Observations by David Robertson, 3/22/24

Central banks were in the spotlight this week. Let’s take a look at what was happening there - and elsewhere.

As always, if you want to follow up on anything in more detail, just let me know at drobertson@areteam.com.

Market observations

The graph below from themarketear.com ($) comes with the caption, “Looks like Madoff drew the SPX trend channel since January, but note we are in the upper part of the channel...” Kind of makes you wonder who (or what) is behind this near-perfect pattern.

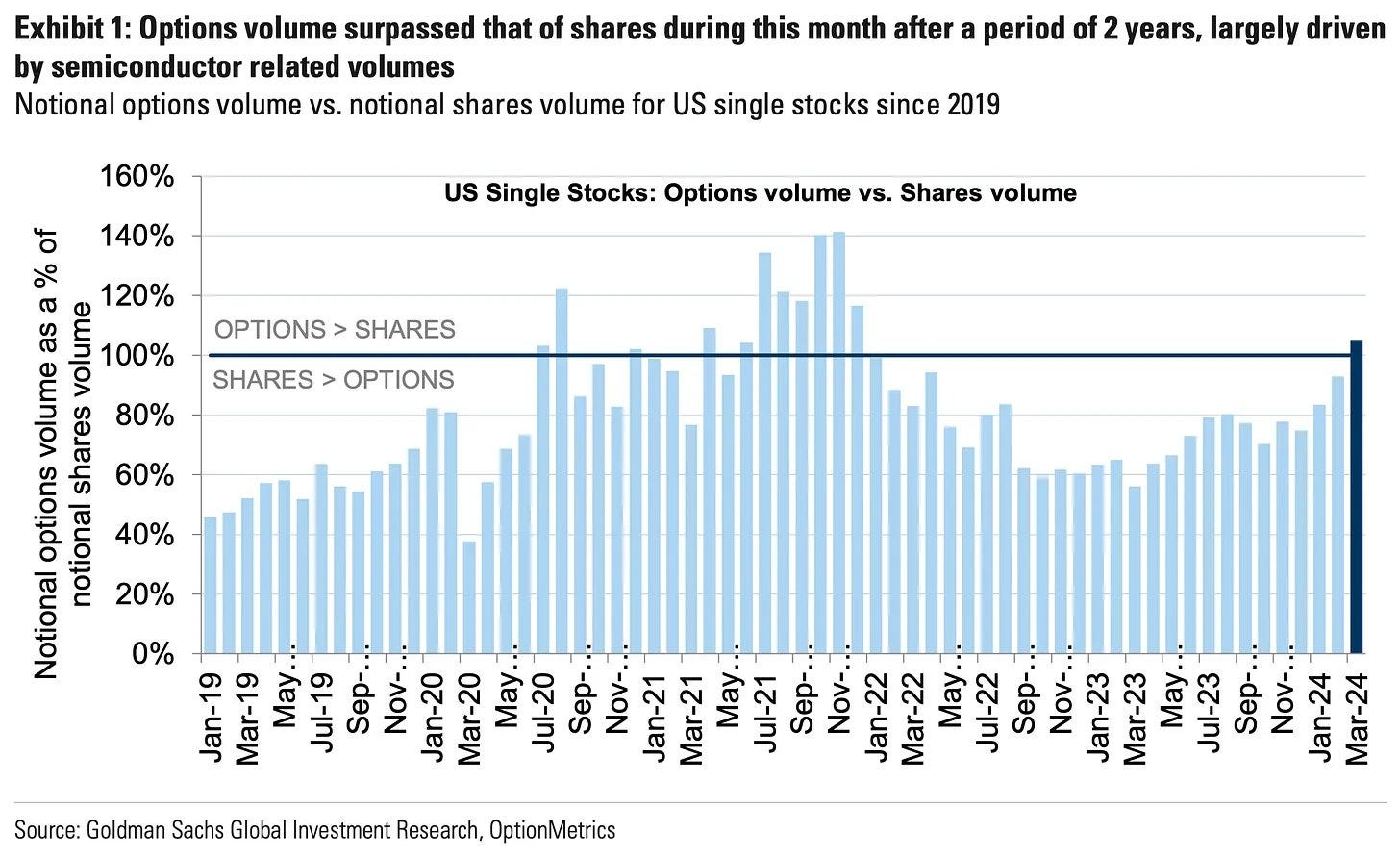

A nice graph here from Daily Chartbook speaks volumes about today’s market environment. For the first time since the heady markets of late 2021, the volume of options has exceeded the volume of shares traded. It truly is the tail wagging the dog.

