Observations by David Robertson, 3/1/24

Even in a seasonally weak time of year, it’s pretty clear stocks don’t want to go down, at least not yet anyway. Let’s take a look at what’s been going on.

As always, if you want to follow up on anything in more detail, just let me know at drobertson@areteam.com.

Market observations

While the exuberance for stocks has continued, it has branched out from being mainly AI-centric to encompassing cryptocurrencies and other more speculative names. The one that stood out most to me was Carvana (CVNA). After posting its first profit last week, the stock jumped over 50% over the following three days.

As Almost Daily Grant’s reported (February 23, 2024), however, “the firm’s senior secured, 10 1/4s of May 2030 changed hands this morning at 79.4 cents on the dollar for a 15.39% yield-to-worst and 1,111-basis point spread over Treasurys.” With a spread that denotes distressed credit and with interest expense “nearly double the $339 million in adjusted Ebitda,” CVNA still looks more like a bankruptcy candidate than a path to riches.

The episode makes John Hussman’s recent comments all the more poignant:

As Ben Graham observed, there is intelligent speculation, but there are many ways in which speculation may be unintelligent. In my view, chomping down on the speculative bit amid record valuations, divergent internals, euphoric sentiment, and overextended market action is among them.

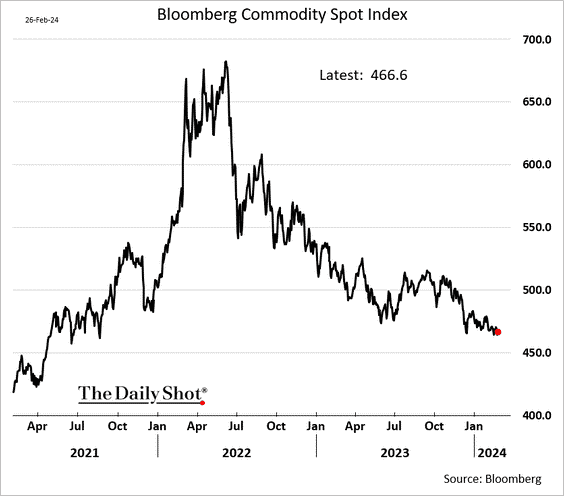

On the other side of the spectrum has been commodities. What had looked like the start of a new chapter for commodities with the Russian invasion of Ukraine a couple years ago has since faded considerably. One more piece of evidence why commodities are so hard to invest in.

Finally, in the category of interesting political associations comes this quote from Senator JD Vance on X: “I think Lina Khan is one of the few people in the Biden administration who is actually doing a good job.”

Public policy

TSMC is having more luck building in Japan than in America ($)

On February 24th TSMC, the world’s most advanced chip producer, will open its first fabrication plant in the country. Earlier this month it announced plans for a second plant nearby.

Contrast that with the Taiwanese giant’s other big international expansion, in America. Last summer it pushed back the start of production at the first of two plants it is building in Arizona from 2024 to 2025. In January it announced that a second plant, previously scheduled to open in 2026, would not be operational until 2027 or 2028. The second was meant to produce three-nanometre (nm) chips, the most advanced currently on the market, but TSMC has raised the prospect that it may now be used for less cutting-edge production.

This exercise of comparing and contrasting industrial policies is constructive on a couple of fronts. First, it makes clear on the fronts of labor relations, helpful local partners, and active subsidies, Japan is handily outperforming the US in incentivizing construction of semiconductor facilities. Further obstacles in the form of required environmental reviews in the US make the contrast even starker.

In addition, the comparison highlights the real, ground-level challenges of effectively implementing industrial policy, and by association, the real, ground-level challenges of engaging in industrial activity at all. Large, industrial projects are inherently complicated as it is, but are made even more so by countless regulations and other policy constraints.

