Observations by David Robertson, 5/5/23

It was a busy news week for a change. Increasingly, the overriding question seems to be, “Can the economy plug along at a decent rate while the financial system restructures?”

As always, if you want to follow up on anything in more detail, just let me know at drobertson@areteam.com.

Market observations

This is one of those pictures that speaks a thousand words. If you want to know what has been driving stock performance year-to-date in one word, it’s “size”. Partly this is a function of greater concern amongst small caps about slowing economic growth. Partly it is a function of the carry regime and volatility selling which disproportionately benefits big stocks. In neither case is the year-to-date return of the S&P 500 a reflection of fundamentals.

On Monday, Treasury Secretary, Janet Yellen, wrote Congress that the Treasury’s cash was likely to run out by early June and “potentially as early as June 1” if Congress doesn’t act on the debt limit. On the same day, Treasury announced it expected borrowing to increase substantially from its January estimate. It now expects to borrow $726B in the April-June quarter and $733B in the July-September quarter for a total of $1.59T over the next five months.

One point is the x-date for the debt ceiling is getting close. Of course, there are all kinds of possible outcomes, not least of which is kicking the can further down the road. Something will need to happen fairly soon though.

Another point is the magnitude of Treasury borrowing is beginning to come into focus for the broader investing public. Bonds got clobbered on the announcement, but have since recovered. Regardless, a lot more debt is going to be issued and it will need to find a home somewhere and at some price.

Housing

Radigan Carter is always a thoughtful commentator and his recent post illuminated an important risk for many borrowers:

just got off the phone with another loan officer, shopping around for [mortgage] rates

she’s telling me I can refi in a couple years because 65% of banking sector thinks Powell will hike 25 bps next meeting and then be done and rates will start going back down in 2-3 years and can then refi

In one sense, this exchange is innocuous; it’s just one loan officer trying to do the best she can in a difficult environment in which rates have increased significantly over the last year and a half.

In another sense, however, the “advice” is quite harmful. A mortgage is a big commitment and potentially a big risk. Not only is it something that someone should not be cavalier about, but the loan officer is in no position to judge where rates might be in 2-3 years.

As it turns out, this phenomenon is not limited to mortgage rates either. The Economist reports: “First, it is clear from how interest-rate markets have behaved, as well as from the way that different types of stocks have moved in different directions, that investors are not betting on all being well with the banking sector or the economy. What they are betting on is rate cuts.”

In short, a lot of people are making big decisions based on things that have not yet happened. At best this is risky; at worst it is a setup for massive disappointment.

Technology

‘The Godfather of A.I.’ Leaves Google and Warns of Danger Ahead ($)

https://www.nytimes.com/2023/05/01/technology/ai-google-chatbot-engineer-quits-hinton.html

But gnawing at many industry insiders is a fear that they are releasing something dangerous into the wild. Generative A.I. can already be a tool for misinformation. Soon, it could be a risk to jobs. Somewhere down the line, tech’s biggest worriers say, it could be a risk to humanity.

“It is hard to see how you can prevent the bad actors from using it for bad things,” Dr. Hinton said.

First look: RNC slams Biden in AI-generated ad

https://www.axios.com/2023/04/25/rnc-slams-biden-re-election-bid-ai-generated-ad

AI-generated images are disrupting art, journalism, and now politics. The 2024 election is poised to be the first election with ads full of images generated by modern Artificial Intelligence software that are meant to look and feel real to voters.

Last week I extolled the virtues of AI so it is convenient that news this week focused more on the negatives. It seems like more than coincidence that after the huge success of chatGPT from Open AI and the merging of Deep Mind and Google Brain within Google, Geoffrey Hinton decided to leave. While he was very careful to not criticize Google’s approach to AI, it also seems pretty clear the cat is out of the bag and AI’s development will increasingly be governed by money and power.

One of his concerns is the unequal distribution of benefits. I reported on AI four years ago on Hinton’s reservation: "The problem is in the social systems, and whether we're going to have a social system that shares fairly ... That's nothing to do with technology."

Another concern is the potential for AI to be used for “bad things”. Clearly this is already happening. As the Axios story relates, AI is being used to manipulate voters even more effectively. If a man was compelled to storm into a DC pizzeria in 2016 to disrupt a “child sex slave ring” based on intel that “wasn’t 100 percent”, imagine what could happen with even more ubiquitous and realistic “intel”.