This phenomenon also reflects an important way in which markets have changed over the years. Options are effectively ways to gain exposure to stocks in a leveraged way. As options markets have grown and access to trading platforms has improved, options volume has exploded.

What this means is the way in which leverage to markets is expressed has changed. It used to be if investors wanted to leverage access to markets, they would expand margin accounts. While that can still be done, options make it so much easier to take that route. As a result, margin no longer provides the same information content it used to. Leverage is still there; it has just found another way.

Economy

The headline story has been that the economy continues to chug along at a fairly healthy pace and that is true. The GDPNow estimate of 2.1% confirms this remains the case.

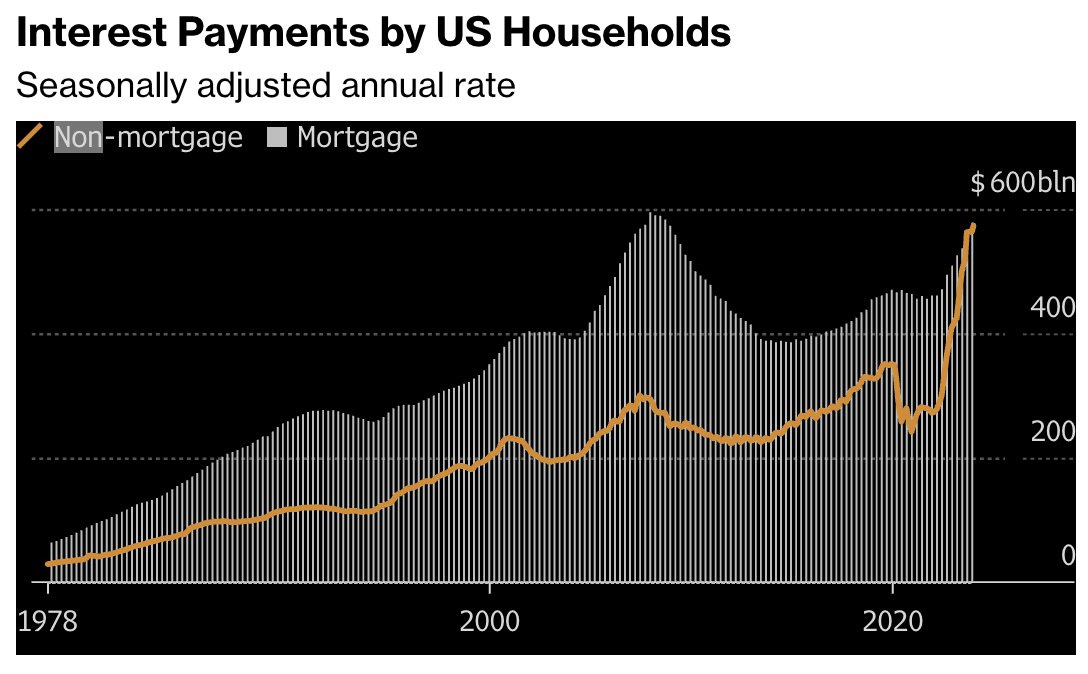

The vigor is not evenly distributed, however. Companies and individuals who have debt, and who have not been able to lock in low long-term rates, are suffering the pains of higher short-term interest rates. Kobeissi recently illustrated the dynamic vividly:

For the first time in history, interest payments on non-mortgage debt in the US are equivalent to interest on mortgage debt, at $575 billion. Exactly 3 years ago, interest on non-mortgage debt was at $250 billion. This marks a 130% increase in household interest expense on non-mortgage items over just 3 years. Furthermore, 3 years ago interest on non-mortgage debt was HALF of interest on mortgage debt. Americans are "fighting" inflation with high interest rate debt. How is this sustainable?

