Observations by David Robertson, 3/21/25

With news again being dominated by political items, I will focus on breaking those down and trying to make sense of them. Let’s take a look.

As always, if you want to follow up on anything in more detail, just let me know at drobertson@areteam.com.

Market observations

Stocks rebounded strongly at the end of last week and into this week before muddling through the middle of the week. Core retail sales were solid on Monday as was industrial production on Tuesday. The new data tamed the worst concerns about imminent recession.

On Wednesday, the Federal Open Market Committee (FOMC) met and kept interest rates unchanged. The bigger news was an incremental tapering of the Quantitative Tightening (QT) program and the shift in the Committee’s expectations to slightly lower growth, slightly higher inflation, and greater uncertainty. On the news stocks popped and yields fell.

Until 4:31 Thursday morning that is — when the Swiss National Bank (SNB) indicated it was done cutting rates. At a very high level these items tell us the market is still jonesing for rate cuts from the Fed and can get blindsided in a lot of different ways from moves made in other countries.

Finally, let’s not forget that higher rates are still impinging upon commercial real estate. As the March 14, 2025 edition of Grant’s Interest Rate Observer highlights:

“If we see a pickup in forced sales—and there is good reason to believe that could happen,” François Trausch, head of Pimco Prime Real Estate, said in a December roundtable discussion, “valuations could face further pressure.”

That “pressure” can manifest in a lot of ways, but looks to be headed our direction.

Politics and public policy I

Last week I said I would dig in deeper this week on the subject of how far Trump might be able to go with his push into authoritarianism. The subject is especially timely as developments on several fronts are beginning to reveal a pattern.

Those fronts include the arrest, detention, and transfer of Mahmoud Khalil, a student activist at Columbia University and pro-Palestinian protester, the detention and deportation of people alleged to be members of the Venezuelan gang, Tren de Aragua, and the persecution of law firms associated with opponents of Trump.

In each case, it certainly looks like the Trump administration is spoiling for a fight with judicial authority. Judicial orders are normally obeyed in both letter and spirit out of respect for the legal system. In these (and other) cases, orders were flouted if not flagrantly disobeyed. Also, in each case, the targets appeared to be singled out on the basis their distastefulness to the majority of the American public.

These similarities suggest a strategy: 1) Pick an opponent so vile that few people will be sympathetic to their cause; 2) Ramp up the narrative machine to cast the opponent in a negative light and as a visceral threat to America, 3) promote the Trump administration as being uniquely capable of dealing with such a threat; and 4) Hope public opinion is favorable enough to pressure the judiciary system to back away from these encroachments on its authority.

It seems pretty clear the Trump administration is hoping to leverage the court of public opinion in order to win concessions from the real courts of law. Indeed, there is good evidence to believe that Trump Republicans are much more effective at shaping opinions through media, social and otherwise, than Democrats. As Jonathan Last writes for The Bulwark ($):

