

Ultimately though, what I am trying to do with this post is parse the available public data on the auction to determine in as much detail as I can, the folks who are bidding, in what amounts, and where on the spectrum of bids that Treasury receives, those bidders are placing their bids. When you do a detailed analysis on all the publicly available data on the auction, making some reasonable assumptions along the way you paint a pretty detailed and insightful picture of what that detailed bid profile looked like.

One point that becomes clear from this analysis is there is a fair amount of price-insensitive demand for longer-term US Treasuries, contrary to many doomsday social media posts. Another point, however, is the ugly November auction was even a bit uglier than advertised. As Comiskey assesses:

Perhaps Treasury’s pullback on increases to 30yr issuance in the November QRA was a good idea. As ugly as the 2.24 bid-to-cover looks for the 11/9 30yr auction, the real bid-to-cover of 2.11 … looks even uglier.

As a result, Treasury’s decision to pullback on 30-year issuance looks prudent. Now we just have to see if it signals a lasting change in policy or simply a temporary logistical adjustment. I lean toward the latter.

I also enjoyed this piece because it made me smile - for a lot of reasons. One is that it provided some genuine insights; I learned a few interesting things about Treasury auctions. Another reason is because it used data and analytics to make a strong case rather than rhetoric.

Finally, this piece made me smile because it is a quintessential example of what a person can do on his/her own, without the resources of a large company or even necessarily a huge amount of domain expertise. Armed “only” with great analytical skills, technological savvy, and an intensely curious mind, Comiskey has opened up a window into Treasury auctions that have been right in the wheelhouse of Wall Street firms for decades, but which they never did, at least not in so public a way. Thanks John!

Investment landscape I

One of the points I have been making, indeed one that I highlighted in the Outlook edition in January, is the changing role of the Fed. In that edition I said,

After the GFC, the Fed took a leading role in guiding markets by keeping rates low and policy loose. Now, however, the Fed is being relegated to more of a support role.

This is becoming clearer and clearer as the year progresses. In particular, the active lever for liquidity has been the Treasury’s decision to fund debt disproportionately with bills (as opposed to longer-term coupons). Andy Constan called out this phenomenon when he said, “the Fed had handed the ball to Janet Yell to Implement monetary policy by choosing bills or bonds”.

One implication of this is the Fed now has little agency; it’s really not in a position to have much of an impact one way or the other. That means most of the FOMC press conferences are just Kabuki theater and statements are little more than lip service. At this point, the Fed is mainly trying to stay out of the political cross hairs and avoid getting blamed for anything bad that might happen.

Another implication of Treasury calling the shots is that its motivations are more important than the Fed’s. This is where things get a little tricky because Treasury Secretary Yellen’s agenda seems to be at least somewhat at odds with that of National Security Advisor Sullivan’s. I’m sure both want to see Biden re-elected next year, which historically would argue for easier financial conditions. However, the rampant speculation fueled by those conditions is antithetical to national security concerns and the rebuilding of industrial capacity.

It will be very interesting to see how this internal conflict gets resolved. Perhaps there will be another emergency next year?

Investment landscape II

I highlighted a blurb by Kris Sidial last week in regard to the short volatility trade. He followed up with a piece outlining the implications:

As we close out the year, we are now going on year 4 without a substantial move in equity vol. The behavioral clock for short vol strats are ticking as that one sided positioning is due for a healthy wash out. Yes, vol can remain low for very long periods, but half a decade with one sided positioning and no shakeout is a bit on the extreme side.

The point here is not to hunker down and not go outside at all, but rather to be fully aware that a storm is brewing. It’s hard to say when it will strike, but there is a good chance we will encounter a volatility explosion event in the not-too-distant future, i.e., the next year or two.

This potential is highlighted in other market observations as well. As PauloMacro posted, lower rate expectations can signal more than just a change in Fed direction on rates; they can also signal some probability of an “economic accident”:

But another defining characteristic in EM is that perceived “priced in” rate cuts are not necessarily a cut expectation, but an EV of the odds of an economic accident. A 10% chance of a -250 cut to address a bank blowout looks like a -25bp cut on the curve.

This is very common in EMs, but the issue is that as long as risk managers perceive it as a real cut expectation, they greenlight risk which lowers the expectation of an accident due to the financialization of everything, and the accident never shows up (until one day).

Now, let’s combine these observations with some comments by Ed Luce at the FT. In regard to the economic landscape, he described:

I think our world is sufficiently unstable that “all things being equal” now ought to mean that we should price in regular shocks, even if we cannot know when and which ones will happen, or whether they will be disinflationary or inflationary.