The main point is that allocating some money to incentivize certain types of industrial activity can be a useful thing, but it is also only one part of a large and complicated puzzle. What is really needed is a more holistic process to adjudicate the costs and benefits of any given project to society. If policy cannot or will not do that, then capital markets will - and it will be expensive.

Monetary policy

What about the velocity of money? ($)

https://www.ft.com/content/24f6eb95-45bf-4fd6-9be1-c13d24785ea3

Today, in the “ample reserves” world, cash is everywhere, nor is it cumbersome to hold. The Fed will pay your bank or money market fund 5.4 per cent to sit on it … This means that velocity and money supply now mostly reflect Fed balance sheet policy. If the Fed is expanding the balance sheet, the money supply rises and velocity falls, because the excess money largely sits around. If the Fed is shrinking its balance sheet, money declines and velocity perks back up.

The punchline for investors, especially those steeped in the 1970s monetarist consensus, is that money isn’t what it used to be. Looking at the money supply and the velocity of money doesn’t render a reliable outlook for inflation because the Fed drives both.

I wrote before about some of the implications of the Fed’s shift to an “ample reserves” regime. This article picks up on the same idea. Namely, in an ample reserves regime, neither money supply nor velocity work the way they used to. Excess cash doesn’t have the same effect on prices because it’s not a zero cost hot potato. Velocity acts differently as well because it mainly fluctuates as a function of Fed balance sheet policy.

Because the new policy regime uses different mechanisms, it is harder to determine its effect on inflation. Why is inflation still running above target? Is the Fed just wrong - as it was about inflation in the first place? Or perhaps, the Fed has just miscalibrated and adjusted its setting too high? It’s hard to say. All we really know right now is the market’s assessment that financial conditions are “loose” varies materially from the Fed’s assessment that policy is “appropriately restrictive”.

Another possibility is the Fed’s policy is approximately correct, but early. Given the famous “long and variable lags” for monetary policy to take effect, maybe it just hasn’t fully kicked in yet. For example, it may be that a good chunk of distressed commercial real estate just hasn’t started sucking liquidity in a big way yet. Further, the Fed’s position may incorporate the possibility of a government shutdown or other disruption.

Regardless, the new environment introduces some new risks for Fed watchers. One is with a multi-dimensional policy regime, there are more variables to keep track of. Further, they may not always act in concert. It’s not just about short-term rates any more.

Another risk is the Fed can change course in regard to any of its policy parameters at any time. That’s good in terms of the Fed having a greater ability to avert major problems, but it’s bad in terms of trying to figure out what effect it is having on the economy.

Inflation

The personal consumption expenditures (PCE) report came out on Thursday and showed a notable increase month over month. PCE ex food and energy was up 0.4% for the month after reading of 0.1% in both November and December. Further, the significant increase happened despite a decrease in spending on goods. In other words, if there had not been goods deflation, PCE would have been even higher.

While the increase was widely expected, not least of which is because most of the data had already been reported, it showed a clear break higher from the downward trend established last fall. Of course, one shouldn’t place too much weight on one data point, but it’s not good to ignore a data point that is yelling out that things might be changing.

And yet, the narrative of low and near-target inflation lives on. Yahoo finance responded with the following headline: “Key Fed inflation gauge logs lowest annual rise in 3 years”. It sounds good and sure enough the S&P 500 added half a percent from the get go and after an already torrid start to the year. That framing, however, completely ignores the inflection that seems to have occurred. The tension between an ideal of low inflation and the reality of re-accelerating price pressures is likely to be an ongoing theme this year.

Investment landscape I

Chairman’s letter [2023], Berkshire Hathaway, Inc.

https://www.berkshirehathaway.com/letters/2023ltr.pdf

Last year BNSF’s earnings declined more than I expected, as revenues fell. Though fuel costs also fell, wage increases, promulgated in Washington, were far beyond the country’s inflation goals. This differential may recur in future negotiations.