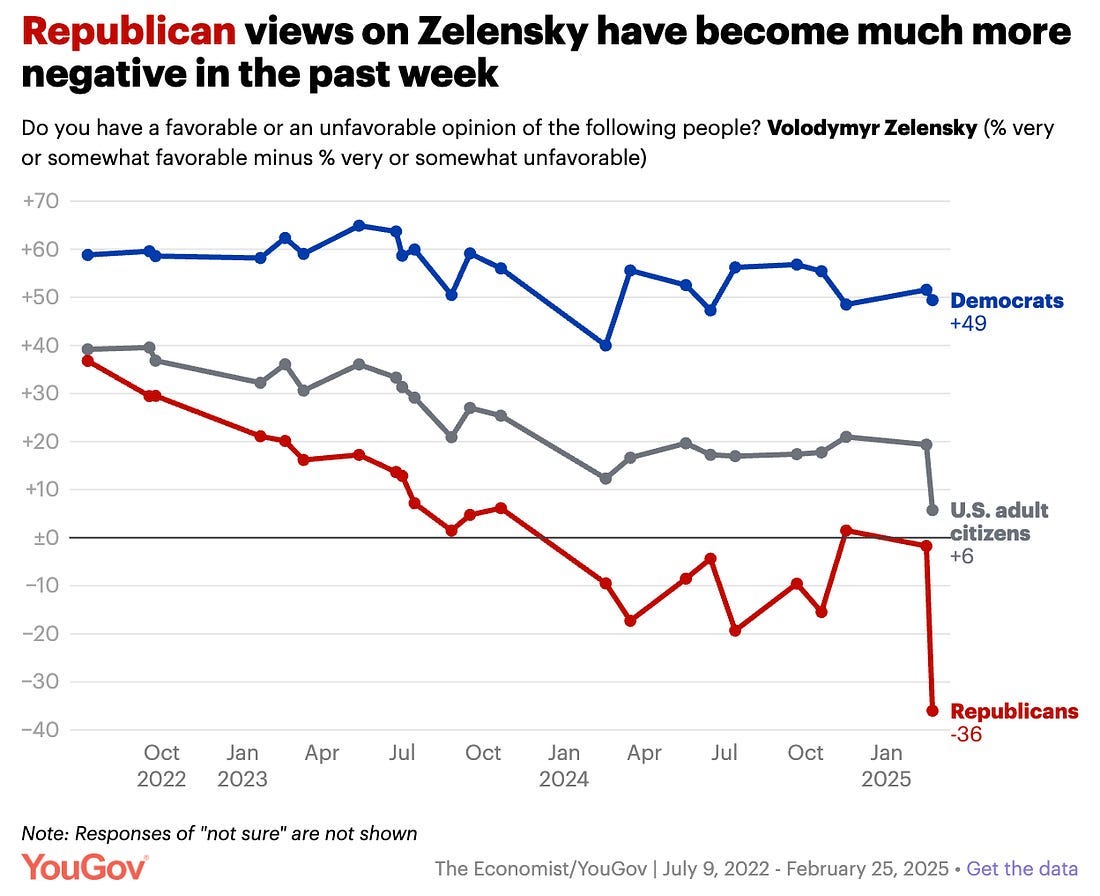

Two years ago Volodymyr Zelensky was massively popular among self-identified Republicans. If “popularism” was still a viable mode of politics, then elected Republicans would have supported Zelensky.

The same pattern was demonstrated with childhood vaccinations. With little public discussion from major political parties, views were similar between parties and little changed over many years. Then, as Republican leaders began vocally challenging the importance of childhood vaccinations, the opinions of supporters changed dramatically.

So, as the Trump administration ramps up its narrative machine against judicial authority, will it be able to achieve the same results? Clearly it has been successful shaping the opinion of its core supports. Beyond that though, depends partly on what the Trump administration is AGAINST and partly what it is standing FOR.

Politics and public policy II

Trump emerged as a political phenomenon in 2016 on the basis of offering change from a neoliberal world order that overstayed its welcome and swung the political pendulum too far to the left. Adam Tooze ($) provides a good summary of the movement:

A key element of the Trump-MAGA challenge, of its bid for freedom, is not so much an attack on truth or reason as such, but rather an attack on the hegemony of the Professional Managerial Class, the social formation that has in recent decades claimed a monopoly of truth and rationality.

This is a fair assessment. Looking back, there is no small body of evidence of “experts” proclaiming “truth” on a subject — and then being proven wrong. For example, a great deal of academic research cannot be replicated, there are multiple examples of public policy that failed miserably, narratives that were passed off as information by mainstream media can be shown to exhibit extreme bias, and on and on. In short, the Professional Managerial Class lied to us repeatedly, and it still does.

Worse, the perpetrators of these transgressions not only were not penalized, but were repeatedly rewarded with constantly rising stock and home prices. No wonder wage earners became disgruntled. Liberals may associate the Trump administration with corruption, but in reality it’s just a different type of corruption.

It is also fair to say the Trump political phenomenon is a rebuke of exceptionally weak leadership from both traditional Democrats and traditional Republicans. Neither recognized the need for change and both abdicated responsibility for leadership. This was probably most vividly illustrated when in the heat of the GFC, Chuck Schumer proclaimed the Federal Reserve as “the only game in town”, implying Congress could not help.

Today, Schumer’s capitulation of leadership is more striking than ever. Bill Kristol and Andrew Egger ($) described the anger over Schumer’s vote for the House’s continuing resolution (CR) as “palpable”. Jonathan Last ($) argues that time’s a-wasting:

the Democratic party ought to be demagoguing exhibiting strong leadership by attacking the Trump/Musk administration, hammer and tongs. Part of that attack should be throwing Schumer under the bus. Maybe even removing him from his leadership position.