One of the main reasons why it is taking so long for higher interest rates to affect economic growth is because so many companies and households have been insulated from them. Companies that could tap capital markets locked in low rates before they started to go up and households that could afford to locked in low mortgage rates.

The unfortunate others, however, have had to bear the cost of higher interest rates - and that is beginning to show. In the graph above, it’s easy to see how the trajectory of non-mortgage interest payments has spiked higher the last couple of years.

Those increased interest expenses are beginning to impinge upon spending more broadly. Robert Armstrong at the FT ($) captured the following quote by the CFO of McDonald’s:

We’ve talked pretty consistently [about how] it’s a challenging consumer environment. Consumers are working through . . . all the inflation that’s hitting their pocketbook . . . Higher interest rates are having an impact. I think in particular for lower-income consumers, you’ve got a couple of additional dynamics, eroded Covid savings that people were drawing on and spending from that are largely gone . . . you’re starting to see food-at-home inflation versus food-away-from-home getting back to its historical dynamic, which means some of those consumers are just choosing to eat at home more often

This is likely to create a big public policy dilemma this year. If nothing is done, consumers will continue to get squeezed by inflation that has been undercompensated for by wage increases. Any broad effort to increase wages, however, will increase costs to companies and threaten markets.

In the short-term, we are seeing some policies like home buyer credits and lower realtor commissions help ease the sting of higher prices. I’m sure we’ll see more, but these are small beer in grander scheme of things.

Longer-term, the answer is for real wages to go up. I think this will happen but I don’t think it will happen meaningfully until after the election. This will present an interesting balancing act for the Biden administration. It will need to appear to do enough to help wage earners in order to win the election, but not so much as to have wage inflation kill the stock market.

Economics

Rethinking economics

https://www.imf.org/en/Publications/fandd/issues/2024/03/Symposium-Rethinking-Economics-Angus-Deaton

Angus Deaton, who is well-known for his work on “Deaths of despair” and for winning the Nobel prize in economics, recently published a note that reads like a confessional for all the misdeeds of the economics community. Among the failings he cites:

“Without an analysis of power, it is hard to understand inequality or much else in modern capitalism.”

“we have largely stopped thinking about ethics and about what constitutes

human well-being.”

“We often equate well-being to money or consumption, missing much of what matters to people.”

“when efficiency comes with upward redistribution—frequently though not inevitably—our recommendations become little more than a license for plunder.”

“But the currently approved methods [of economic analysis], randomized controlled trials, differences in differences, or regression discontinuity designs, have the effect of focusing attention on local effects, and away from potentially important but slow-acting mechanisms that operate with long and variable lags.”

In part, he levels criticism at the economics profession for its role in promoting policies that hurt a lot of Americans: “I also no longer defend the idea that the harm done to working Americans by globalization was a reasonable price to pay for global poverty reduction because workers in America are so much better off than the global poor.”

This alone would be damaging enough to the economics profession, but he goes even further: “economists, who have prospered mightily over the past half century, might fairly be accused of having a vested interest in capitalism as it currently operates.”

Whew, that’s quite a gut punch from one of the industry’s luminaries! In short, I think he’s right and commendable for both recognizing the sins of economics over the years and admitting to them himself. The evidence is becoming clearer with time that the broad policy of globalization caused a lot more harm to American workers than anyone wanted to admit. Now, these mistakes are manifesting themselves in nihilistic politics.

While this pronouncement isn’t likely to change very much in the short-term, it is an important signpost that the neoliberal order, and the economics policies that justified it, are on the way out. That means there will be different economic policies and different political trends in the future. I read this as a nod in favor of labor relative to capital.

Monetary policy I

The Bank of Japan (BOJ) did finally come through and exit itself from negative interest rate policy at its meeting this week. According to Zerohedge’s checklist, the BOJ was fairly hawkish in terms of its policy modifications. That said, as Lisa Abramowicz posted, the BOJ also stated Japan’s economy “is expected to be under downward pressure stemming from a slowdown in the pace of recovery in overseas economies”.

Unsurprisingly, the mixed message got a mixed reception. By conventional measures it was a “buy the rumor, sell the news event”. After the announcement of the rate hike, 10-year JBG yields actually came down and the yen weakened. On the other hand, bitcoin dropped about 7% on Monday night and S&P 500 futures were down 50 bps before the open on Tuesday.

