Observations by David Robertson, 1/7/22

Stocks jumped out of the gates with the new year, but rates also popped which obscured any kind of all-clear signal. With Fed tapering, midterm elections, and some degree of normalization from the pandemic all on the docket, this year looks to be an extremely interesting one. If you have questions or comments along the way, let me know at drobertson@areteam.com.

Market observations

The new year got off to an enthusiastic start with futures up strongly before the open on Monday. After US manufacturing PMI hit a 12-month low, stocks sold off but recovered through the afternoon to finish up on the day. One of the losers in the process has been speculative stocks such as those with high short interest.

Another phenomenon has been the continuing decline in volatility. After cracking higher with the emergence of Omicron after Thanksgiving and breaking higher in early December, VIX has been absolutely crushed down to the range of its practical floor for the better part of the last year (themarketear.com/premium, Jan 03 2022).

The 10-year yield also made news by shooting cleanly through 1.6% on Monday and continuing up through the week. Growth stocks didn’t pay much heed to the move on Monday but began taking notice later in the week. All in all, it still looks mainly like stock investors are working from a different playbook than bond investors.

Economy

The good news is the worst appears to be over in terms of the feverish pitch of spending on durable goods. Who knows, maybe you can even get a new dishwasher in less than four months now?

The bad news is twofold. For one, as durable goods spending reverts, the potential for excess ordering, and therefore of excess inventory build, is high. In addition, with Omicron flaring up over the holidays, there is a good chance many of the same supply chain problems will continue to cause problems.

Credit

Mortgage Crises Yesterday and Today

https://www.theinstitutionalriskanalyst.com/post/mortgage-crises-yesterday-and-today

“The bad news, however, is that the urban subset of commercial loans, including mortgages on multifamily real estate, are in for a tough year. National statistics for commercial real estate are improving, yet for some reason the indicator of loss given default or LGD for the $500 billion in bank-owned multifamily loans was 75% of the loan balance in Q3 2021. This is above the ten year average LGD for multifamily loans.”

“Our best guess on commercial credit exposures is that banks and bond holders could face tens of billions in losses over the next several years. The change in asset utilization for many urban properties in New York City is profound. New York City and its environs face a difficult period of right-sizing government to fit a metropolis with an expanding sense of entitlement and a shrinking commercial base.”

When lockdowns first started early in 2020, I noted the disruptions would wreak havoc on credit markets due to demand destruction and massively decreased utilization of assets such as real estate. Due to sweeping public policy measures such moratoriums on rents and mortgages, my negative view has not played out - at least not yet.

Chris Whalen foreshadows the potential problems with a ballpark guess that there could be “tens of billions in losses over the next several years.” As Whalen points out, banks will likely continue to roll commercial loans in order to avoid having to recognize impairments so the consequences won’t necessarily be felt immediately, but they are on the way. The same thing will happen with residential housing as well but that will probably take even longer to develop.

Commodities

As I have noted several times, the case for commodities is mainly one of timing. There is a good case to be made for the notion that prices need to be sustainably higher in order to allow producers to profitably increase capacity. So, there is a good case for long-term investors to have exposure to commodities.

But when? And at what prices? The graph above illustrates both the longer-term opportunity and the shorter-term risk. With commodities bumping along resistance on the chart while also flirting with overbought status, it is hard to argue for rushing out the door to buy commodities.

With the prospect of both economic growth and inflationary impulses cooling off over coming months, this is an excellent time to do the work of researching commodity exposures so you can act decisively when the great opportunities do arise.

Geopolitics

Top Risks 2022

https://www.gzeromedia.com/top-risks-2022

No zero COVID

A technopolar world

US midterms

China at home

Russia

Iran

Two steps greener, one step back

Empty lands

Corporates losing the culture wars

Turkey

Gzero Media put out a good list of geopolitical risks for the new year so I highlighted it here. The list reveals many of the reasons geopolitics can be such a useful discipline: There are several global trends and hotspots that have the potential to cause all kinds of trouble. Importantly, the US features most prominently in only one of them.

This is a good reminder for anyone who is investing based on faith in the Fed to keep markets afloat. Quite arguably the Fed has virtually no control over any of the top ten risks listed above.