The potential threat is real enough as to compel Ben Hunt to make this claim: “I honestly believe that if you gave me an unthrottled GPT-4, a couple of $m to buy astroturfed media and 3 months I could destabilize any belief system on Earth.” He is not just referring to the US; he means “any belief system on Earth”. As a result, it’s best to consider the enormous potential benefits of AI along with the almost unimaginable harm that could be caused.

Public policy

Remarks by National Security Advisor Jake Sullivan on Renewing American Economic Leadership at the Brookings Institution

Jake Sullivan, the National Security Advisor, gave a speech a week ago that was wide-ranging, thoughtful, and cohesive. In it, he listed “four fundamental challenges”:

“America’s industrial base [that has] been hollowed out.”

“a new environment defined by geopolitical and security competition, with important economic impacts”

“an accelerating climate crisis and the urgent need for a just and efficient energy transition”

“the challenge of inequality and its damage to democracy”

One point is the speech stands out as a rare instance of public policy actually addressing the most important underlying challenges. This is encouraging because it is only when problems are properly diagnosed that they stand a decent chance of being solved. While there are certainly political preferences woven into the text, it would be a mistake to treat this as anything other than a very muscular policy statement and a noticeable change from the past.

The speech also stands out for its vast scope. As the National Security Advisor, Sullivan focuses mainly on economics, but also trade policy, international relations, sociology, and other fields that traditionally fall outside the confines of national security. This makes the point even stronger that this is not a run-of-the-mill smattering of political ideas, but rather what can be described as a “new Washington consensus”, a topic I touched on two weeks ago. In other words, this is a plan to reconfigure, or at least modify, many of the post-World War II policies and institutions that are no longer fit for purpose. As such, Sullivan’s speech is a massively ambitious statement.

It also clarifies and validates many of the hypotheses I have been using to guide investment decision making. For example, when Sullivan talks about the decline in global market share of US semiconductor manufacturing as creating a “critical economic risk and a national security vulnerability”, it is clear national security is a driving force. When he mentions, “a new global labor strategy that advances workers’ rights through diplomacy”, it sounds a lot like favoring labor over capital. When he complains of former policy direction privileging “some sectors of the economy, like finance, while other essential sectors, like semiconductors and infrastructure, atrophied”, it expresses a desire to boost manufacturing relative to finance.

A key takeaway from the speech is that there is a new sheriff in town in regard to public policy and he has a holistic and cohesive view as to what he wants to have happen. Certainly, though, it is important to not overestimate where this policy will take things. Talk is cheap, there are always frictions, implementation is difficult, initiatives don’t always work out as planned, and what is said is often different than what is done.

Nor should investors underestimate what this policy might accomplish, however. Many of the problems it addresses have been too big to tackle with dearth of political consensus in Washington. As a result, most policies have been more a matter of political bluster aimed in the general direction of problems, rather than true problem solving. This is different. It is a comprehensive review of major problems that need to be resolved in order to achieve sustainable growth.

Investors shouldn’t underestimate the direction specific policies may take from this statement either. While the Biden administration has been criticized for positions that favor “clean” energy over fossil fuels, a “just and efficient energy transition” argues for a more thoughtful consideration of fossil fuels than an outright exclusion. In addition, the desire to “rebuild” sectors of the economy such as manufacturing and scale back the growth of finance implies higher interest rates, more bank-based lending, and less capital markets/asset-backed lending.

Yes, it will take time. Yes, there are all kinds of things that can go wrong. But Sullivan is properly diagnosing the main problems and is articulating a thoughtful way forward. Investors who continue to gripe about past transgressions risk missing signs of important progress.

Monetary policy

The FOMC met this week and raised rates another 25 bps as expected. Perhaps the most notable change was the exclusion of the statement suggesting further rate increases would be required to reach appropriately restrictive policy. In other words, pausing here is now the baseline.

There was some pushback regarding the Fed’s handling of SIVB. The Fed recently released a report highlighting that SIVB had been considered an organization of regulatory interest. Powell interpreted this by saying it was evidence that “we’re on the case”. One has to wonder how many other cases the Fed is on that will end up as failed banks.

The broader point is this: it is very difficult to consider the Fed’s multiple failures and deduce that it was created with the intent of competently implementing monetary policy and regulation.

Indeed, this concern was quickly inflamed when, just after the FOMC press conference, PacWest Bancorp (PACW) announced it was considering a sale amongst other strategic options. The stock, which was down 78% from its high this year, was down another 40% before the open on Thursday.

