Observations by David Robertson, 3/29/24

There was a lot of market activity in the holiday-shortened week. Let’s dig right in.

Happy Easter to those who celebrate and I hope everyone enjoys the long weekend!

As always, if you want to follow up on anything in more detail, just let me know at drobertson@areteam.com.

Market observations

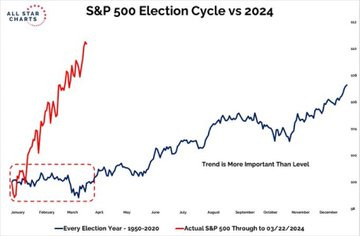

I am not a big fan of comparing market trajectories across different periods largely because it fosters oversimplification. It can be useful, however, to provide perspective. As such, this graph from JustDario compares this year’s market trajectory to the normal election year pattern.

Yes, markets tend to go up in election years. Yes, this year is almost off the charts in comparison.

One of the big drivers of financial assets this year is declining volatility. The VIX index of stock volatility rose in September and October last year but cratered in November and has remained subdued since. More recently, the MOVE bond volatility index has dropped precipitously since the beginning of the year. Lower bond volatility expands the capacity of bonds to serve as collateral - which increases liquidity - which can be used to buy more financial assets. Whee!

While the initial decline in the MOVE index made some sense in light of expectations of declining inflation, its continued path downward has made less sense as expectations of both growth and inflation have ticked back up.

Is the downward move just a normalization from previous levels that were exceptionally high? Perhaps. Is the decline a function of momentum trading in the context of weak resisting forces? Perhaps. Is it possible the MOVE is getting some help from policymakers trying to ease financial conditions? Also, perhaps.

Regardless, for the time being, easing financial conditions are causing volatility to decline … which further eases financial conditions. There is room for this to continue. If/when it reverses, however, there is also a lot of room for conditions to get tighter.

Economy

Torsten Slok: the Fed won’t cut this year ($)

https://www.ft.com/content/c32813ca-aee2-4273-8d37-b254fc1dded8

Which consumers have been impacted [by higher interest rates]? Look at delinquency rates for credit cards for people in their 20s and 30s. Young households have three characteristics. They have more debt, lower credit scores, lower incomes. It’s not surprising that those households have been negatively impacted by rates going up. Likewise, for auto loans, people in their 30s are now falling behind on their loans at a faster pace than during the pandemic. Think about that: 2008, people lost their jobs, so of course they stopped paying the bills. Today, no one’s lost their job. We just created 275,000 jobs and still more and more young households are falling behind.

This interview of Apollo’s chief economist by the FT’s Unhedged team sheds some more light on the mixed economic picture. Yes, higher rates are having a disproportionately negative impact on subset of consumers with “more and more young households are falling behind”. However, “Young households don’t account for a significant share of consumer spending.” As a result, this PhD economist concludes, the Fed won’t cut because there is relatively little impact on the economy overall.

This reminds me of an old jibe about Microsoft customer support: It’s technically correct but not helpful. While I believe Slok’s analysis is technically correct, I also believe, like so many economic analyses, that it misses important social and political considerations.

Even ignoring for the moment the questionable moral grounding of a policy that disproportionately hurts younger generations, there is an important political consideration: Younger voters skew heavily towards the Democratic side of the political spectrum. If enough of these voters change sides because of imposing economic conditions, or if many of them decide to just not vote out of apathy or disgust, the effect could sway the November election. I doubt the Biden administration is unaware of this.

This all serves as a reminder that we are not operating in completely free markets and economic analysis based on that assumption isn’t very useful. The key driver is high level policy goals and the highest goal of the Biden administration right now is to win the election. Accomplishing that will require the support of young voters and that will require less punitive interest rates.

Monetary policy

The Fed should avoid messing with success ($)

https://www.ft.com/content/59827415-c1e8-4e8c-b43c-f78411443fad

History shows, though, that recessions aren’t caused by excessively high real interest rates. Most of the ones we’ve experienced since the 1960s were caused by the tightening of monetary policy until it triggers a financial crisis that is quickly followed by a credit crunch, which causes a recession. It is financial crises that have caused the Fed to lower the nominal federal funds rate in the past, not a perception that the borrowing benchmark was too high and about to cause a recession.

And what about Milton Friedman’s claim that monetary policy operates with a long and variable lag? If so, then the central bank should start lowering the federal funds rate soon to offset the delayed impact of the past two years of monetary tightening. But if financial crises are the main risk for recessions, instead of Friedman’s ambiguous hypothesis, the Fed might want to focus more on credit cycles in deciding rate levels.

