Observations by David Robertson, 6/14/24

News on inflation dominated the week but there were plenty of other things going on as well. Let’s dig in.

As always, if you want to follow up on anything in more detail, just let me know at drobertson@areteam.com.

Market observations

Trading last Friday was wacky after the nonfarm payrolls came out. Le Shrub provided some color in his substack:

NASDAQ intra-day: Equity Traders initially sold equities on the back of the strong Employment data, they then bought back equities since the unemployment rate ticked higher, and then they sold the equities again since Wage growth was strong and Bonds were selling off. For all the fanfare, the Nasdaq closed down 11bps on the day, thus destroying both bullish and bearish day traders alike.

While none of these movements really matter to long-term investors, they do provide some useful color on the current state of markets. For one, traders are paying a lot of attention to numbers that have a lot of noise. The same thing happened with CPI (the consumer price index) this week.

For another, amidst all the frenetic activity around payrolls data, both bullish and bearish day traders alike got beaten up. Finally, this activity is not the result of any kind of deep calculus; it is just gamblers placing bets on numbers. By the end of the week, however, the situation had flipped and momentum was gushing.

Speaking of numbers, long-term interest rates have been all over the place and Jim Bianco has been right on top of it:

Friday's rise in the yield of 14.7 basis points, triggered by the payroll beat, was the second-largest daily rise in yields since the December 27 low. Only April 10, the CPI beat, was larger).

The second-largest daily decline in yields since the December 27 cycle low was Monday, June 3, when the 10-year yield fell 11 bps.

Restated, last week saw both the second-largest daily decline and rise in yields in the last 6+ months.

With this week’s events, we can now add the 14 bps decline in the 10-year yield as of just before the FOMC meeting on Wednesday and after the soft CPI report.

The additional data makes Bianco’s point even stronger: “while actual volatility in the bond market cranked up last week (chart above), the options market doesn't see this lasting and is not pricing in elevated volatility”. He concludes: “In my experience, when market volatility cranks up, and everyone is sanguine about it, volatility will keep rising until no one is sanguine about it.” Well said.

Another oddity that is worth keeping track of is the continued accumulation of assets in inverse-VIX ETFs (graph from @SoberLook). These are funds that generate yield by selling volatility. Their model is “picking up nickels in front of a steamroller”. In other words, they work great until they fail miserably.

Lest investors think this is some abstract warning, it is exactly what happened with the ETF XIV on the “Volmageddon” event of 2/5/18. This episode won’t end well either, but at least investors can be aware of the risks that are out there.

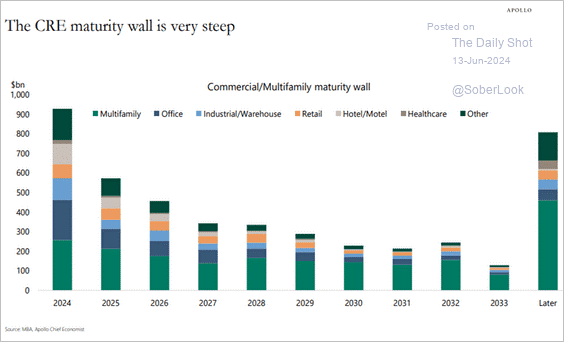

Finally, while the slow-motion train wreck that is commercial real estate (CRE) isn’t making a lot of headlines, it is becoming progressively more pertinent to the economic landscape. All the debt that needs to get refinanced at lower rates is no longer years in the future; it is here and now (graph from @SoberLook):

Geopolitics

France made news this week for two reasons. First, as John Authers reports, “French President Emmanuel Macron announced snap legislative elections after sustaining a hammering from the far-right Rassemblement National in European elections, and by Tuesday even had to bat away rumors that he was resigning”.

So far, so bad, but that wasn’t all. Shortly after Macron called for elections, the yield on its long-term bonds shot up. This is troubling partly for France which has allowed its sovereign debt to rise higher than other developed countries. It is also troubling for the Eurozone as it threatens to cause ruptures in the political coalition.