As easy as it is to attribute this to the Fed’s incompetence, there is another possible explanation, and one that I think is quite credible. It could be argued that a culling of the herd is the best thing for the long-term resilience of the financial sector. Such a culling, involving weak banks, but also nonbanks, would also be consistent with Jake Sullivan’s emphasis on resilience and on strengthening strategic manufacturing sectors relative to the finance sector.

If this is the case, investors should expect more banks, and a lot more nonbanks, to fail in coming months. It will be the darkness before the dawn. The thing to watch is the threshold at which the Fed feels compelled to change direction.

Inflation

One of the reasons why I have believed inflation will persist is because debt levels are so high as to almost make inflation a necessity for public policy. Indeed, excessive debt is the one thing inflation is good for. Since you can pay the debt off with dollars that are worth less in the future, the value of the debt declines with inflation.

This is exactly the point made by Vincent Deluard of StoneX on Twitter. He notes, “The US net* public debt-to-GDP ratio is now lower than it was pre-COVID”, despite spending having increased. He describes, “Inflationary growth is the miracle remedy for debt traps.”

True enough. This doesn’t mean we are in the “all-clear” now, but it does show progress is being made on the debt pile and validates the policy choice.

Of course, the other side of the inflation coin is less attractive. As John Authers reports, Huw Pill, chief economist at the Bank of England, raised some hackles by calling out the pernicious effects of inflation: “someone needs to accept that they’re worse off and stop trying to maintain their real spending power by bidding up prices”.

Pill’s comments highlight the insidious nature of inflation. In its early stages, it seems like people are getting ahead. However, after the pattern of price increases continues to circulate through the economy, it becomes progressively clearer that almost everyone is worse off. Pill was really just trying to warn of this eventuality to a public who is still in the early honeymoon phase of inflation.

Investment advisory landscape

One of the things I get out of Twitter is every once in a while, I see a snippet from someone who has obviously been in the industry for a long time and reveals some interesting snippet or some dirty little secret of the business. Accordingly, a recent post by Stimpyz highlighted this:

“HNW" individuals: AKA 200K income

"Secured loans" AKA secured by the equity

"Middle Market" AKA the stuff banks wont do now

Translation: Suckers wanted. Apply within.

This highlights a couple of useful points. One is the use of specialized vocabulary which sounds sophisticated, is not well understood by people outside of the industry, and often serves as a euphemism for something quite a bit less attractive.

Another point is the deliberate manipulation. This particular response was in regard to a fund started by Ares Management to target “secured loans” of “US middle-market companies” to “high-net-worth individuals”. In plainer terms, it is marketing crappy loans from companies that aren’t credit-worthy enough to borrow from banks to individuals who generally have more money than financial sophistication.

While this is a pretty cynical, in my experience it is also mostly true. Be careful out there!

Landscape

T1 Alpha Sit-Rep: Thursday, April 27th

https://mailchi.mp/67f03b07b769/market-sit-rep-april-27th-2023-introduction-of-the-index-fund

