Observations by David Robertson, 7/29/22

Busy week this week - FOMC meeting, GDP announcement, and lots of earnings. Let’s dig in. As always, let me know if you have questions or comments at drobertson@areteam.com.

Market observations

Outside of an earnings disappointment from WMT early in the week, the market was pretty quiet in advance of the FOMC meeting on Wednesday. As has frequently been the pattern, the S&P 500 made a hefty advance of 1.5% on the morning before the meeting.

The basic outcome of the meeting was exactly in-line with expectations of a 75 bps raise. During the press conference, Powell referred to the 75 bps hike as “unusually large” and expressed a desire to “slow” the pace of increases.

Apparently, the market took this as an expression of capitulation. By the close of the market the S&P 500 advanced another 1.1% to finish up 2.6% on the day and the Nasdaq closed up over 4%. Hardly the stuff of tapped out markets.

In one sense the reaction demonstrates the large degree of speculative fervor still evident. For example, bitcoin, which has been a high beta proxy for the market was up 8.5% on the day.

In another sense, however, this reaction demonstrates just how difficult the Fed’s job is going to be. It will need to be tough enough to break the persistent speculative bid, but not so tough as to blow the market up. Days like this show just how hard that job is going to be.

A related observation is that 10-year Treasury yields have maintained their weakness. This weakness is largely attributed to concerns about imminent recession, and there is certainly a degree of truth to that interpretation.

Another possible interpretation, however, is that lower yields are simply the result of higher demand for longer duration Treasuries. Organizations such as defined benefit plans and insurance companies love long duration fixed income to inoculate long duration liabilities. With Treasury bonds reaching more attractive prices, it makes a lot of sense to neutralize those risks.

In short, there is more than one thing going on with Treasury yields. Be careful to avoid seeing only what you want to see.

Gold

Gold has been getting dinged along with other commodities and gold miners have been getting dinged even harder. For example, top producers like NEM and AEM are now at prices comparable to the depths of the Covid selloff in March 2020.

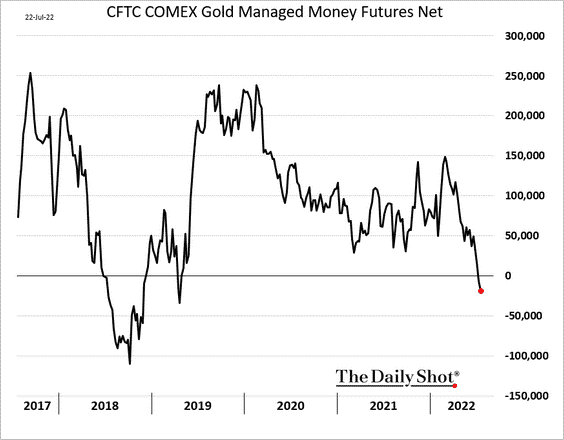

One part of this is a change in positioning with hedge funds and other discretionary funds now shorting the metal (see chart from @SoberLook below). With prices down and operating costs rising, profits are getting severely squeezed. This phenomenon was on display in NEM’s results last week.

For as long as recession risk remains high AND expectations for inflation are to quickly dissipate, pressure can remain on gold. If inflation does not quickly dissipate (and I don’t expect it will), this is likely to prove to be an exceptionally fortuitous time to add to gold exposure.

China

We finally seem to be getting past the “knee-jerk” response phase of China’s real restructuring. For most of the past year, any time an announcement of liquidity or support of any kind was made, stocks would rally. It finally seems to be sinking in that this is a monster problem that will be a long, slow grind to resolve.