While there were reasons for the Dems to pass the CR, doing so without a clear and public explanation not only made them look weak, but also left supporters feeling betrayed and without a meaningful voice in Washington.

On the other side of the ledger, it is much less clear what the Trump Republicans are FOR. Part of the challenge is there are several distinct factions and part is there is no cohesive governing philosophy. Mainly, there is a general appeal for change to a new global system, but even that is subject to a lot of different interpretations. Also, there seems to be appeal in Trump’s predilection for action, especially in contrast to the feebleness of Democratic leadership.

There are a number of other things Trump Republicans are FOR that are better described as cultural. For example, Adam Tooze reports: “As Judith Butler spells out in this clip, one key element of Trump’s appeal is that he promises many of his supporters the ‘right-wing thrill’ of ‘being free to hate. Being free to be irrational’.”

There are certainly elements of this in Elon Musk, who fancies himself an Ayn Rand type of hero. Paul Crider ($) writes he is more like an Ayn Rand type villain: “Beyond corruption, there is the brute desire to dominate others … He enjoys the feeling of hurting those he considers his enemies, along with bystanders, in the knowledge that everyone is powerless to stop him … Musk takes an arsonist’s delight in destroying things that people value, and have reason to value.”

So, an important element of what Trump Republicans are FOR seems to be the freedom to be badly behaved, to not have to be civil to others, and to accept the basest of human impulses. This ties in neatly with the thread of authoritarianism I mentioned last week. While every administration has its flaws, supporters will need to be able to reconcile this reality with their own belief system.

Finally, as crude as these sentiments are, it is not as different from the neoliberal value system (as practiced) as one may think. In one framework, you screw people over to their face, in the other you screw people over behind their back.

Politics and public policy III

On a scorecard of sorts, the things that are working for Trump include a strong desire for reform/change, weak political opposition, and a powerful narrative/propaganda machine. Working against him are inconsistent policies, lack of a cohesive strategy, a divided team, and being dealt a bad hand (i.e., inheriting excessive debt and deficits). Is the upside, whatever one imagines that to be, worth the threats to civil society, the rule of law, and democratic ideals?

Of course, the way in which that tradeoff gets made depends on the probabilities and importance assigned to each. In assessing the upside, I personally have a hard time seeing where there is much — other than beginning the transition to a better place.

Yes, the economy and financial system need to be reformed, but there is no easy path from point A to point B. A number of Republicans seem to believe tax cuts are the ticket, but as Oren Cass highlighted in the FT ($), that thinking is either delusional or dishonest:

The embarrassing dishonesty of this argument should be self-evident. The only reason Congress finds itself dealing with expiring tax cuts in the first place is that these same tax cheats wanted to use the fact of expiration to make their last cuts appear less costly. The only reason they were allowed to pass the TCJA in 2017 was because under current law it would not affect the deficit in the long term … So let’s observe simply that when Senate finance committee chair Mike Crapo says: “If you’re not changing the tax code, you’re simply extending current policy — you are not increasing the deficit,” he is far from the truth.

In short, while tax cuts are widely viewed as a political “silver bullet”, they are no such thing. The harsher reality, and one that has been hugely underfollowed, is that a big tax cut package without massive incremental spending cuts has a big chance of causing a “Liz Truss” moment in the US.

Another reason to be suspicious that significant upside can be achieved is because the Trump administration’s chief economic strategist, Treasury Secretary Scott Bessent, is a political neophyte who does not seem to have a good read on the political environment.

For example, Bessent recently stated, “Access to cheap goods is not the essence of the American dream." While I appreciate the point he was trying to make, it came across as billionaire-level tone deaf to the whole reason Walmart and Amazon have succeeded so massively over the years — because people LOVE cheap goods! In addition, many of those goods are imported! Further, people have been willing to accept a wide range of negative side effects in order to keep those cheap goods flowing. I don’t get the sense Bessent appreciates the political “third rail” he is touching here.

A third reason to be suspicious of the upside potential are the limitations of Trump himself. For one, Trump is a much better destroyer than a builder. He is better at channeling outrage and appealing to the worst demons of our nature than articulating purpose or inspiring unity. In addition, he is accustomed to working in forgiving economic conditions, not challenging ones like we have today. Finally, when he is able to use power to gain advantage, too often those gains are consumed by his ego rather than parlayed into an even stronger position. There are a lot of different ways to lead large organizations successfully; I don’t see any of them in Trump.