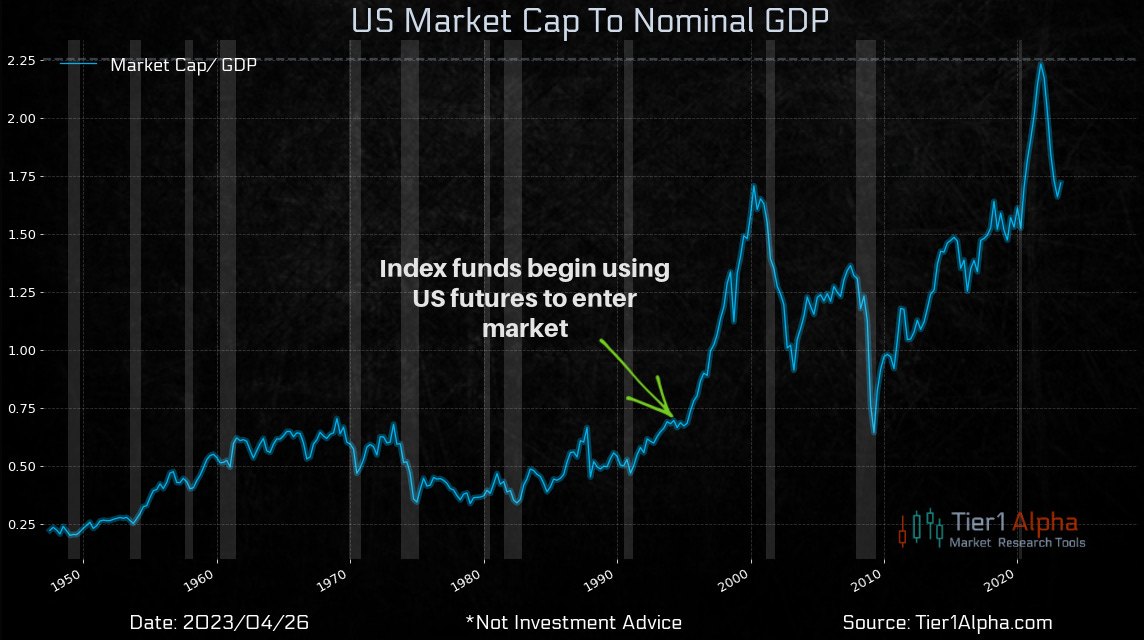

Over the past half century, the introduction of the index fund has likely been the most profound change to financial markets. First launched in the early 1970s (by Wells Fargo on the institutional side and Vanguard on the retail side), they grew slowly to roughly 3% total market share by 1990. Today, the best estimates for passive penetration sit well over 40%. Within that estimate, we include mutual funds, ETFs, CITs (unregulated mutual funds sold to large users), futures, separately managed accounts, total return swaps referencing indices, etc. More than 100% of all net flows coming into the market are now linked to passive-vehicles, creating a condition of net share gain approaching 3% per year. We are aware of no other force that remotely approaches this scale.

I continue to believe this is one of the most important, if not the most important issue for investors to understand right now: The proliferation of passive investing has “caused the most profound change to financial markets”.

One point is passive strategies create a “giant monolithic bid for equities” - to the point that “More than 100% of all net flows coming into the market are now linked to passive-vehicles”. More than 100%! That means net flows are entirely determined by investment vehicles that are completely insensitive to price.

The result, as Tier1 explains, is “predictable”: “valuations expand”. They don’t expand because of revenue growth, or improved productivity, or for any fundamental reason. They expand simply because more money continues to be automatically shoved into equities.

This is good for stock prices as long as money continues to come in. As soon as it starts to flow out, reasonable, fundamental-based valuations suggest there will be significant downside.

While timing is always a question mark, it is virtually certain the net money inflows will stop. For one, passive cannot gain share over active strategies forever. Eventually it will reach the peak of saturation.

