Observations by David Robertson, 9/30/22

It was quite a week - it seems like momentous global and market events were going off like canons in Tchaikovsky’s 1812 overture. If you have questions or comments about anything, let me know at drobertson@areteam.com.

Market observations

The pound is not alone ($)

https://www.ft.com/content/5578b6ac-1bfa-409e-beb6-ed0d25640013

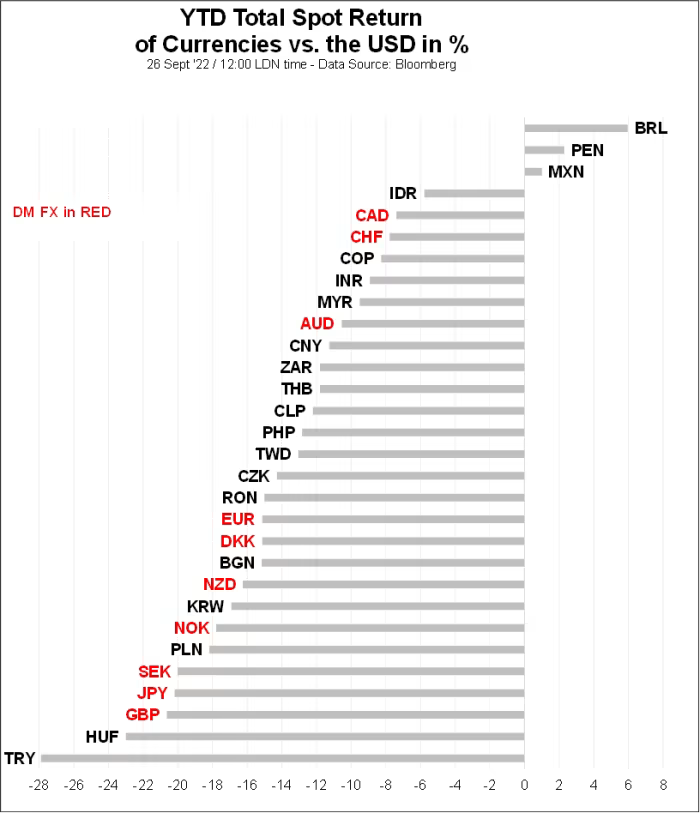

Everything is down against the dollar, and the pound has plenty of company among developed market currencies. What is happening to the pound, the krona, the krone, the yen and the euro, all at once? The Fed is. A stronger dollar is the global transmission policy of the Federal Reserve’s rate policy, that policy is tightening fast, and it is uncertain where it will stop.

Perhaps the most notable observation over the last couple of weeks has been the weakness of the yen … and the yuan … and the euro … and the pound … and well, pretty much everything against the US dollar.

The issue of currency volatility, which I flagged back in May of 2021, is finally becoming manifested in a very un-subtle way: “when governments accumulate excessive levels of debt, the currency is often the pressure release valve.”

Insofar as the Fed’s monetary policy remains relatively tighter than that of other central banks, it is fair to expect the dollar to remain strong. The main implication is we are probably getting close to seeing a major currency devaluation.

What Comes After a Week That Shook the World ($)

The downward trend in 10-year Treasury yields that has persisted ever since the Fed under Paul Volcker slew inflation is over. There have been false alarms before. Dig through the archives and you’ll find I wrote at very great length about what appeared to be the end of the trend during a bond selloff as long ago as 2007. But that market seizure triggered the credit crisis, which would bring Treasury yields to previously unimaginable lows. High inflation in 2022 will make that prohibitively difficult to repeat

The 10-year Treasury yield has been on the move up most of this year and has shown another burst over the last couple of weeks. As John Authers points out, “But it’s still a big deal that the most important measure in finance is the furthest above its trend in 28 years”. Indeed it is.

The main reason the 10-year Treasury is so important is because it is the baseline for valuing so many other securities. If the yield goes up on Treasuries, it is almost certainly going up on everything else as well - which also means the price is going down. Given the decisive break with the long-term trend, this also suggests we are in a new world and won’t be going back to “lower rates for longer” any time soon.

Finally, it would be hard to overlook the fact the S&P 500 had back-to-back 2% moves with Wednesday being up 2% and Thursday being down by just a tad more. As significant as these moves are, however, they are much more a function of happenings in the currency and rates markets than the other way around.