It is probably a sign of the times that Ed Yardeni, one of Wall Street’s perma-bulls, is advocating moderation in regard to monetary policy for fear of “inflating a speculative bubble”. While recognizing the potential need to offset the tightening effects of past rate hikes, he focuses on credit conditions as being the better arbiter of rate levels. If credit is fairly healthy, which it is, there is little risk of financial crisis and therefore little risk of recession.

Once again, all true … and not super helpful. While credit conditions overall are fairly healthy, they are clearly deteriorating among younger consumers. Economically this is not a hugely important cohort, but politically it is.

My interpretation is the Fed is making a deal with the devil whereby it will cut rates this year regardless of what the data says. It will hope for supportive data but will also be prepared to make all kinds of verbal and logical contortions to justify the move.

The lowered rates will serve as a starting gun for increased spending and therefore increased business investment which will plant the seeds for economic growth, but also for a sustainably higher level of inflation. But that won’t hit hard until after the election.

Of course, there are other possible reasons why the Fed is leaning so dovish despite higher inflation readings lately. The main reason is it knows something the rest of us don’t. That “something” may be brewing problems at banks, growing signals of deflationary forces elsewhere, or any number of other wildcards. To the extent some other explanation arises, which is a real possibility, the Fed’s rate cutting will look less inflationary.

Currencies

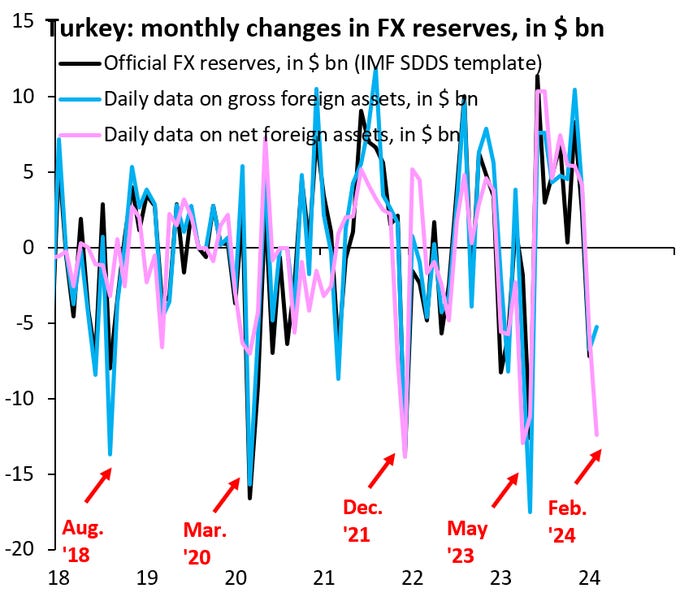

Almost two and a half years ago I mentioned Turkey as being “a top candidate to spark global instability,” and that wasn’t the first time I mentioned it. Despite President Erdogan’s Harry Houdini-like ability to wriggle out of tight currency spots, the prospect of devaluation is arising again. As Robin Brooks posts:

Turkey is in a bad policy cycle. The gov't pump-primed spending ahead of the May 2023 elections, but it didn't want a devaluation before the election, so there were big losses in official FX reserves instead. It's the exact same again now. A big deval is coming after March 31...

While a devaluation may be in store, the situation may not be so cut and dried. As I reported in 2021:

The trigger to look out for is capital controls. We have already seen a mild form of that with a crack down on cryptocurrencies in Turkey. Concerns about further devaluation and even stricter capital controls are exacerbating weakness in the lira and boosting stronger stores of value like the US dollar and gold.

Among other things, this poses an interesting analytical dilemma. A devaluation in Turkey, or anywhere else (China?), would likely boost the value of the US dollar. Yet at the same time, the US government seems to be doing its level best to overspend and undermine the value of the dollar. As a result, it may well transpire that despite obscenely high ongoing fiscal deficits in the US, the dollar may continue to remain fairly strong. After all, with fiat currencies it’s all relative.

Investment landscape I

Universal Capitulation and No Margin of Safety

https://www.hussmanfunds.com/comment/mc240321/

Several facts seem to be taken as common knowledge among investors. They include the belief that earnings are the proper fundamental to use when valuing stocks; that the increase in profit margins over recent decades is owed primarily to improvements in technology that provide a permanent basis for elevated profitability; and that surging profit margins among mega-cap stocks, particularly technology companies, have been a central driver of these trends.