All this would be bad enough on its own, but it is happening in the context of Russia becoming more aggressive and knocking on Europe’s door in Ukraine. This is exactly how small geopolitical struggles turn into big geopolitical struggles.

Gold

metals, oil and everything else

https://jj745.substack.com/p/metalsoil-and-everything-else-15a

Open Interest is now 10k from its penultimate 5-year lows indicating gold trading in the NY time zone has completely lost its share of the market … And the idea that official flows have ceased because China did not add to its gold reserves in May is simply FUD, I think. Gold can go down, but it won’t go down because of spec liquidation or disheartened longs on the Comex.

I might as well speak my mind on this: I believe the Treasury is managing USD FX and gold prices because our adversaries are managing FX prices and buying gold which in turn has led to other CBs, even so-called allies, to manage their currencies and rates in ways favorable to themselves. This is a trade war subtext that ulltimately turns friends into enemies and vice versa.

The first point is positioning in gold is very much at the low end which is good because any additional interest will most likely be on the upside. What is interesting is that so much trading occurred around China not adding to its gold reserves when China data is terrible and there is every indication China has a long-term interest in continuing to build its gold reserves.

The second point adds some perspective from someone who trades gold: Prices are being manipulated/managed. Interestingly, insofar as such activity is a representation of trade war subtext, one would expect gold prices to increase. Indeed, that is exactly what I think will happen, but probably episodically and over time.

Monetary policy

A weak 3-year auction on Monday, a good 10-year auction on Tuesday, and softer than expected CPI on Wednesday morning, provided the backdrop for the FOMC meeting Wednesday afternoon.

When the Summary of Economic Projections (SEP) came out it showed one to two cuts were expected this year and showed incremental increases in expectations for inflation over the SEP report from three months ago. As Robert Armstrong summarized in the FT ($): “A naive reader of the SEP might conclude that, since March, the committee has become less optimistic not only about inflation this year, but inflation forever.”

When it came to the press conference, there was very little of note with the exception that a couple of reporters pressed on the subject of why inflation was expected to come down when key drivers such as employment and economic growth were not expected to deteriorate substantially.

The response was that inflation was expected to come down due to the continued maintenance of restrictive policy. While there is some truth to that, it also sounds like they are just crossing their fingers.

Investment landscape I

The Death of QE - The ECB Ditches QE To Focus On Creating

Money Through Commercial Bank Balance Sheet Expansion

(07/06/2024) ($)

The Solid Ground newsletter by Russell Napier

QE exposes central banks to considerable interest rate risk. After the pandemic, when policymakers were forced to raise interest rates in the pursuit of their primary mandate, these risks turned into substantial costs for taxpayers worldwide...

Even if losses do not impede central banks’ ability to pursue their price stability mandate, in several countries they have led to enquiries, warnings and calls for more transparency and research by legislators and other public authorities regarding the future use of asset purchases...

Surging asset prices do not only pose risks to financial stability but may also exacerbate wealth inequality. While monetary policy always has distributional effects, portfolio rebalancing as part of QE may amplify

these effects...The experience over the past 15 years suggests, however, that the effectiveness of QE in stimulating aggregate demand is state dependent and that QE can come with costs that might be higher than those of other policy instruments....

Napier picked out these highlights by Isabel Schnabel who is a member of the Executive Board of the ECB (European Central Bank). They come from a speech she gave at the end of May at conference entitled, “Price Dynamics and Monetary Policy Challenges: Lessons Learned and Going Forward”.

The “lessons learned”, according to Napier, were that after “almost fifteen years of denial,” the central bankers have figured out that QE (Quantitative Easing) has created wealth inequality.” He believes the comments “confirm that a new monetary age has come to the eurozone”. Going forward, the new policy backstop “will focus more on directly controlling the rate of bank credit growth”.

One observation is the catalyst for this change in heart at the ECB seems to be the hundreds of billions of “Dollars, Yen, Euro, Sterling etc.” central bankers lost on their bond portfolios as rates increased … and which will cost their respective taxpayers. Oopsie. Clearly, the political consequences of QE in the form of expanded wealth inequality are weighing on central bankers around the world. That fallout could take the form of new monetary policies, reduced central bank independence, or both.