China

China’s coming COVID crisis?

https://www.gzeromedia.com/chinas-coming-covid-crisis

“Beijing’s ‘zero-COVID’ policy was a major public health success story in 2020 … But in 2022, argues Eurasia Group, China will face highly transmissible omicron with apparently less effective vaccines and far fewer people protected by antibodies created by previous infections. This year’s COVID outbreaks in China may not set records for deaths, but they will be larger, and ‘zero-COVID’ lockdowns will be more severe and involve tens of millions more people. This crisis will continue until China can roll out domestically developed mRNA shots and boosters for its 1.4 billion people, which still appears at least a year away.”

“That, according to Eurasia Group, will mean a lot more economic disruption and maybe rising public anger – at a time when President Xi Jinping wants to formally extend his time as leader and roll out more reforms designed to maintain and extend the state’s reach into daily life across the country.”

China has a lot of challenges to juggle and Covid is yet one more ball in the air. While it has been easy the last several years for investors to write off challenges in China as being serious threats, that dismissiveness is looking increasingly misplaced.

At a time when the country is massively overleveraged and the real estate sector is unwinding, Covid poses an especially toxic element to the mix. As the report concludes, Eurasia Group has a “surprisingly dark view of what’s about to happen in China.”

Inflation

Biden's monopoly gambit

“Monopolies cause inflation — so cracking down on monopolies will cause inflation to decline. That's the claim of the Biden administration, anyway.

In the 12/17/21 edition of Observations I wrote how the perspective of inflation can change on the basis of the time period considered. The point is that the difficult task of gauging inflation can be assisted to some degree by considering the issue from multiple perspectives.

Increasingly, one perspective that must be considered is the extreme politization of inflation. Investors must now do more than just cut through mixed market signals; they must also cut through intentionally misleading narratives. The latest effort by the Biden administration is to blame the recent bout of inflation on monopolies, i.e., industry concentration. While there is certainly a degree of truth to the connection between concentrated industries and higher prices, the focus on the meat industry seems miss the bigger target. As The Morning Dispatch ($) put it:

“Concentration in the meatpacking industry isn’t what caused used car prices to go crazy. It isn’t what’s causing rent to now push up. [But] if you want to pursue that tiny little narrow niche area, okay. [It’s just] not in any way more broadly indicative of why we’re in the inflation situation we’re in, which is more about demand-side pressure and supply chain stuff.”

One takeaway is an issue like inflation is complicated which means any simplistic attempt to describe it is going to be wrong in many respects and misleading in others.

Another takeaway is when an issue like inflation is politicized, it often has less to do with solving the problem than with promoting other political goals. If the Biden administration really wants to address the hardships of rising prices for many people, it would start with goods that have the biggest impact on household budgets such as housing/rent, gas, and food (broadly). That isn’t happening.

As a result, it is fair to conclude, at least for the time being, that 1) the Biden administration recognizes inflation as a political problem but is not willing and/or able to commit political capital to properly dealing with it, and 2) addressing the issue of excessive industry concentration seems to be a higher priority.

There is one more possibility to consider. Perhaps the President and the Fed believe that inflation really will cool off but cannot say so publicly for fear of inflaming voters who are clearly paying higher prices. Targeting a niche industry like meat processing creates an illusion of caring about the problem while also planting seeds for the regulatory agenda of constraining corporate power. Now that would be killing two birds with one stone.

Interest rates

A History of Interest Rates by Sidney Homer and Richard Sylla ($)

“In historical times credit preceded the coining of money by over two thousand years.”

“Almost every generation is eventually shocked by the behavior of interest rates because, in fact, market rates of interest in modern times rarely have been stable for long. Usually they are rising or falling to unexpected extremes. Students of the history of interest rates will not be surprised by volatility. Their backward-looking knowledge will not tell them where interest rates will be in the future, but it will permit them to distinguish a truly unusual level of rates from a mere change.”

Two of the trends that have had the most impact on investment analysis the last thirteen years have been the proliferation of ETFs and other passive funds and the embrace of extraordinary monetary policies by the world’s major central banks. The net effect has been to highlight macro trends at the expense of micro trends. One major consequence has been that interest rates have become central to almost any analysis.

