Observations by David Robertson, 7/15/22

Now that we have passed the seasonally slow first couple weeks of July, it will be interesting to see how traders interpret coming earnings announcements and continuing progress on Quantitative Tightening (QT). I am doubting it will be a calm and quite summer. As always, let me know if you have questions or comments at drobertson@areteam.com.

Market observations

The US dollar continued its strength during the week to the point where themarketear.com/premium ($) referred to it only half jokingly as a “coin” chart. True enough. This chart puts into context just how strong the dollar has been, especially relative to the Euro.

Oil prices had another rocking time when for the second consecutive week the commodity got hammered (down 8% on Tuesday) for no discernible fundamental reason. It got hit again early Thursday too but recovered most of the losses. As @JavierBlas notes below, physical is acting very differently - weird.

Natural gas is also making waves. While spot prices in Europe have been high, the prices for delivery in the intermediate future have ramped up considerably. It seems concern may be spreading that this whole lack of energy thingy could actually be a big deal.

Finally, stocks sold off during the week but things could have definitely been a lot worse. It seems like investors are like deer caught in headlights - not enough conviction (or something) to sell en masse yet.

Credit

Are We There Yet?

https://www.hussmanfunds.com/comment/mc220707/

When we evaluate speculation versus risk-aversion among investors, our analysis includes the behavior of “debt securities of varying creditworthiness.” That behavior has been particularly interesting in recent weeks, because Treasury yields have retreated from their highs, even as junk bond yields have continued to surge. As I’ve often observed, when two securities diverge, the dispersion provides information about factors that they do not share in common. In this case, the dispersion suggests that the financial markets are becoming more concerned about credit risk and potential bankruptcies.

It’s been so long since credit risk has been an imminent threat that a lot of younger players are unfamiliar with such adversity and a lot of older players have lost a fair bit of muscle memory. High levels of debt combined with rapidly rising rates create something of a “perfect storm” for a lot of companies that will be a challenge to deal with. Without the prospect of a tow into a safe harbor, many companies are going to be faced with riding out the storm on their own.

This is a good time to reflect on how deeply credit has permeated culture both in business and across society as well. The practice of simply borrowing more in order to get more stuff has become a deeply ingrained habit. As borrowing costs go up and credit becomes less available, almost everything will get harder. Some people and companies will have the temperament for it, but many will not. This is not a test: I expect to see quite a bit of carnage resulting from tighter credit.

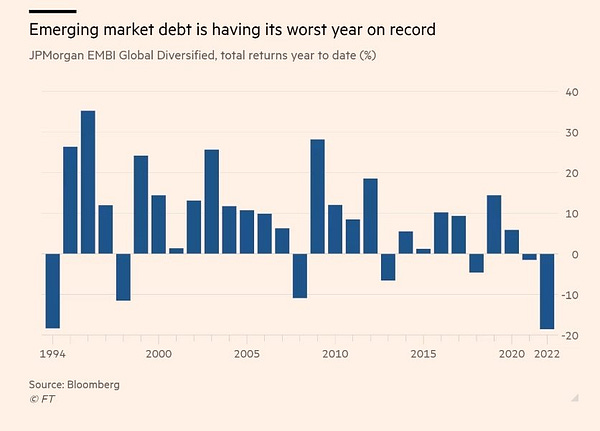

Emerging markets

Emerging markets are often a good representation of positive feedback loops. When things are good, capital flows in and growth gets boosted even more. When things are bad, capital flows out and it can be hard for a country to even provide sustenance for its people.

Russell Clark recently highlighted this phenomenon from the perspective of the strong US dollar. There are a number of different influences on currencies - and credit is one. As he notes, “Credit quality is deteriorating, and this affects all ‘risk’ assets - including currency.” Indeed, deteriorating credit quality is a big part of what is happening with emerging markets right now - and why the dollar is so strong.

It is also important, however, to appreciate that these “credit” problems have far more serious consequences in emerging markets than a couple of late payments. For many, access to credit is what provides basics like food and fuel. As we are seeing in places like Sri Lanka, China, Libya, and many other parts of the world right now, people are protesting for very basic things - like food and access to their own money. While it can be easy to write off such incidents as somewhat trivial relative to our “more important” developed country concerns, that would be to vastly underappreciate the humanitarian impact.

Finally, what happens in emerging markets doesn’t always stay in emerging markets. There will be debt restructurings and that debt often comes from somewhere else. Michael Pettis, an expert on the matter, reminds us there is a symbiotic relationship between creditor and debtor when things go bad.