All of these propositions are incorrect.

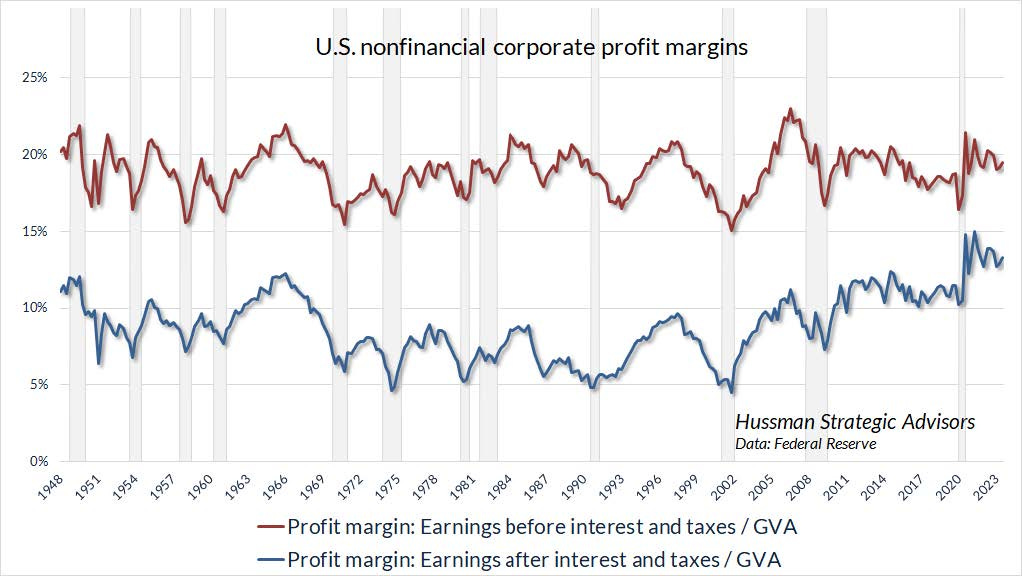

Notice something. Despite all the bluster about technological improvements driving durable increases in corporate profitability over time, the fact is that corporate profit margins before interest and taxes have hovered around the same level for 75 years.

massive government subsidies and household dissaving provided a temporary boost to corporate profit margins following the pandemic, but these are being phased out; and progressively falling interest costs – the strongest driver of progressively rising profit margins – have already reversed, but margins don’t yet reflect that because corporations locked in record low rates during 2020-2021.

This is classic John Hussman - clearly and methodically making the case that corporate profit margins are unusually high and unlikely to stay that way. This is a direct rebuke to the widespread belief that artificial intelligence and other technologies are sustainably boosting profit margins.

Probably the most vivid illustration of his argument is the graph of earnings before and after interest and taxes. Earnings before interest and taxes have been rangebound between 15 and 20% for 75 years. It has only been in recent years that earnings after interest and taxes have surged to new highs.

As Hussman clearly delineates, falling interest rates have been “the strongest driver of progressively rising profit margins” and they “have already reversed”. The change has not yet been reflected in reported margins because many companies locked in low rates and have not yet had to refinance.

So, we have a picture of unusually high profit margins and a mechanism (already triggered) to push them lower that just hasn’t kicked in yet. It’s like being at the top of a roller coaster taking in the beautiful scenery of the countryside … just before plunging downward. How far this plunge will be and how long it takes will depend on future monetary policy. My bet is margins will end up looking like they have in the past.

Investment landscape II

YOU CAN'T HANDLE THE TRUTH ($)

https://www.russell-clark.com/p/you-cant-handle-the-truth

Having been around awhile, I often think that the best opportunities come from trying to find a truth that investors cannot come to accept. I have found old managers and young managers far more accepting of price action. Mid career managers often make their names by avoiding collapses, like the GFC or the dot com bust, or China or commodities in recent years, and typically don’t want the world to change. Older managers that have survived know that things can and do change, so have learnt to embrace it.

What truth can people not handle? Almost certainly that interest rates and yields are going much higher.

One of the interesting phenomena in the investment world has been the ongoing divergence between stock prices and their underlying economic fundamentals. Sure, there are structural mechanisms that help explain this such as the proliferation of passive investing, the prolific use of stock buybacks to provide a nearly continuous bid, and persistently easy monetary policy. Even despite these factors, however, the lack of pushback and the willing acceptance have been notable.