Inflation

Chartbook #133 Under the hood of the power dynamics of inflation

https://adamtooze.substack.com/p/chartbook-133-under-the-hood-of-the

Sustained inflation ultimately involves a self-reinforcing feedback between price and wage increases – so-called wage-price spirals. Changes in individual prices can broaden into aggregate inflation. And they can also erode real wages and profit margins for very long spells. But, ultimately, they cannot be self-sustaining without feedback between prices and wages: profit margins and real wages cannot fall indefinitely. So, beyond the important impact of aggregate demand conditions on wage- and price-setting, a key question is how changes in relative prices that pass through to the aggregate price index (“first-round effects”) can trigger feedback between price and wage increases (“second-round effects”).

Though it does not say so in so many words, de facto, in the current era, the first round shock in an inflationary process comes from the side of the price of goods. So preferring to dampen second round reactions effectively implies favoring producers over workers.

Quoting liberally from the BIS, Adam Tooze raises a couple of important points about inflation. One is, “Low-inflation regimes turn out to be very different from high-inflation ones.”

In other words, low inflation regimes are not just quantitatively different from high inflation regimes, but also qualitatively different. That difference is a feedback loop. In order for prices to rise persistently, there needs to be a reaction function that raises wages such that consumers can continue to afford to pay ever-rising prices.

A second point is any effort to control inflation by inhibiting the wage-price feedback loop “effectively implies favoring producers over workers”. If part of the current market “motivation” is favoring labor over capital, as Russell Clark claims, then central bank policies to quell inflation will directly conflict with broader political leanings to improve conditions for working people.

This could get extremely interesting and leave the Fed in the incredibly unenviable position of trying to fight an inflation that most people actually want (by way of rising real wages) and that public policy increasingly addresses.

Horizon Kinetics 2nd Quarter Commentary July 2022

https://horizonkinetics.com/app/uploads/Q2-2022-Review_FINAL_2.pdf

Two years from now, or five or ten, which questions will you wish you knew to have asked [about inflation]? For instance … Invest for how long? Maybe you invest differently for a 1- or 2-decade structural inflation than for a 1- or 2-year cyclical inflation … Invest for what kind of inflation? Hard-commodity-based price pressure, or monetary-driven currency debasement? Or both?

Point number one is Horizon Kinetics is one of the most thoughtful, independent, fundamental research-oriented firms out there. It is always worth reading their commentary to get a fresh perspective and to pick up on important details that are often glossed over or omitted entirely by parties more interested in just telling a story.

Point number two is this particular report which focuses on inflation is a master course in research and analysis. Namely, one of the most important things for an analyst to be able to do is to ask good questions. The questions above not only help frame a fruitful discussion about inflation, but in doing so also reveal many of the important details other discussions leave out.

Monetary policy

Harley Bassman: Inflation, Bond Yields, VIX vs. MOVE, Demographics & More

I'd also say that I would push back very hard on the notion that the Fed can't go hard. I think they can and I think they will for a lot of reasons. Not the least of which is Jerome Powell's legacy.

They [the Fed] can't push down supply or push up supply. So they'll push down demand. They will throw people out of jobs. And think about it in the grand scheme of things … We'd rather go and reduce the damage to the entire 60% [middle three quintiles of income distribution] than for these small amount of people who lose their jobs and you know what, they're not wrong.

One of the assumptions underlying many assessments of the Fed is the Fed has a very low tolerance for weak economic growth. The belief seems to be that economic growth is an absolute good and should be promoted at all costs. This assumption is disputed by Harley Bassman here and by Joseph Wang in the following piece.

For Bassman’s part, he sees the Fed’s position as one of having to make a difficult tradeoff. Sure, monetary tightening will cost some growth and some jobs, but at a much lower expense than runaway inflation - which would cause even more harm. It’s a very fair point.

The Money Still Flows

https://fedguy.com/the-money-still-flows/

The market’s implied path of policy appears to misunderstand the Fed’s priorities. Over the past few weeks the market has more aggressively priced in rate cuts in early 2023 following a string of weak economic data. The Fed’s current priority is inflation, and then full employment. This means declining economic activity is a desired outcome of monetary policy and not a reason for a dovish pivot.