Commodities

There is definitely some funky stuff going on in commodities markets. Front and center is the divergence between paper and physical oil mentioned above in the “Market observations” section. Copper is down which makes sense in the context of concerns about slowing growth, but not in the context of massive future demand and limited supply. Gold fell when rates started going up and kept falling when rates started going down.

One point is that a lot things can happen with “paper” prices that do not reflect underlying fundamentals. In the stock market it is now common for the derivatives “tail” to wag the stock market “dog”. It is also possible for prices to be manipulated. Lower oil and other commodity prices would certainly help the Biden administration manage economic concerns with inflation and geopolitical concerns with Russia. Just sayin’. As a result, I am treating most commodity prices with a grain of salt right now as I am suspicious that they accurately represent the supply and demand conditions for the physical product.

Another point is one made by Jeff Currie from Goldman Sachs on a Grant Williams podcast ($). In describing the rationale behind approximately twelve year cycles for commodities, Currie said, “I’d like to say it’s never about the supply and demand of the commodity itself. It’s always about the supply and demand of the money used to produce the commodity.”

This has a couple of important implications. One is that the cycle may start to turn based on demand exceeding supply for the commodity itself, but it doesn’t really get going until investment money starts coming in. Another implication is that due to the wild volatility endemic to most commodities, investment money doesn’t start coming in until a reasonable prospect of good returns emerges. That requires something of a track record and can easily be disrupted by instability in the macro environment and public policy arena.

This helps explain why the supply response in many commodities has been so weak. The answer is because the environment is just too unstable to invest in.

Public policy

I have been doing a fair amount of thinking lately about the direction of public policy. Obviously, there are a number of major problems that need to be dealt with so any identifiable patterns can be useful in sketching out possible outcomes.

The main pattern I see is a complete lack of direction or cohesive strategy. It begs the question of whether authorities want things to blow up.

I am increasingly believing this to be the case. It’s probably not so much they want things to blow up as to feeling powerless to do anything about anything less than an all out crisis.

As Jonathan Haidt argues (and I reported), “When our public square is governed by mob dynamics unrestrained by due process, we don’t get justice and inclusion; we get a society that ignores context, proportionality, mercy, and truth.” Indeed, public policy has largely devolved to partisan positions most notable for ignoring context, proportionality, mercy, and truth. Whether in regard to energy or cryptocurrencies or almost anything, reasonable policies and discussions are subject to mob rule and vicious cancelation.

Izabella Kaminska ($) takes the issue of social media’s effect on the information environment a step further: “What we have as a result is a super-star economy where a handful of stories increasingly crowd out the really informative ones in ways that mislead critical decision makers and influencers.” In other words, a lot of decision makers are getting bad information and a lot of people follow the least informative stories. Not a formula for success.

What is likely to come of this? While I hate being dramatic, I have a hard time envisioning how many problems start getting solved unless we run out of stuff. For example, I don’t see how policies that facilitate more oil production and refining get past ESG activists unless gas is a lot more expensive and only available on an irregular basis. That would focus some minds, but not much short of that.

I hope I am wrong, but I am increasingly preparing for a period in which a lot of things become hard to do and many things become hard to get. I don’t see how that won’t happen until public policy can more effectively diagnose and address problems.

Inflation

In the much awaited CPI report for June, the overall number came in at 9.1% for the last twelve months, which was a little higher than the 8.6% annual rate last month. Food and energy costs continued to be an important part of the equation but came in largely as expected. Interestingly, the rent index was up 0.8% sequentially which the BLS reports as “the largest monthly increase since April 1986”.

Stock futures dropped a percent and a half immediately after the report indicating hopes were once again dashed that this month would mark the end of this nasty little episode of inflation.

One point is inflation is obviously still extremely high. Another point is the Fed is still behind the eight ball as inflation is still rising.

While it is fair to expect a peak in the annual headline rate of inflation soon, the longer-term impact will be judged by the pace at which inflation decelerates. Two factors bode poorly for a quick decline. One is shelter costs which are high and tend to be pretty sticky. The other is wages. Real wages continue to fall but inflation will only subside as a political problem once real wages start rising. As a result, it is fair to expect some catch-up in wage inflation.

Monetary policy

Don’t Fight The Fed

https://fedguy.com/dont-fight-the-fed/

One of the tropes making the rounds is it is just a matter of time before the Fed capitulates from its tightening program and when it does, it will be QE (quantitative easing) all over again. The conclusion: No need to worry too much about stocks going down because the Fed will be back supporting them again soon enough.

This is a situation where perspective can help a lot and an extremely helpful one is that of former Fed trader, Joseph Wang. As he writes, “the Fed now has the tools to support the real economy and keep tightening until the last ounce of inflation is squeezed out”. As a result, the Fed is no longer confined to using “blunt tools like rate cuts and QE”. Therefore, “Policy can be far tighter and remain so even after ‘something breaks’.”