Regular shocks, the chance of an economic accident, and the potential for volatility to explode, then, are key elements of our investment landscape. While this also creates fertile ground for traders, it’s a good thing for long-term investors to keep that in mind so as to calibrate risk exposure appropriately.

Investment advisory

One of the more important facets of investment advisory work is to determine a client’s level of risk tolerance. This is done so as to develop a portfolio that is accordant with that risk tolerance.

There are a number of challenges in nailing down what an abstract concept like risk tolerance means in practice, however. While questionnaires and other devices have improved the exercise of linking investors’ behavioral traits with appropriate portfolio construction, the whole practice is, well, fraught with risk.

Another element of that risk assessment occurred to me in reading the book, The Confidence Map, by Peter Atwater (which I first mentioned last month). Namely, perceived risk is also a temporal function; namely, there are times in which we feel more and less confident than others.

This can occur for any number of reasons such as winning a big game or losing a job. We encounter things every day which can nudge us up or down the confidence scale. Since risk tolerance is very much a function of confidence, then, it is appropriate to consider it at least partly as a dynamic function, and not just a relatively stable personality trait.

Such a perspective should help both investors and advisors. Not only can it help improve communication between them, but it can also help better calibrate long-term risk exposure.

Implications

One implication of this environment of unusually low equity volatility is the chance of some kind of volatility explosion event keeps increasing. If this did happen, it would not only be broadly disruptive to markets, it would be extremely painful for the growing number of strategies that sell volatility to generate income.

Of course, an interesting, and perhaps even intended, side-effect might be to nudge income-seeking investors back into Treasuries. That could go quite a ways in lessening the demand shortfall (relative to supply) for Treasury bonds.

On the other side of the volatility spectrum, bond volatility is marching back up again from already high levels. Given the breathtaking (some might say, nauseating) reversal in the 10-year Treasury yield in the last month and a half, and the large daily moves, it shouldn’t be surprising vol is jumping again.

While punters who bet on lower rates are regaling the recent performance, it is useful to consider the implications. First, 10-year US Treasury bond yields are arguably the most important price in the world. Everything else is based on them. Second, when those rates consistently exhibit large daily moves, which they have, it means there isn’t great price discovery. It means there is no firm underpinning for what 10-year Treasury rates will be, and therefore, nobody really knows what any risk asset is worth.

When I say there is no firm underpinning for what 10-year Treasury rates will be, I mean there is no firm underpinning for “what the Treasury wants them to be”. This is where things get interesting because there is increasingly a conflict between the Biden administration’s short-term goals and longer-term goals.

Short-term, the administration wants to get re-elected so that probably argues for easier financial conditions, which are facilitated by lower rates. This comes with costs, however. For one, increased speculation increases the chances of some kind of accident. For another, easier financial conditions favor capital over labor, which is the opposite direction of current political trends.

Longer-term, the goal is to reduce the financialization of the economy and to rebuild industrial capacity. That requires short- and long-term interest rates more in the mid-single digit range than the low single digit range. The cost of this, of course, is the downfall of overly indebted companies, individuals, and investment vehicles.

I don’t know how things will turn out and I don’t think anybody can know. We do know some things though. With debt levels as high as they are and with inflation now a known threat in consumers’ minds, there will be no “going back to normal”. Instead, there will have to be a significant re-arrangement of financial structures worldwide. That will involve surprises and volatility.

As a result, long-term investors will be well-served by taking this time to review their asset allocation and risk exposure and make sure they are comfortable with their positioning. It’s going to be a bumpy ride.

Note

Sources marked with ($) are restricted by a paywall or in some other way. Sources not marked are not restricted and therefore widely accessible.

Disclosures

This commentary is designed to provide information which may be useful to investors in general and should not be taken as investment advice. It has been prepared without regard to any individual’s or organization's particular financial circumstances. As a result, any action you may take as a result of information contained on this commentary is ultimately your own responsibility. Areté will not accept liability for any loss or damage, including without limitation to any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

Some statements may be forward-looking. Forward-looking statements and other views expressed herein are as of the date such information was originally posted. Actual future results or occurrences may differ significantly from those anticipated in any forward-looking statements, and there is no guarantee that any predictions will come to pass. The views expressed herein are subject to change at any time, due to numerous market and other factors. Areté disclaims any obligation to update publicly or revise any forward-looking statements or views expressed herein.

This information is neither an offer to sell nor a solicitation of any offer to buy any securities. Past performance is not a guarantee of future results. Areté is not responsible for any third-party content that may be accessed through this commentary.

This material may not be reproduced in whole or in part without the express written permission of Areté Asset Management.