Geopolitics

And this support [for Ukraine] is bipartisan. For example, 78 percent of Republicans and 85 percent of Democrats said they supported “increasing economic and diplomatic sanctions on Russia.” When asked about sending “additional arms and military supplies to the Ukrainian government,” 66 percent of Republicans and 84 percent of Democrats thought it was a good idea. Even when asked about accepting Ukrainian refugees and providing non-military economic assistance to Kyiv—points cited by the Heritage Foundation as reasons for opposing U.S. aid to Ukraine—most Republicans said they would support such policies (66 percent and 64 percent, respectively). The key takeaway here for our elected leaders is that the American people support broad assistance to Ukraine, want this help to be decisive, and understand our strategic interests in punishing Putin’s aggression.

As Fred Kagan eloquently observed, “We’re paying another country to fight a horrible war on its own soil so that we won’t have to fight a worse one on the soil of a NATO ally.” This is as much of a realpolitik assessment as any that has been offered by natcons, only it has the additional benefit of being true. And the American people understand.

When Russia first invaded Ukraine it struck me as a very important game-changing kind of event but also one that hinged on continued support in the West. Given the persistent partisan political bickering and short attention span of the American public, this seemed like a big risk.

Seven months later and the big surprise is not just how strongly the US public still supports Ukraine, but how uniformly the support runs across political affiliations. As Kitchen puts it, “Most polled Americans are in it to win it”.

Of course, American support alone will probably be insufficient to “win”. European support, not to mention cohesion, will be important as well and that is likely to be sorely tested, especially in the depths of this upcoming winter.

Nonetheless, the geopolitical payoffs are so disproportionately large, it would take some major setbacks to justify a change in tack. As a result, I suspect the continued strength of the US dollar will continue to be part of the geopolitical playbook for as long as it needs to be to “win”.

Monetary policy

The million (billion?, trillion?) dollar question for monetary policy is when does the Fed pause/pivot on its program of tightening?

One interesting observation is the magnitude of complaining the Fed is going way too far and is going to break things. While these rumblings may be true to some extent, they are also farcical. There was no bitter complaining when the Fed was way too easy for way too long. Nope, people were too pre-occupied to complain while they were making money. It is only now that stocks are going down that negative assessments of the Fed are becoming more vocal.

Another observation is the anxious awaiting of a Fed pivot is predicated upon the assumption that such a pivot will signal a return to the “glory days” of easy Fed policy and regularly rising stock prices. As @UrbanKaoboy intimates, the presence of “Structural Inflation” alters the landscape from which the Fed operates and constrains it in important ways. In short, with inflation, there will be no more Fed coming to the rescue.

As @UrbanKaoboy also suggests, the Fed’s clipped wings are an issue not just for US assets, but also for the world’s. Prior to the emergence of inflation, the Fed could be counted on to save not just US financial assets, but assets globally. For quite some time after Covid threw Fed interventions into overdrive, any little global hiccup was reason enough to forestall policy normalization.

As @PauloMacro describes, the Fed’s position regarding foreign stress has completely flipped. Now, foreign stress is not a consideration for Fed policy at all.

It seems like there is something more going on. While price stability is a primary objective of any central bank and inflation has presented a challenge the Fed has not seen in quite a while, its rapid dismissal of the highly collaborative global central bank paradigm for a go-it-on-your-own approach seems odd.

Further, every time in the past the Fed has started tightening, it hit emerging economies early and hard - and prompted plenty of loud pleas to stop. Given the widespread stress the strong US dollar is causing abroad, the absence of global outcry seems a lot like the dog that didn’t bark. In other words, the absence of vocal pleas to allow the dollar to weaken indicates something has changed.

My working hypothesis continues to be that the strong dollar policy is more than just an inflation fighting program, but also part of a high-level effort to engage Russia and China in what is effectively a war. In this effort, the US is deploying its most potent weapon, the US dollar, to weaken its opponents.

Insofar as this hypothesis is correct, it has significant implications for investors. First, the timing of any kind of pause or pivot is going to be more of a geopolitical call than an economic one. This is very different than where the consensus seems to be right now. Further, when the Fed does ease off the brakes, its is likely to be just that, an easing, not a major change in direction.