To make things especially interesting, the longer-term reaction function is also mixed. On one hand, John Authers reports, “Further hikes will be easier [with this recent move out of negative territory], and if Japanese inflation entrenches further, they’ll happen.” On the other hand, Authers ($) also reported the comments of Citi Research’s Dirk Willer last week: “History would therefore suggest that, once more, the BOJ will not get all that far in its cycle, even though it will be clearly easier to hike during preemptive Fed cuts, as opposed to Fed cuts driven by recession fears.”

While slowing economic growth certainly poses a risk to further rate hikes at BOJ, I lean toward the former interpretation that further rate hikes will be easier now. The “history” that Dirk Willer refers to is one of global Quantitative Easing (QE) which has now largely been proven ineffective. In other words, there is unlikely to be a landscape of near zero interest rates and low inflation to insulate the BOJ. It won’t happen overnight, but it definitely looks like we are entering a new era of higher inflation and higher interest rates and BOJ will be a part of that.

Monetary policy II

The Federal Open Market Committee (FOMC) also met to conclude the one-two punch of major central bank meetings this week. Virtually nothing was changed in terms of the wording of the press release or the framing of the Fed’s monetary stance. The dot plot, however, revealed both economic growth and inflation were coming in higher than expectations.

There were also a couple of comments that may have been slight giveaways. First, Chair Powell described the January and February inflation data, when taken together, still support the story of inflation coming down. While it is true there was some noise in the January number, this is still a generous interpretation of numbers that were quite clearly higher than in the latter months of 2023.

In addition, while Powell remained noncommittal regarding when a rate cut might occur, he did clearly indicate that weakening of the labor market would be viewed with special interest. This may be a slight “tell”. Given a potentially difficult decision between allowing inflation to remain higher than desired or allowing the labor market to weaken, the Fed would opt for the former.

This paints the picture of the Fed stuck in a kind of purgatory. It just does not have, nor will likely have in the foreseeable future, clear evidence to lower interest rates as a result of inflation coming down sustainably to target. That means it will likely be forced to lower rates as the labor market weakens, even as inflation remains well above target.

During the press conference, stocks rose almost 1%, gold jumped over 1%, and the US dollar (DXY) fell about 60 bps. It seems the market is starting to price in the fact the Fed no longer has control over prices, at least not at the 2% target it has articulated.

Investment landscape I

Record low US options skew shows investor confidence on stock market rally ($)

https://www.ft.com/content/7314c9c3-318e-4ed2-935b-1dbfcbe95860

Such a narrow price gap between puts and calls — a “flat skew” in industry jargon — is unusual during aggressive market rallies when investors generally take out insurance against potential pullbacks.

Investors are so bullish that “fear of a crash-up” now trumps “any meaningful concern of a correction lower”, said Charlie McElligott, managing director of cross-asset strategy at Nomura, who wrote in a note to clients that markets “are foaming at the mouth”.

This piece provides some nice perspective on the psyche of the market right now. Normally, when prices get stretched, investors start looking to add some downside protection. Not now. The bigger perceived risk is that prices can go up so much more. As noted market commentator Charlie McElligott puts it, markets “are foaming at the mouth”.

This suggests a “bubble” is the wrong analogy to characterize market behavior. After all, it’s not really excessively high perceptions of growth that are driving prices. There is something else going on. Rather, there seems to be an uncontrollable desire for greater exposure to stocks irrespective of fundamentals. This sounds more like the market is being rabid, than exuberant.

There are plenty of reasons why this might be the case. Certainly policy, both fiscal and monetary, have pretty consistently leaned in favor of financial assets. That, combined with a fairly pervasive sense of financial nihilism (which I described last week), are creating a fertile environment for speculation.

Investment landscape II

With artificial intelligence continuing to buzz and central banks getting the spotlight this week, less attention has been placed on China recently. This graph from @SoberLook, however, shows China is still very much a part of the equation for US markets. The reason is “China’s worsening credit impulse” provides a strong support for the US dollar.

As I have reported several times, the credit situation in China is not trivial or transient. It’s going to take a long time to restructure its property industry and it’s also going to take time to revamp it’s economic model to be less reliant on exports.