At very least this provides a cautionary message against being too cavalier about the impact of Fed tightening. It also disrupts the exercise of determining what will be the first thing to break. Armed with a much broader set of support tools now, the Fed can more selectively support “breaks” without deviating from its broader mission to control inflation by tightening.

As a result, the exercise now is to determine what will be the first thing that breaks -that the Fed chooses to not support? Can anyone say, Lehman Brothers?

Investment landscape

THE GRANT WILLIAMS PODCAST: The End Game: Episode 34, Greg Jensen, Bridgewater Associates ($)

https://www.grant-williams.com/podcast/the-end-game-ep-34-greg-jensen/

So what does that mean as an investor? Well, largely that means that A, the risks are massively elevated. This is a pretty terrible time to own assets … So I would start with recognizing you’re in this hurricane and just be wary of doing anything in big size or being very confident in anything.

It’s just such a wide range of huge things going on that you want to be diversified across because who knows you’ll be wrong about some of them, but today is extremely target rich for our systems and because there’s such big policy changes and policy mistakes in our view and huge flows, financial flows all around the world. So it’s one of the most target rich macro environments that we’ve ever seen.

This is about as good of a description of the yin and the yang of today’s investment landscape as one can find. On one hand, the risks are “massively elevated” and it is a “terrible time to own assets”. On the other, “there’s such big policy changes and policy mistakes” that it is also an amazingly “target rich” environment for macro traders.

As the tables turn, investment success will only be achieved by doing very different things than what has succeeded in the past. Namely, conditions are becoming much more difficult for passive and target date strategies. Conversely, there are a number of interesting opportunities for those who can be more active while at the same time being vigilant about managing risk.

Implications for investment strategy

THE GRANT WILLIAMS PODCAST: The End Game: Episode 34, Greg Jensen, Bridgewater Associates ($)

https://www.grant-williams.com/podcast/the-end-game-ep-34-greg-jensen/

You need to have, in our view, you need to have balance to whether growth goes up relative to what’s expected or growth goes down. Or whether inflation goes up relative to what’s expected or inflation goes down. So how do you protect yourself in this environment? If you had enough assets, energy, et cetera, that, okay, if inflation rises and growth weekends, and you have enough of those, that they can balance out the assets that do poorly when the opposite happens. And for us, we try to build four portfolios, this is now on the purely passive side, but four portfolios that each of which are set up to take in assets that do well in the opposite situations. What assets do well, if inflation falls, what assets do well if inflation rises, what assets do well if growth falls and what assets do well if growth rises? And that’s how you can create a portfolio that’s balanced.

Bridgewater’s framework for diversification is useful for long-term investors in two major ways. First, economic growth and inflation are the two key factors that affect asset prices and that define different investment regimes. Second, and relatedly, the four different scenarios (e.g., low growth, high inflation) broadly capture the types of investment landscapes an investor might experience over a very long time frame.

Which brings us to today. The last forty years has been an environment dominated by low inflation and (relatively) high growth. Largely as a result, portfolio construction has become dominated by 60/40 (stock/bond) mixes which have performed exceptionally well in that environment. As such, however, portfolios have also become over-specialized to a single investment scenario.

This raises two important implications for investors. One is that as the landscape evolves, the other three quadrants are likely to become far more important. As a result, it will be important to reduce exposure to the 60/40 standard and increase exposure to things that can do well in other environments. Second, purely passive exposure is likely to perform far less well in such a dynamic environment. These two phenomena alone will shake up a lot of investors.

Thanks for reading!

Note

Sources marked with ($) are restricted by a paywall or in some other way. Sources not marked are not restricted and therefore widely accessible.

Disclosures

This commentary is designed to provide information which may be useful to investors in general and should not be taken as investment advice. It has been prepared without regard to any individual’s or organization's particular financial circumstances. As a result, any action you may take as a result of information contained on this commentary is ultimately your own responsibility. Areté will not accept liability for any loss or damage, including without limitation to any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

Some statements may be forward-looking. Forward-looking statements and other views expressed herein are as of the date such information was originally posted. Actual future results or occurrences may differ significantly from those anticipated in any forward-looking statements, and there is no guarantee that any predictions will come to pass. The views expressed herein are subject to change at any time, due to numerous market and other factors. Areté disclaims any obligation to update publicly or revise any forward-looking statements or views expressed herein.

This information is neither an offer to sell nor a solicitation of any offer to buy any securities. Past performance is not a guarantee of future results. Areté is not responsible for any third-party content that may be accessed through this commentary.

This material may not be reproduced in whole or in part without the express written permission of Areté Asset Management.