Our second and even more severe earnings disappointment last year occurred at BHE [Berkshire Hathaway Energy]. Most of its large electric-utility businesses, as well as its extensive gas pipelines, performed about as expected. But the regulatory climate in a few states has raised the specter of zero profitability or even bankruptcy (an actual outcome at California’s largest utility and a current threat in Hawaii). In such jurisdictions, it is difficult to project both earnings and asset values in what was once regarded as among the most stable industries in America.

As usual, Warren Buffett dispensed some gems in his annual letter to shareholders which came out last weekend. The comments that most caught my attention were in regard to his railroad, BNSF, and the utilities that are part of BHE.

With BNSF, Buffett complained about wages going up faster than inflation. He also noted the responsibilities of being a “common carrier” on one hand, but also potentially having wage negotiations being mediated by politicians on the other.

In regard to BHE, Buffett highlighted the increasingly unfriendly regulatory environment for electric utilities. He describes the “fixed-but-satisfactory return pact” has been broken in a few states. Not only does that impose much greater uncertainty on an industry that had been stable for decades, but introduces the risk that “such ruptures may spread.”

In both cases, Buffett is lamenting the increasingly capricious intervention of politics into economic enterprises. While this is a fair point, it seems at least somewhat disingenuous given several decades of “capital” having been favored over “labor”. Regardless, the these incidents are evidence the political tides are turning against capital.

For someone like Buffett, who is a risk manager extraordinaire, these examples are useful lessons from which to learn. For other business leaders, these are early warning signs of what could be substantial threats to their business models. For long-term investors, this is an early warning sign that uncertainty is increasing in the business environment and the cost of capital is going up.

Investment landscape II

Uber’s buyback plan: what’s the return? ($)

https://www.ft.com/content/4caf0af8-b18d-4415-a57e-a337c56d7064

Some days ago I argued Uber’s share buyback plan only makes sense if its stock is cheap. Otherwise, it would be better to do something else with the money. Over the weekend, Warren Buffett summed up the point nicely in his annual letter: “All stock repurchases should be price-dependent. What is sensible at a discount to business-value becomes stupid if done at a premium.”

That is why it was distressing to hear Uber’s CFO describe the buyback in these terms: “We want to consistently be in the market. We’re going to start with actions that partially offset stock-based comp, and then we’re going to work our way up towards a consistent reduction of share count.” Uber should not want to be consistently in the market; it should not care about reducing the share count for its own sake. It should be focused on using capital where it earns the best returns.

From a financial perspective, the issue of stock buybacks is pretty straightforward. Warren Buffett sums it up best: “All stock repurchases should be price-dependent. What is sensible at a discount to business-value becomes stupid if done at a premium.”

Interestingly enough, the Unhedged team got a response from Uber’s CEO regarding the company’s very questionable policy regarding stock buybacks. While agreeing with the sentiment of buybacks being price-dependent, he argues he is not Warren Buffett and does not have the same acumen to make such determinations of value. As a result, he does dollar-cast averaging instead.

Hmmm. Sort of plausible, maybe. But if he has no idea what the stock is worth, why is he spending shareholders’ money on it at all? Sounds like Mike Green might have an answer: “Unfortunate that the C-suites are the key beneficiaries with buybacks benefitting their stock options most, but unsurprising.” Sounds about right.

Asset allocation

As the chart on bitcoin (from themarketear.com ($)) shows, price action and technicals have been unbelievably strong. No doubt, the opening up of spot ETFs early this year created an avenue for many would-be adventurers to jump in.

Whether many of those newcomers were actually making a new allocation to cryptocurrencies remains to be seen though. Namely, I highlighted Jim Bianco’s comments last week that most of the action thus far seems to be hot money that can leave just as quickly.

Interestingly, as money has chased into bitcoin ETFs, gold has remained relatively unchanged. Also interestingly, as gold has remained unchanged, gold miners have gotten hammered since the beginning of the year.