Also, given the central banking community is a fairly close-knit one, it’s fair to assume the ECB’s new rejection of QE has been discussed and is widely accepted as a new direction for monetary policy globally. As it happens, this would be completely consistent with the theme of the Jackson Hole Economic Policy Symposium (Aug 22-24) this year which is, “Reassessing the Effectiveness and Transmission of Monetary Policy”. It sounds like Schnabel’s comments may be serving as a trial balloon for a communication of broader policy change at Jackson Hole.

If so, this would be really interesting. What if we’re about to experience a global pivot in monetary policy from QE to bank credit growth? This would accomplish two things a lot of investors are not expecting. First, it would grow broad money supply and therefore promote not just economic growth, but also put additional upward pressure on prices.

Second, it would (at least eventually) fairly dramatically reset rate expectations higher. Lowering rates to support economic growth is part of the QE playbook. If that playbook is being discarded, it will be tough for businesses who need to refinance at lower rates, not least of which is commercial real estate.

Another really interesting aspect of this is the timing. By stopping a program (QE) that systemically worsen economics inequality, monetary authorities are taking a big step away from capital and a big step towards labor. If the Fed pursues a similar path, it would also be doing so soon enough to provide a symbolic boost to the election but late enough that inflationary effects would be unlikely to manifest until after the election.

Napier bills this as a “monetary policy revolution” and “the structural change which heralds higher levels of inflation and financial repression.” If he’s right, the next few years are going to be a doozy. A big question will be the degree to which the Fed pursues a similar path.

Investment landscape II

The Rise of Carry: The Dangerous Consequences of Volatility Suppression and the New Financial Order of Decaying Growth and Recurring Crisis, by Tim Lee, Jamie Lee, and Kevin Coldiron ($)

We have argued in this book that carry is a naturally occurring phenomenon, but we have suggested that it has been turbocharged by the regime of fiat money and central bank policies.

Monetary policy has become ever more a source of moral hazard, the tool for the further extension of the carry regime, rather than being about setting interest rates at a level consistent with long-run monetary stability.

The authors of this book (which I have mentioned before here and here) have done more than anyone else I know of to analyze and diagnose what has happened with monetary policy over the last fifteen years. In short, monetary policies have “turbocharged” a carry regime which has had the effect of hobbling real economic growth and increasing wealth and income inequality. In the authors’ words:

But the management of the monetary system over the last few decades has helped carry returns become supernormal returns—to the detriment of the real economy and society broadly.

When it is seen in this light—inequality intensifying as a political concern, while the carry regime and the current monetary system reinforce it—history tells us that we must expect change.

For the years spanning from the GFC to Covid, it seemed like this giant carry regime could go on almost forever. Central bankers certainly weren’t doing anything substantive to turn the ship around and investors loved prices going up almost every day. Nonetheless, carry regimes must end and when they do, they end badly. As the authors describe, “The emergence of the carry regime presents a specific existential challenge to the current system because it engenders both instability, in the form of carry crashes, and growing inequality.”

As a result, policymakers (in the form of both government and monetary authorities) have a choice: They can either unwind the system deliberately and have some control over the process, or they can risk instability and growing inequality.

As it turns out, the quick succession of the Covid pandemic and Russia’s invasion of Ukraine forced the hands of authorities. Policy responses to the pandemic sparked inflation and therefore constrained monetary policy responses. Russia’s invasion, combined with growing tensions with China, highlighted an increasingly challenging geopolitical climate which could make any financial instability devastating. In short, the costs of allowing the carry regime to continue became markedly higher very suddenly.

The most immediate result was the significant increase in short-term rates by the Fed. More recently, the comments above by Isabel Schnabel make is sound like the ECB is going even further down the path of unwinding the carry regime.

While Schnabel’s comments represent an important milestone in that process, it will not be easy or painless to complete the journey. As a result, investors should expect plenty of bumps in the road along the way.