I’m not the only one. As Shannon Brandao reports, the chief investment officer of Goldman Sachs Group Inc.’s wealth-management business, Sharmin Mossavar-Rahmani, cited “a steady slow down in the economy over the next decade” and recommended that investors “should not invest in China.” Not this quarter or the next quarter, “over the next decade”.

This is likely to frustrate US dollar bears. For as high as US debt is, and as profligate as spending is, and as uninterested (and unable) as anyone is in fixing these things, weakening credit in China is going to continue to soften any adverse impact on the dollar. As a result, there will be a lot more room for maneuver than there might appear to be.

Implications I

Since late October last year stocks have been on a roll. Although enthusiasm for rate cuts was an important driver of the narrative, virtually all of those expectations have reverted. Yet, stocks continue to roll. How long can it go on?

For the next couple of months anyway, liquidity conditions remain amenable so that is unlikely to be the catalyst for a selloff. It is possible first quarter earnings fail to justify sky-high expectations and cause stocks to rollover. The economy could rollover, but there are not signs of that happening imminently. None of these are high probability factors though.

Interest rates are more likely to be the culprit to cause a selloff, but again, not in the near-term. The Fed made clear we are at the peak in short-term rates and its bias is strongly towards lowering them. The only issue is time.

Longer-term rates are more of a wildcard. The dramatic decline in the 10-year Treasury yield last fall precipitated the runup in stocks. Since then, yields have started working their way back up, but thus far have not had any material impact on financial conditions. In fact, lower bond volatility has contributed to higher stock prices and easier financial conditions. For most of this year, longer-term rates have been the linchpin keeping stocks rolling.

This is interesting because there are plenty of indications longer-term rates should be pushing higher. Economic growth and inflation have come in higher than expected so far this year and inflation expectations are pushing higher. In addition, higher issuance of longer-term Treasuries in the second quarter is likely to strain demand which should force rates higher. Yet, for the time being, longer-term rates seem to be pacified by the soothing narrative of disinflation.

So, when are longer-term rates likely to break high enough to kill the rally? If I had to pick a time for this to happen it would be around May. That should give plenty of time for the data to irrefutably contradict the narrative of disinflation and for bond markets to express the cost of additional supply.

Implications II

One of the interesting aspects of the stock rally is it simultaneously embraces two ideas that are logically inconsistent with each other. One is that growth is strong and likely to keep going and the other is that inflation is unlikely to be a problem.

This inconsistency is increasingly being picked up on by natural resources and in particular, by gold. These markets have a different interpretation of the landscape than the stock market. Gold markets are saying the Fed has lost (or ceded) control over prices and as a result, inflation will be higher than advertised. Worse yet, the Fed may very well end up cutting rates while inflation continues to pick up.

The implication for investors is that resources may very well be the better indicator of, and protection against, higher inflation (relative to stocks). While gold is the purest form, other resources are likely to demonstrate their capacity to store value as well.

If this is the way events unfold, then the higher costs of resources themselves will further enflame inflation and eventually pressure stocks. Maybe the bond vigilantes have given way to the resource vigilantes?

Note

Sources marked with ($) are restricted by a paywall or in some other way. Sources not marked are not restricted and therefore widely accessible.

Disclosures

This commentary is designed to provide information which may be useful to investors in general and should not be taken as investment advice. It has been prepared without regard to any individual’s or organization's particular financial circumstances. As a result, any action you may take as a result of information contained on this commentary is ultimately your own responsibility. Areté will not accept liability for any loss or damage, including without limitation to any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

Some statements may be forward-looking. Forward-looking statements and other views expressed herein are as of the date such information was originally posted. Actual future results or occurrences may differ significantly from those anticipated in any forward-looking statements, and there is no guarantee that any predictions will come to pass. The views expressed herein are subject to change at any time, due to numerous market and other factors. Areté disclaims any obligation to update publicly or revise any forward-looking statements or views expressed herein.

This information is neither an offer to sell nor a solicitation of any offer to buy any securities. Past performance is not a guarantee of future results. Areté is not responsible for any third-party content that may be accessed through this commentary.

This material may not be reproduced in whole or in part without the express written permission of Areté Asset Management.