Second, this implies pain will be felt by everyone - this is what happens in a war. The US is likely to suffer far less than any other country, but that doesn’t mean there won’t be a reset of asset values and other such inconveniences.

Finally, when the geopolitical situation clears, there will be an opportunity to redefine international relationships and to establish a global currency system that is more sustainable. But it will mainly be dictated by the US.

Inflation

One of the oddities of the investment world is the frequent and very unspecific use of language. For example, real rates (rates less inflation) are an important financial indicator. The most common proxy for real rates is 10-year TIPS because the TIPS yield reflects a risk-free return and an expectation for longer-term inflation.

But the longer-term inflation expectations often follow the Fed’s guidance fairly closely. And here is the important part: The Fed’s guidance on inflation is terrible. Not surprisingly, the Fed’s guidance on inflation represents what it wants inflation to be, not what it is likely to be.

How and why does this matter? The yield on 10-year TIPS has now risen considerably up to about 1.3%. If this is taken at face value as the real rate, it suggests very tight monetary policy - in fact as tight it has been since 2011.

But that number should not be taken so literally. Let’s say, as I happen to believe, that longer-term inflation is more like 4% than 2%. Then the current 10-year yield of 3.96% minus inflation of 4% = a real rate of -0.04%, or very modestly negative. Mainly, it is not restrictive at all.

I think this is going to be a very big deal over the next few years. As “market” expectations for inflation shift away from empty Fed wishes to something more empirically-based, those numbers will go up and that will put additional pressure on the Fed to raise rates even higher. If that transpires, those expecting a quick pivot will be very sorely disappointed.

Investment landscape

Trust Me: It Will Be Enough

Let me stress out something: when it comes to financial conditions, markets first care about the shock - which is best represented by the rate of change in US Dollar, interest rates, credit spreads etc.

And while this is widely understood, investors often underappreciate the second dimension: after the shock, markets care about the time persistence of loose/tight financial conditions.

It’s pretty clear the Fed and other large central banks are dictating tight monetary policy as a baseline condition under which markets must operate. As Alf Peccatiello rightly points out in this piece, the rate of change policy tightening is important and gets a lot of attention. However, time persistence is also important but gets a lot less attention.

Persistence plays an important role because a lot of different businesses and financing structures can withstand intermittent periods of tightness. A lot fewer of them can withstand sustained tightness, however, unless substantial economic value is created through the venture.

This means over time, if the Fed just maintains rates at higher levels and continues QT, eventually quite a few firms will need to refinance on much less attractive terms. Whether it involves a company with a term loan, a private equity company trying to roll over some debt, or an asset backed securitization funded at ever-increasing short-term rates, the pain of tighter financial conditions will eventually be felt.

How long will the Fed remain tight? I can think of a lot of reasons so I will just list some of them: At least until the election in November. Until higher rates make housing more accessible. Until low-value asset-backed securitizations go under. Until the threats from China and Russia are largely “contained”. Until speculative behavior subsides. Until market leaders like AAPL also feel the pain (this may have started on Thursday). In short:

Yet another condition would be when retail investors stop buying the dip. Unfortunately, the tendency to keep reloading and buying whenever the market is down, regardless of reason, still seems to be an ingrained reflex …

Russell Napier: Knock-on Effects of Secular Inflation, October 7th, 2021

We're here to forecast what is likely. And what is likely in all the forecasts that I've talked about so far are all based on politics. And the problem is simple. The debt-to-GDP ratio is so high, that debt has to be inflated away. And you do not inflated away by handing the power to grant money to independent central bankers, nor the private sector for cryptocurrencies.

I came across this as I was going through some old research in order to gain perspective on the investment landscape today. Two points are highlighted here that are critically important for every investor to understand.

The first is that debt relative to economic production is at such a high level it can’t be kicked down the road much longer. As such, by far the best way of managing it is through financial repression. This means an extended period in which interest rates are kept below inflation. This is not in place today, but it’s coming.

The second point is these decisions are political, not financial or economic. The reason is because no politician will get re-elected once debt/GDP passes the point of no return. The implication is monetary policy is now set by the government, not the Fed. Investors who understand these two points will be able to establish a much clearer picture of what is going on and will be far less likely to get blindsided.