While Bassman takes the perspective of the Fed as policymakers, Wang takes the perspective of the Fed as economists. To make the point, he shows that none of the evidence regarding credit, wages, or wealth are yet at levels that would impede inflation.

Regarding credit, he notes, “Bank lending remains robust with loan growth accelerating to historically high rates despite recent rate hikes.” Regarding wages, “Wage growth has been very strong and is likely to remain so amidst an apparent shortage of labor across a wide range of industries. The 5% overall wage growth rate is historically high and appears to be accelerating.” Regarding wealth, “Household net worth rose to a record $150t earlier in the year largely from asset inflation and is still notably above pre-pandemic levels after recent declines.”

While many investors are anticipating a pivot from the Fed before too long, that perspective comes from the selfish desire to look past recent market declines rather than the objective analysis of what the Fed is trying to do. When you put yourself in the position of the Fed, as Wang and Bassman have done, it is a lot easier to see that tighter money is going to be around for a while.

Public policy

The New Productivism Paradigm?

There are signs of a major reorientation toward an economic policy framework that is rooted in production, work, and localism instead of finance, consumerism, and globalism.

Unlike neoliberalism, productivism gives governments and civil society a significant role in achieving that goal [of disseminating economic opportunities more broadly]. It puts less faith in markets, is suspicious of large corporations, and emphasizes production and investment over finance, and revitalizing local communities over globalization.

While these ideas are imbued with a fair amount of wishful thinking, they also address some real issues. Namely, there is broad support for the notion that economic opportunities should be realized more broadly. This is very consistent with the “motivation” or political zeitgeist I mentioned in Observations a few weeks ago.

The first point I would make is I wouldn’t count on a “productivism paradigm” happening any time soon. We may start to seem some seeds germinate but it will take time. Second, I am extremely skeptical that government could do a good job of disseminating economic opportunities. Of course, markets have not done such a good job either and people may just want some change.

Finally, any such policy direction, were it to transpire, would conflict with the Fed’s policy direction. Since the Fed is trying to quell inflation by preventing a feedback loop from becoming established through a wage-price spiral, it would be working to suppress real wage growth while government and civil society would be working to increase real wage growth. Could get interesting.

Investment landscape

Recession has been the talk of the town and for good reason. With the first quarter GDP growth falling by 1.6% and the final GDPNow estimate (before the actual report on Thur) coming in at -1.2%, it was looking like there would be two consecutive quarters of negative growth which would qualify for the standard definition of a recession. The advanced estimate reported on Thursday was -0.9% and confirmed that suspicion.

One point is the economic weakness is notable especially in the context of expectations of strong growth at the beginning of the year. At the time, it was expected that bottlenecks would clear up, mobility would increase again, and consumers would look to “catch up” on much needed vacations and other services. Much of that happened but was still overwhelmed by the debilitating effect of higher prices. Cyclical industries have borne the brunt of the disappointment so far.

Another point, however, and one that seems to elude many commentators, is that strong economic growth does not just magically happen, especially in the context of excessive amounts of debt. Decent economic growth for the last several years was largely a function of the debt problem being papered over by the Fed. Now the cost of that deferral is coming due, and it comes in the form of stagflation.

As a result, the baseline expectation for investors should be lower than usual growth and higher than usual inflation for the foreseeable future. The one thing that could really change that equation is constructive public policy - especially industrial and energy policy. I don’t expect that coming any time soon either, though it could make a huge difference if it did.

Investment analysis

The Fifteen Faces of Fiat News

https://www.epsilontheory.com/the-fifteen-faces-of-fiat-news/

Several years ago, we introduced the concept of fiat news on these pages.

It is a simple idea. In the same way that money created by fiat debases real money, news created by fiat debases real news.