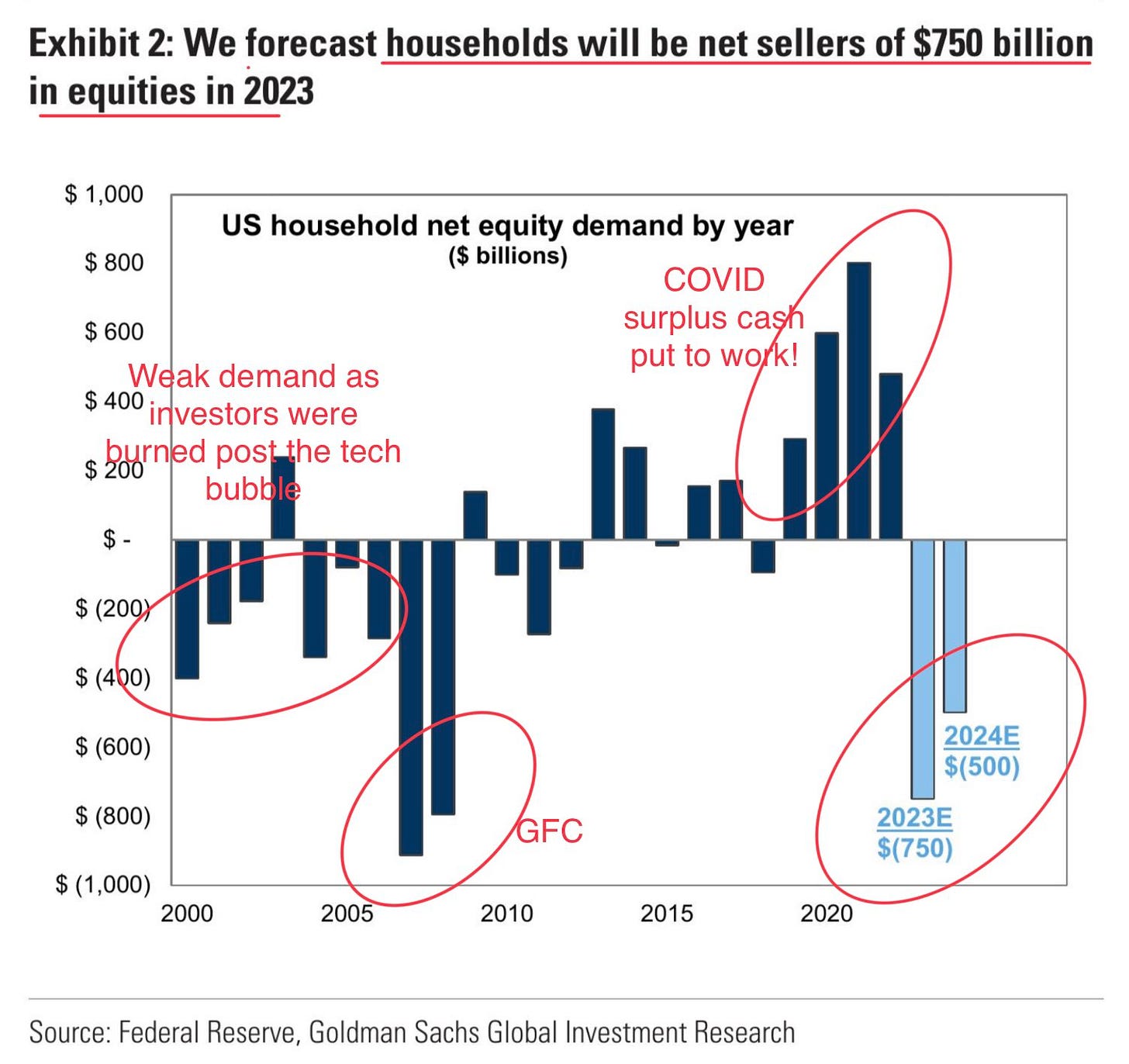

For another, as the remainder of baby boomers age into retirement, more and more of them will need to start reducing their holdings - partly to lower risk and partly to satisfy minimum withdrawal requirements of retirement funds. I noted the potential for greater selling pressure in the 4/7 edition of Observations (which also contained a link to a useful graph from Wasteland Capital):

Implications

With liquidity conditions worsening, the financial system going through some pains, and with the imminent sale of stocks from retail, the market looks like an accident waiting to happen. While that has not happened yet, the clock is definitely running out. Therefore, the question for long-term investors is, how badly do you want to try to beat the clock with your retirement assets?

Nor is the clock the only thing investors are betting against right now. Investors are also betting the Fed will quickly and substantially reduce rates - and that such action will boost the market thereafter. I continue to think this belief system is a hangover from the low inflation era and completely fails to consider the implications of Jake Sullivan’s policy direction on monetary policy and the financial system in general.

As Annie Duke says in her book, Thinking in Bets, “a lot of good can result from someone saying, ‘Wanna bet?’” The reason is because “Offering a wager brings the risk out in the open, making explicit what is already implicit (and frequently overlooked).” So, do you wanna bet that stocks keep going up without a major selloff?

Note

Sources marked with ($) are restricted by a paywall or in some other way. Sources not marked are not restricted and therefore widely accessible.

Disclosures

This commentary is designed to provide information which may be useful to investors in general and should not be taken as investment advice. It has been prepared without regard to any individual’s or organization's particular financial circumstances. As a result, any action you may take as a result of information contained on this commentary is ultimately your own responsibility. Areté will not accept liability for any loss or damage, including without limitation to any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

Some statements may be forward-looking. Forward-looking statements and other views expressed herein are as of the date such information was originally posted. Actual future results or occurrences may differ significantly from those anticipated in any forward-looking statements, and there is no guarantee that any predictions will come to pass. The views expressed herein are subject to change at any time, due to numerous market and other factors. Areté disclaims any obligation to update publicly or revise any forward-looking statements or views expressed herein.

This information is neither an offer to sell nor a solicitation of any offer to buy any securities. Past performance is not a guarantee of future results. Areté is not responsible for any third-party content that may be accessed through this commentary.

This material may not be reproduced in whole or in part without the express written permission of Areté Asset Management.