This commentary from Russell Clark provides a nice explanation: “Mid career managers … typically don’t want the world to change”. It also jives neatly with Upton Sinclair’s quote, “It is difficult to get a man to understand something when his salary depends upon his not understanding it”. In other words, while there are structural mechanisms to explain the divergence, there are also psychological ones.

Consider that most mid career investment managers have made their careers riding on low interest rates and rising markets. That’s what they know and that’s what has worked for them. It’s understandable they don’t want that to change. This clinging on to the past explains why so market participants are still hanging on the promise of Fed rate cuts despite the evidence of a normalization of monetary policy. It also explains the dearth of bond vigilantes.

One consequence of not being able to handle the truth of rate normalization is the emergence of a surreal environment in which the evidence of a meaningful change in the trajectory of both inflation and monetary policy become increasingly evident and yet neither market prices nor most of the investment public acknowledge it.

Not surprisingly, this creates enormous opportunities to do something different than operate from the conventional investment playbook. Whitney Baker hit the nail on the head in an interview with Joe Lonsdale when she said not only is it “a bad time for beta”, but “It’s a great time for alpha”.

That can be translated as bad for passive and good for active management. High debt has pulled forward returns to the point where future returns are very unattractive for popular financial assets like the S&P 500. Because flows have been concentrated in those assets, other assets are now much more attractive.

This will bode extremely poorly for conventional 60/40 strategies and potentially extremely well for more active, more open-ended strategies.

Implications I

Last year when I was anticipating the election year ahead, I judged the best way to provide the usual economic boost in front of the election would be to allow things to cool off in the fall (of 2023) and then to stimulate in the spring of 2024. This would give enough time for the economy to be running solidly by November without running the risk of destabilizing markets by allowing financial assets to run wild.

This thinking proved wrong. Rather than allow a cooling off period in the fall, both the Fed and the Treasury goosed markets by talking up rate cuts and jawboning long rates down. I think the inflation in asset prices this activity generated will make it hard to control liquidity, but hey, that’s the path that was taken.

As a result, I am far less sanguine about getting an opportunity to increase exposure to risk assets at very attractive prices. Bob Elliott makes the case in a nice thread that “the Fed & Treasury will continue to juice the economy which will create higher than expected growth and higher than expected inflation pressures”. Short-term that should be good for stocks in general. Longer-term, excessively high valuations are likely to constrain returns.

That said, I am more sanguine about opportunities outside of US large cap tech stocks. Stocks that benefit more directly from US economic growth should do well. I expect policy support of the economy to also start helping commodities while also mitigating the downside risk. In short, I very much agree with Whitney Baker that “It’s a great time for alpha”.

Implications II

One of the clearer illustrations that the time is coming for hard assets was provided by Tavi Costa. The combination of rising inflation expectations and loosening monetary conditions provides a rare impetus for hedging against monetary debasement.

Of course, right at the top of the list for hedges against monetary debasement is gold. Almost Daily Grant’s (Thursday, March 21, 2024) reports that Bank of America is saying, "gold is still one of our favorite trades for 2024 as an attractive portfolio hedge for equity investors." It continues with an FT report that “Elliott is establishing a new venture which seeks to snap up mining assets valued at $1 billion and above under the auspices of former Newcrest Mining CEO Sandeep Biswas”. These are very positive signs.

Note

Sources marked with ($) are restricted by a paywall or in some other way. Sources not marked are not restricted and therefore widely accessible.

Disclosures

This commentary is designed to provide information which may be useful to investors in general and should not be taken as investment advice. It has been prepared without regard to any individual’s or organization's particular financial circumstances. As a result, any action you may take as a result of information contained on this commentary is ultimately your own responsibility. Areté will not accept liability for any loss or damage, including without limitation to any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

Some statements may be forward-looking. Forward-looking statements and other views expressed herein are as of the date such information was originally posted. Actual future results or occurrences may differ significantly from those anticipated in any forward-looking statements, and there is no guarantee that any predictions will come to pass. The views expressed herein are subject to change at any time, due to numerous market and other factors. Areté disclaims any obligation to update publicly or revise any forward-looking statements or views expressed herein.

This information is neither an offer to sell nor a solicitation of any offer to buy any securities. Past performance is not a guarantee of future results. Areté is not responsible for any third-party content that may be accessed through this commentary.

This material may not be reproduced in whole or in part without the express written permission of Areté Asset Management.