Politics and public policy IV

Finally, in this assessment of the potential for authoritarianism to take hold in the US, it’s also necessary to review the guardrails in place.

On a political basis, the news is not especially good. As Joyce Vance ($) points out, “So far, there has been no outcry on the right that we must remain a rule of law country.” Likewise, Jonathan Last ($) laments the fecklessness of Democrats to provide any meaningful resistance:

America is in a race between Trump’s attempt to tear down the federal government and rule of law and the Democrats’ attempt to make Trump so unpopular that other institutions are capable of resisting him.

Yet I fear that only the Trumpists recognize that they are in this race.

Unfortunately, failure to push back is an endorsement of sorts. Further, intimidation is working. A lot of parties find it easier to step aside than to get in a big fight. Approval ratings from the general public are mixed.

The judiciary system should be an important guardrail, but repeated instances of shenanigans on the part of Trump administration lawyers indicate judicial authority is being challenged. Further, social media propaganda directed against judges who rule against Trump are making the judicial arena far more political. We’ll have to wait and see if Justice Roberts’ message on Tuesday regarding the inappropriateness of impeaching judges has a meaningful effect or not.

Finally, the market has served as a guardrail in the past and may very well do so again. It is an open question as to how much market pain the electorate is willing to absorb before Trump retreats. As John Authers ($) at Bloomberg illustrates, such a judgment is relative:

Viktor Shvets, macro strategist at Macquarie, takes a similar view. Born in Ukraine, Shvets comments that Americans tend to think things can’t get worse — “whereas where I come from, you always know that things can get a lot worse.” That means that there is plenty of support in the Trump base for the notion that it’s best to burn the house down — while non-Americans might believe it safer just to try a renovation.

As is often the case, this view from someone born outside of the US provides useful perspective. Namely, “burning down the house” does not seem especially conducive to a healthy market.

In sum then, there are a lot of puts and takes in the assessment of the potential for authoritarianism. The Trump administration has a powerful narrative game that not only keeps supporters engaged but also shapes their opinions. Supporters seem more than happy to dismiss legal transgressions as unimportant details, red tape so to speak, that are necessary to skip over in order to “take care of business”.

On the other hand, opponents see those legal transgressions as being critical to maintaining the rule of law. Making concessions on those is a very slippery slope to authoritarianism. Once you start, it’s hard to stop.

Where people end up on this depends a lot on who they trust more — Trump, or the Professional Managerial Class. Both have their shortcomings. This also makes for a tug-of-war of sorts. Can Trump push far enough and fast enough to secure much greater executive authority? Can political opposition coalesce fast enough to form meaningful resistance? A lot will also depend on the tradeoff between the urgency for change and the baggage that comes along with it.

Investment landscape I

Over the last week or two I have gotten the sense that the information density of investment news has declined. Mainly, I have just felt there wasn’t a whole lot of “meat” in the reports I’ve been reading.

Of course, the environment for political news has been radically different — with waves of news and then commentary and opinion following.

What occurred to me is this is probably an incredibly hostile environment for most investment analysts and advisors and researchers. For one, stocks are going down and that’s never fun. For another, there really aren’t any economic indicators that point clearly to why this should be happening.

Most importantly, however, is that the investment environment has been almost completely taken over by politics. Worst, most investment analysts shun political analysis. The excuse most frequently given is that politics is virtually impossible to predict. While there is truth in that, markets are only as “predictable” as the public policy that governs them. Mainly, most investment analysts don’t understand politics and frequently don’t even care about the subject.

This is likely to be a blind spot for a lot of investment analysis going forward. When times get tough, economics always becomes a matter of politics. Just because those politics may be hard to understand, or even capricious, doesn’t mean they can’t and won’t have a huge impact on investment portfolios. Time to get with the game if you haven’t already.

Investment landscape II

As investors are starting to get a little nervous after a modest downturn in stocks, it is useful to recall the market hasn’t experienced a major downturn in over fifteen years. It is also useful to recall that major downturns are not singular events but rather a smorgasbord of ills such as overextended trends, undiscovered malfeasance, and deferred problems.