Investment advisory landscape

Almost Daily Grant’s, Tuesday, September 27, 2022

https://www.grantspub.com/resources/commentary.cfm

ARK is excited to share the exciting news of our partnership with @titanvest! Together, we aim to democratize investing, enabling investors to capitalize on exponential growth opportunities.

This is an excellent example of the kind of hypocrisy that pervades the world of investment products. The new fund has a management fee of 2.75% which is ridiculously high, but then adds another 1.47% in distribution (read: marketing) expenses that brings the total to 4.22%.

This compares to actively managed institutional fund fees that normally come out in the neighborhood of 0.5 - 0.7% and separately managed accounts that can be as low as 1%. Multiples more expensive.

Explain that the mission is to “democratize” investing, however, and apparently all is forgiven. Stuff like this is not illegal per se, but that doesn’t make it ethical either. As always, buyer beware.

Implications for investment strategy

One of the most common, but also most dangerous, assumptions regarding investment portfolios is that stocks should be heavily favored because their returns are higher “over the long-term”. This is true in a very general sense, but overlooks the potentially huge impact an investor might bear over his or her investment horizon when starting valuations are excessively high - as they are now.

In other words, it is perfectly plausible, even reasonable, to consider the investment landscape and current conditions when establishing a portfolio allocation. The best allocation can change over time based on changes in rates and stock valuations, among other variables.

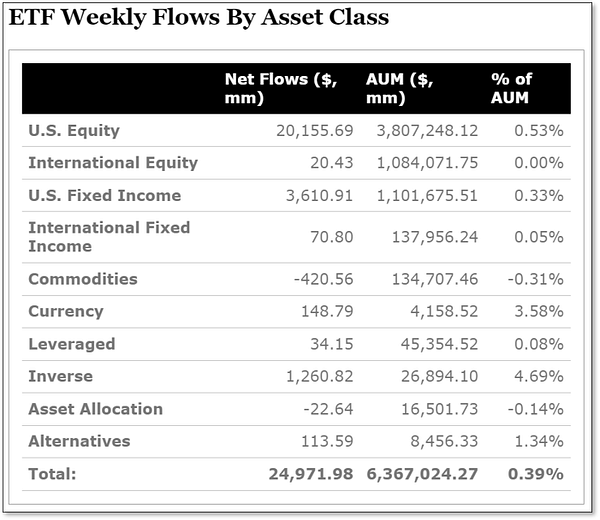

This is a point John Hussman made in his Strategic Allocation model published in 2019. In my adaptation of that model, a couple of points stand out. First, the recommended allocation is currently about 73% Treasury bills and about 27% stocks. Bonds are just not attractive enough yet to warrant inclusion. A number of investors are figuring this out and moving assets to cash.

A number of investors have not figured this out, however, and that is the second point. Still enamored of stocks, and energized by lower prices than at the beginning of the year, many investors are still shifting money into stocks. This is happening at a time when expected returns from stocks over the next twelve years (as indicated from the allocation model) are still negative.

The bottom line is this remains a time to be defensive. While there are always some opportunities that can arise, the main message is there is no evidence stocks in general are giving the “green light” for investment yet.

Note

Sources marked with ($) are restricted by a paywall or in some other way. Sources not marked are not restricted and therefore widely accessible.

Disclosures

This commentary is designed to provide information which may be useful to investors in general and should not be taken as investment advice. It has been prepared without regard to any individual’s or organization's particular financial circumstances. As a result, any action you may take as a result of information contained on this commentary is ultimately your own responsibility. Areté will not accept liability for any loss or damage, including without limitation to any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

Some statements may be forward-looking. Forward-looking statements and other views expressed herein are as of the date such information was originally posted. Actual future results or occurrences may differ significantly from those anticipated in any forward-looking statements, and there is no guarantee that any predictions will come to pass. The views expressed herein are subject to change at any time, due to numerous market and other factors. Areté disclaims any obligation to update publicly or revise any forward-looking statements or views expressed herein.

This information is neither an offer to sell nor a solicitation of any offer to buy any securities. Past performance is not a guarantee of future results. Areté is not responsible for any third-party content that may be accessed through this commentary.

This material may not be reproduced in whole or in part without the express written permission of Areté Asset Management.