Although it misinforms, fiat news should not be understood as misinformation, at least in the colloquial sense. News which contains false information or distorted interpretations of facts can be better thought of as counterfeit news. Like counterfeit money, enough counterfeit news can debase the real thing, too. Yet even considering how widespread counterfeit news has become, fiat news exists on such a massive scale that its power to debase is in a different category. Nor is fiat news synonymous with bias. We think bias represents a causal explanation for a very specific kind of recurring fiat news.

Because fiat news is the presentation of opinion as fact. Fiat news is news which is designed not to provide information for the reader to process, but to provide interpretations of information for the reader to adopt. Fiat news is the primary vector for nudging, shaping common knowledge, or what everybody knows everybody knows. Fiat news is how governments, parties, corporations and other institutions in a free and always connected society meticulously shape it – then tell us that it was our idea.

Historically, some of the most important work of an analyst has been gathering and synthesizing information. More recently, some of the most important work of an analyst has been disentangling and discerning fact from opinion. Epsilon Theory has been on the leading edge of this effort and provides invaluable insights for anyone trying to make sense of the news.

The problem is that many of the media sources which we have relied upon for information content have been hijacked by fiat news. In essence, we are receiving carefully crafted messages that are designed to affect us a certain way more so than we are receiving objective data to inform us and guide us to better decision making. Of course, this is not an entirely new effort, but it has been significantly amplified by social media and its utility has risen in a time when pleasant stories are needed to hide ugly truths.

While delving into the “narrative machine” takes some initiative and an open mind, once you see it, it is hard to unsee. And then you start seeing it everywhere. And then you start seeing economic and political and other happenings from a very different, and very useful, perspective. And then you realize you weren’t crazy after all.

Implications for investment strategy

Harley Bassman: Inflation, Bond Yields, VIX vs. MOVE, Demographics & More

“When you get inflation in the early stages, that is very bullish for stocks. And the reason why is, by definition, if you have inflation, prices are going up. And if prices are going up, who's ever selling you the goods at higher prices, is making more nominal dollars, their nominal revenues are increasing. So that's good. On the other side, you have to discount that back. And so early on when you get the inflation, that's good for stocks, good for earnings, but as rates go up, you have to discount them at a different rate.”

The really important point here is that inflation does not have a uniform effect on financial assets over time. Indeed, the early stages of inflation tend to inflate company revenues before costs and therefore is positive. It is only later that cost inflation catches up and higher discount rates reduce the sum of discounted cash flows.

Based on what I see, we are very close to the point of transitioning from the first stage to the second stage of inflation. The first stage pushed already high profit margins to record high levels.

Now, with more and more reports from retailers like Target and Walmart indicating bloated inventories and forecasting weaker margins, it sure looks like we are on the front end of the process of inflation eating into earnings and discount rates getting reassigned to higher levels. If this is correct, it will be very damaging for most stocks. It is also a process that is unlikely to be easily or quickly reversed.

Thanks for reading this edition of Observations by David Robertson!

Note

Sources marked with ($) are restricted by a paywall or in some other way. Sources not marked are not restricted and therefore widely accessible.

Disclosures

This commentary is designed to provide information which may be useful to investors in general and should not be taken as investment advice. It has been prepared without regard to any individual’s or organization's particular financial circumstances. As a result, any action you may take as a result of information contained on this commentary is ultimately your own responsibility. Areté will not accept liability for any loss or damage, including without limitation to any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

Some statements may be forward-looking. Forward-looking statements and other views expressed herein are as of the date such information was originally posted. Actual future results or occurrences may differ significantly from those anticipated in any forward-looking statements, and there is no guarantee that any predictions will come to pass. The views expressed herein are subject to change at any time, due to numerous market and other factors. Areté disclaims any obligation to update publicly or revise any forward-looking statements or views expressed herein.

This information is neither an offer to sell nor a solicitation of any offer to buy any securities. Past performance is not a guarantee of future results. Areté is not responsible for any third-party content that may be accessed through this commentary.

This material may not be reproduced in whole or in part without the express written permission of Areté Asset Management.