For starters, there are a whole host of issues associated with the business cycle. Excessively high earnings expectations are almost always part of the mix. Indeed, when the market turns earnings don’t even need to be bad, just lower than expectations. Lower sales and earnings expectations often manifest in reduced capital investment (which lowers prospects for future growth) and layoffs (which increase unemployment). Lower cash flows also induce deleveraging on many levels.

Of course, lower cash flows and business values increase the credit risk for the banking system which in turn causes credit to tighten up. Unfortunately this time around, banks are already laden with losses from Treasury bonds and commercial real estate loans acquired in times of much lower interest rates.

After a while, other problems often emerge, as if by a stroke of really bad luck. There’s nothing like an extended losing streak to finally expose companies and individuals who were overleveraged and/or committing fraud. Interestingly, most of the Mag 7 companies are involved in serious legal battles that have gotten little attention to date. Also, extended downturns normally expose a big derivatives blow up somewhere.

Due to the extent and duration of the current bull market, there are also some broader phenomena that could impose unusually harsh conditions if triggered. The US dollar and US assets have been hugely supported over the years by purchases from foreign entities. If and when that reverses, it would further pressure the prices of US securities. In addition, the proliferation of passive investing has provided a persistent bid for US stocks. If and when those flows get overwhelmed, clearing prices will almost certainly be significantly lower.

This is by no means a comprehensive list, but one meant to illustrate just how many things can go wrong with the stock market. Given their advancing age and high exposure to stocks, Baby Boomers are at especially high risk of a major downturn crippling their retirement plans.

The main point is to highlight the potential for a lot of bad things to happen to stocks over the next few years. Investors who would be adversely affected should be absolutely sure they are comfortable with their risk exposure. Market rebounds should be viewed as opportunities to adjust risk.

Using the baseball analogy, the game has just started and we are about two pitches in.

Implications

The most important implication of all is the mere consideration of a fall into authoritarianism should rattle markets to their core. The fact that this has not happened, at least not yet, suggests investors are still “whistling past the graveyard”. Either economic conditions will get better, which I think is unlikely in the short-term, or expectations will start falling.

I continue to find it interesting how many people seem be FOR markets but AGAINST regulation and AGAINST the rule of law. Sure, these things can be overdone and have been in many ways. To significantly dismantle them is even worse for business though. As Friederich Hayek highlighted in The Road to Serfdom, the rule of law goes hand in hand with a more predictable and manageable business environment:

Stripped of all technicalities, this [The Rule of Law] means that government in all its actions is bound by rules fixed and announced beforehand—rules which make it possible to foresee with fair certainty how the authority will use its coercive powers in given circumstances and to plan one’s individual affairs on the basis of this knowledge.

Another implication is that Trump trades this time around have more to do with culture than policies and industries. On that front, it is pretty clear that vindictiveness ranks highly as a motivator for Trump’s actions.

Businesses and institutions that are most at risk are those that can be most closely associated with progressive policies and philosophy. Universities are near the top of that list, but any advocates of ESG (environmental, social, and governance) goals are being targeted, as is the “Professional Managerial Class”. Think doctors, lawyers, management consultants, and university administrators to name a few. A similar, but broader group is large, multinational companies.

Importantly, the key theme here is vulnerability to attack from the Trump administration, not probability of receiving benefit.

Note

Sources marked with ($) are restricted by a paywall or in some other way. Sources not marked are not restricted and therefore widely accessible.

Disclosures

This commentary is designed to provide information which may be useful to investors in general and should not be taken as investment advice. It has been prepared without regard to any individual’s or organization's particular financial circumstances. As a result, any action you may take as a result of information contained on this commentary is ultimately your own responsibility. Areté will not accept liability for any loss or damage, including without limitation to any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

Some statements may be forward-looking. Forward-looking statements and other views expressed herein are as of the date such information was originally posted. Actual future results or occurrences may differ significantly from those anticipated in any forward-looking statements, and there is no guarantee that any predictions will come to pass. The views expressed herein are subject to change at any time, due to numerous market and other factors. Areté disclaims any obligation to update publicly or revise any forward-looking statements or views expressed herein.

This information is neither an offer to sell nor a solicitation of any offer to buy any securities. Past performance is not a guarantee of future results. Areté is not responsible for any third-party content that may be accessed through this commentary.

This material may not be reproduced in whole or in part without the express written permission of Areté Asset Management.