As a result, having some historical perspectives on rates is useful. Fortunately, the “go-to” source for such perspective is easily accessible in the form of the book, A History of Interest Rates. One interesting point is that credit has been around longer than even money has - by some 2000 years. This speaks to the fundamentally important and useful nature of the activity to human enterprise.

Another interesting point is that there are clear historical patterns in interest rates, and therefore also clear historical lessons to be learned. Against the swath of 5000 years of history, the presence of $18 trillion of debt at negative rates stands out as a “truly unusual level of rates”. This is not just a hyperbole. Indeed, this is exactly the kind of situation that can “shock” many investors, but which will also not be a surprise to students of history.

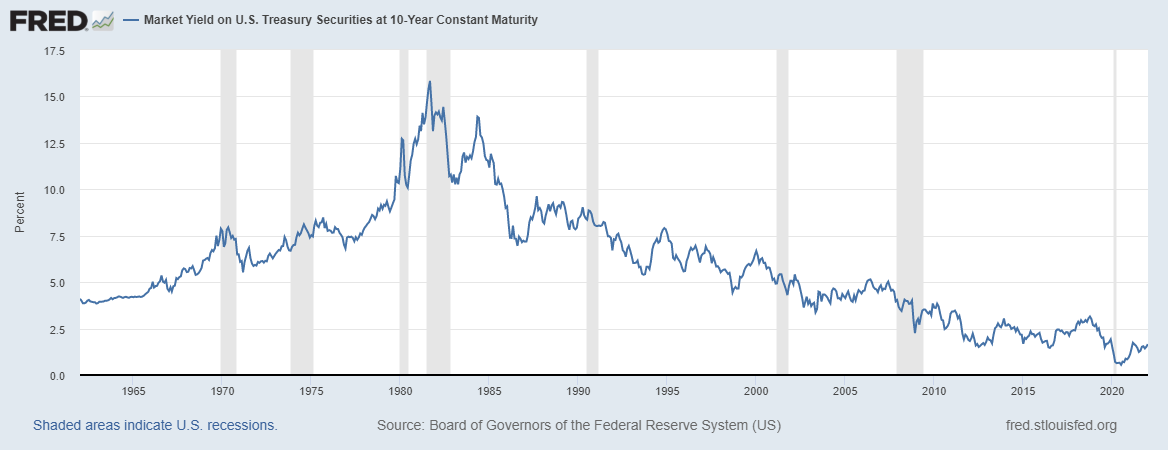

Speaking of patterns, while the rise in 10-year yields from the lows of 2020 have seemed a bit extreme, yields are just now breaking into the bottom part of the range of most of the last ten years.

Incorporating a broader swath of history reveals how low yields currently are in even starker terms. While none of this is sufficient to forecast future rates, it certainly provides useful context for understanding where we are today. With some good analysis and historical context, investors at least have a fair chance to avoid being “shocked” by rate volatility.

Monetary policy

FOMC Minutes Shows Hawkish Fed Hiking "Faster Than Anticipated", Warn Of Omicron Risks

“Tl;dr: The FOMC Minutes are considerably more hawkish than expected in terms of both the timing of the liftoff of rates and the pace of normalization of the balance sheet.”

"Participants generally noted that, given their individual outlooks for the economy, the labor market, and inflation, it may become warranted to increase the federal funds rate sooner or at a faster pace than participants had earlier anticipated.

“Participants noted their continuing attention to the public’s concern about the sizable increase in the cost of living that had taken place this year and the associated burden on U.S. households, particularly those who had limited scope to pay higher prices for essential goods and services.”

After stocks got off to a good start to the year the good times came to a screeching halt on Wednesday afternoon after the Fed’s minutes were posted. In an important respect the comments were very much in line with previous communications but emphasis on the potential for actual tightening forced investors to get more serious about hawkish possibilities.

One possible interpretation is the Fed is now suddenly scrambling to try to get back in front of the inflation problem it had a huge part in creating. It’s not hard to imagine that Powell got an earful from Biden who is taking all kinds of political heat for the impact of a higher cost of living. Indeed, the tone of the minutes smacks of a bunch of bureaucrats suddenly hustling to cover their butts so they won’t be blamed (for inflation).