Investment landscape III

Well, that was sad... ($)

https://www.yesigiveafig.com/p/well-that-was-sad

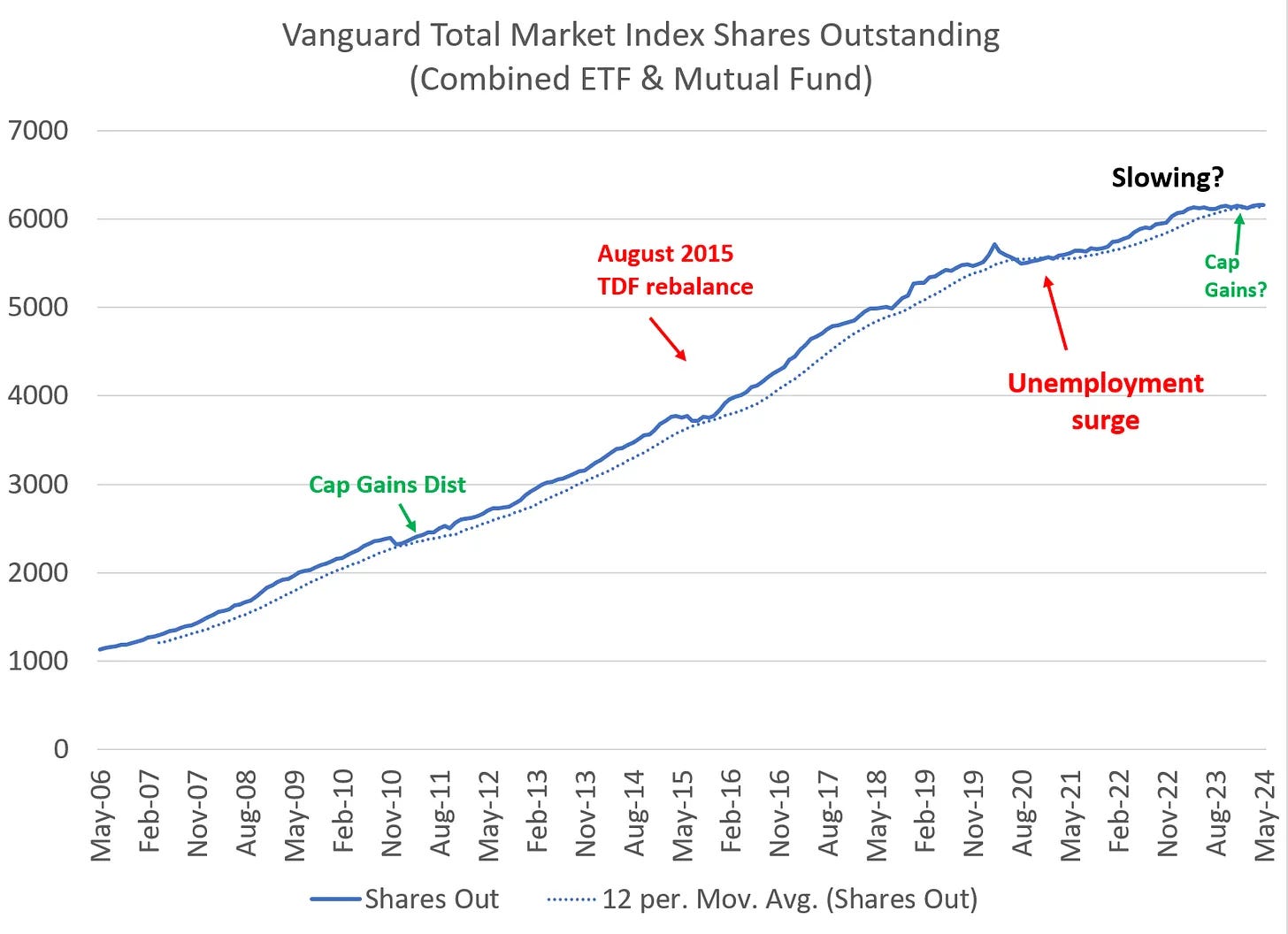

I continue to believe that a reversal in flows is at hand. So far, through May 2024, it appears that flows have slowed and possibly reversed. Importantly, we do not have Vanguard mutual fund flows for June until later this month. We are still operating off of May data. And while there was a modest rebound in mutual fund shares in May, that was offset by ETF share declines (suggests tax trading). On net, May was down:

One of the points Mike Green has been harping on for a long time (and rightly so) is the important impact flows have on market prices. Prices are set by the marginal buyer and for many years the marginal buyer has been passive funds such as the Vanguard total market fund. The reason is the retirement programs like 401ks have increasingly focused on these generic offerings. As a result, as employment has risen with economic growth, and as passive has increased penetration of investment funds, prices have increasingly been set by these funds.