Some of the differential could be explained by a repositioning of hot money to the trade that is working better. Some of it could be due to some less than stellar performance from gold mining companies. Some of it could be due to short positions taken to offset other long positions. Regardless, such total lack of interest is exactly what you want to see when you are looking to add to/initiate a long-term holding.

Also on the subject of allocation, but in regard to another asset class, commercial real estate (CRE) may be getting more attention in coming days. As the FT’s Alphaville ($) reports, “somebody’s going to be holding the bag for the steep decline in US office values.” The report elaborates it is not banks that hold most of the CRE debt:

But non-banks still hold the most CRE debt, it seems, along with a large share of mortgages, corporate loans and auto loans. They’re even big in consumer lending, where large and mid-sized banks have a greater presence.

So, it looks like most of the CRE problems will show up in investment funds - pensions, endowments, and retirement funds. While this is good news in regard to systemic risk, it will be a sore point for the beneficiaries of those funds. Adding insult to injury will be the justification that CRE was added to diversify the portfolio.

Implications

So many of the explanations of the market’s incredible strength since last October revolve around fundamentals - namely sales growth and earnings growth. I continue to believe one of the most under-appreciated factors is public policy. Whether it be the Fed’s shift to an “ample reserves” monetary policy, or the Treasury’s shift to disproportionate funding with Treasury bills (vs. coupons), or the government’s ability to keep the fiscal spending spigots wide open, public policy hasn’t so much controlled the market, per se, but it has allowed the market to continue pushing ahead.

Thinking about the rationale of investors who feel compelled to chase the market momentum reminds me of the joke about what libertarians and cats have in common. The answer is they both act like they are independent and self-sufficient but in reality are utterly dependent on a system they can neither appreciate nor understand.

In other words, while investors may feel like they are independent and in control of markets, there are a lot of policy choices going on in the background that are facilitating them, at least for the time being. Most importantly, those policy choices can change - and will change as circumstances dictate.

As I suggested at the turn of the new year, current choices may very well reflect the prophylactic use of policy given anticipated challenges. Domestically, slower growth or even recession have to be considered as possibilities. In addition, large debt defaults in commercial real estate or other areas could crimp commercial lending which would impinge upon growth. It is also fair to assume the political sensitivity to these risks is especially high in an election year.

At least as important are challenges that might come from other parts of the world. If/when Japan tightens monetary policy, it is likely to have a negative effect on financial assets everywhere. If China devalues the yuan, a massive wave of deflation could fall across the world.

If these risks come to fruition, current policy settings will look like prescient safeguards. If they don’t come to fruition, there is a good chance the settings will be changed. Either way, it is perfectly understandable for punters to assess the situation and glom on to risk assets to take advantage. Based on the unusually frenetic and undisciplined activity, however, it looks like a lot of investors will be be harshly surprised by a system they “neither appreciate nor understand”.

Note

Sources marked with ($) are restricted by a paywall or in some other way. Sources not marked are not restricted and therefore widely accessible.

Disclosures

This commentary is designed to provide information which may be useful to investors in general and should not be taken as investment advice. It has been prepared without regard to any individual’s or organization's particular financial circumstances. As a result, any action you may take as a result of information contained on this commentary is ultimately your own responsibility. Areté will not accept liability for any loss or damage, including without limitation to any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

Some statements may be forward-looking. Forward-looking statements and other views expressed herein are as of the date such information was originally posted. Actual future results or occurrences may differ significantly from those anticipated in any forward-looking statements, and there is no guarantee that any predictions will come to pass. The views expressed herein are subject to change at any time, due to numerous market and other factors. Areté disclaims any obligation to update publicly or revise any forward-looking statements or views expressed herein.

This information is neither an offer to sell nor a solicitation of any offer to buy any securities. Past performance is not a guarantee of future results. Areté is not responsible for any third-party content that may be accessed through this commentary.

This material may not be reproduced in whole or in part without the express written permission of Areté Asset Management.