Another interpretation, however, is that the comments in the minutes are simply an ongoing part of the Fed’s “communication strategy”. In this case, Fed governors have simply tweaked their language a bit in order to come across as more vigilant about inflation and therefore are putting forth their best effort at being good “team players” with the current administration. In this case no new information has been revealed. We will see which view proves more accurate.

Investment landscape

2021 Year in Review: Crisis of Authority and the Age of Narratives by David Collum

“White House economists are assuming negative real interest rates all the way through the end of the 10-year budget window in 2031.”

“The last 50 years are the first time we’ve seen such a broad upswing in the global price level across multiple countries…don’t take it for granted that our system of the last 50 years will survive your whole career.”

I would be remiss if I didn’t at least mention Dave Collum and his Year in review. While his writing can be crass at times, it can also be entertaining, and is almost always informative. Collum is the kind of person I always enjoyed interviewing as an analyst - because he speaks his mind and because he is thoughtful. His YIR is always one of the best reads summarizing the year’s events.

Regular readers of Observations will find many points of commonality with Collum’s thinking from the inflation/deflation debate to the case for owning gold. That said, I probably get the most value out of his positions that are different than mine. His arguments are always sound and well documented and as such, force me to be especially careful when my positions are different.

Two especially useful takeaways are captured in the quotes above, the first by the Wall Street Journal editorial board and the second by Jim Reid. The first highlights exactly how challenging the investment environment is likely to be over the coming ten-plus years. Negative real rates means financial assets will not only not continue compounding but will actually depreciate in real terms. Few retirement models incorporate this.

The second quote puts the market extremes of the day in historical context. In short, there is a thinly veiled warning that the financial system will radically change in the foreseeable future. I agree with this prognosis and have been making similar comments myself. This is a very big deal for investors to get their heads around.

Implications for investment strategy

The first point to make in this landscape of flaring inflation is that there are precious few good options to protect the purchasing power of one’s investments. As a result, worthy goals include savoring even small victories and avoiding situations in which the perfect can be the enemy of the much better.

On the latter point, the Treasury I series savings bonds present the potential for a small victory for many investors. They provide a rate of interest that combines a flat rate with a component that is adjusted for inflation. Bonds bought through April 2022 provide an interest rate of 7.12 percent which, needless to say, is extremely competitive. The main hitch is the opportunity is limited; there is a limit of $10,000 per calendar year. Check out the details at https://www.treasurydirect.gov/tdhome.htm

The notion of small victories leads to a bigger idea - all losses are important. I once had a conversation with a colleague who argued that a 35% loss was effectively no different than a 30% loss. There is some truth to this since very few people are going to carefully scrutinize statements with huge losses.

This is somewhat careless thinking though. On a nest egg of $1 million, the difference is $50,000. For retirees who are no longer earning income, or people who are near retirement and have only limited ability to generate future income, every little bit counts. Further, the math of returns means that bigger losses require even more heroic rebounds to recover from. While it has been easy to take big gains for granted, big losses are very serious risks.

Disclosures

This commentary is designed to provide information which may be useful to investors in general and should not be taken as investment advice. It has been prepared without regard to any individual’s or organization's particular financial circumstances. As a result, any action you may take as a result of information contained on this commentary is ultimately your own responsibility. Areté will not accept liability for any loss or damage, including without limitation to any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

Some statements may be forward-looking. Forward-looking statements and other views expressed herein are as of the date such information was originally posted. Actual future results or occurrences may differ significantly from those anticipated in any forward-looking statements, and there is no guarantee that any predictions will come to pass. The views expressed herein are subject to change at any time, due to numerous market and other factors. Areté disclaims any obligation to update publicly or revise any forward-looking statements or views expressed herein.

This information is neither an offer to sell nor a solicitation of any offer to buy any securities. Past performance is not a guarantee of future results. Areté is not responsible for any third-party content that may be accessed through this commentary.

This material may not be reproduced in whole or in part without the express written permission of Areté Asset Management.