The issue is that these funds are completely indiscriminate about price. They buy simply based on the flows coming in. As long as the flows come in, they pay whatever is required to acquire the necessary stocks. This has created a persistent upward bias in price movement that is completely unrelated to company or economic performance.

The point Green makes in this piece is that it appears the flows picture is on the cusp of changing. One of the main reasons for this is unemployment is creeping higher as higher rates take their toll. As unemployment goes up, flows from employment-related retirement funds slow down. Green concludes, “I continue to believe that a reversal [in flows] is ahead with economic weakening.”

Now, I am probably more optimistic than Green is on economic growth and there are also other factors (such as foreign flows and stock buybacks) which could forestall a reversal of flows into passive funds. Regardless, when that reversal happens, prices will be set by buyers who are sensitive to price and that is likely to be at a level much lower than where prices are today. Needless to say, the potential for significant turbulence is approaching.

Implications

As stocks continue to rise on hopes of lower inflation and rate cuts, it is especially important for long-term investors to understand the situation: Stocks are extremely overvalued partly due to the extended carry regime supported by central banks and partly due to the ongoing flows coming in from passive funds. With the end of both tailwinds coming into view, the potential for significant disruption is ratcheting up.

One of the ways to track this risk will be to monitor central bank communications and narrative formation. As The Rise of Carry highlights, central banks have used short-term interest rates to signal “willingness to support financial markets”:

Short-term interest rates were only important to the extent that they sent a signal about the central bank’s willingness to support financial markets. If an interest rate increase appears to be part of a process in which the central bank is withdrawing its support for financial markets, and by extension the carry regime, then it is possible that an interest rate increase could trigger a carry crash; the carry crash means the evaporation of liquidity and economic collapse. In this paradigm, whether the economy is strong enough to merit an interest rate increase therefore is a question that misses the point.

As a result, any indication of a shift away from supporting markets will be extremely important. Any shift in narrative whereby new and/or different mechanisms are recommended to promote economic growth and full employment would also be important signals.

Thus far, the Fed seems to be proceeding gingerly. It doesn’t want to interfere with the market’s momentum, it doesn’t want to appear to affect the election, and it certainly doesn’t want to get caught doing something that could screw things up and that it could get blamed for.

Nonetheless, as long as it continues to do nothing, the market will continue to assume the Fed is supporting financial markets, and the carry regime will continue to rage - along with all of its ill effects. Time is running out for the Fed to determine its own fate. It will either have to change course/withdraw support for the markets, or allow the carry regime to follow its natural course to a disruptive crash. Not an easy decision.

Note

Sources marked with ($) are restricted by a paywall or in some other way. Sources not marked are not restricted and therefore widely accessible.

Disclosures

This commentary is designed to provide information which may be useful to investors in general and should not be taken as investment advice. It has been prepared without regard to any individual’s or organization's particular financial circumstances. As a result, any action you may take as a result of information contained on this commentary is ultimately your own responsibility. Areté will not accept liability for any loss or damage, including without limitation to any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

Some statements may be forward-looking. Forward-looking statements and other views expressed herein are as of the date such information was originally posted. Actual future results or occurrences may differ significantly from those anticipated in any forward-looking statements, and there is no guarantee that any predictions will come to pass. The views expressed herein are subject to change at any time, due to numerous market and other factors. Areté disclaims any obligation to update publicly or revise any forward-looking statements or views expressed herein.

This information is neither an offer to sell nor a solicitation of any offer to buy any securities. Past performance is not a guarantee of future results. Areté is not responsible for any third-party content that may be accessed through this commentary.

This material may not be reproduced in whole or in part without the express written permission of Areté Asset Management.