Observations by David Robertson, 8/4/23

Very different tone to the market this week. There’s lots of good stuff so let’s jump right in.

As always, if you want to follow up on anything in more detail, just let me know at drobertson@areteam.com.

Market observations

The US Dollar (USD) and stock volatility have both been notable lately for sending what may be some warning signals. As recently as a month ago, USD was declining as lower inflation suggested rate hikes were over. Similarly benign conditions in the market allowed the VIX index of volatility to touch down with a 12-handle at the end of July. Both moves supported stocks.

By mid-July the DXY dollar index moved off the 100 level and has marched consistently up since then. Likewise, stock volatility has reawoken and VIX (as of Thursday) pushed past 17. Did both of these just overshoot and are now recovering to more normal levels? Did the moves anticipate the higher funding Treasury announced just this week?

Hard to say of course, but if USD is regaining strength, which I suspect it is, things are about to get a lot harder for a lot of foreign borrowers. Here’s looking at you, China.

Commodities

Since well before the Russian invasion of Ukraine I have been looking for an opportunity to add to commodities. The feeding frenzy after the invasion had all the earmarks of herding so I waited. Last year, after commodities eased off, short rates were still rising and China was locked down by the end of the year, so I continued to wait.

This year I have been waiting for the US economy to slow down in order to allow the commodities stocks to wash out. Alas, resilient growth and moderating inflation has triggered a binge on stocks, including commodity stocks. With this context, Brent Donnelly does a nice job characterizing the environment for commodities:

Friday Speedrun: July 28, 2023

https://fridayspeedrun.substack.com/p/friday-speedrun-july-28-2023

Most of the commodities rallies we have seen over the past two years have had an element of financial speculation to them. Commodities as an asset class has brought billions of speculative dollars into the commodity markets and can often lead to huge swings and overshoots as the commodity markets cannot always handle the size of the flows specs want to move.

Given the important role of hot, speculative money in commodities, you want to stay away from popular trades in commodities because the herd moves fast and breaks things, and when the narrative turns, it can look like a bunch of buffalo stampeding toward a door like this:

True enough. For all the allure of commodities when prices are going up, they can be treacherous on the way down, especially when driven primarily by fast money. Hence my general caution on timing.

Several things are bugging me about the recent jump in commodities, especially oil. For starters, while the US economy is reasonably strong, China’s is not. Also, current supply is being intentionally curtailed by Saudi Arabia. Not only is the duration of such decisions tenuous, the desired outcome of higher prices is quite likely to force China to reduce demand.

In addition, there are other contributing factors. For example, as Rory Johnson points out, “Chinese apparent oil demand appears wildly strong at the moment and, for me and many others, this smells fishy given the widely reported malaise across the broader Chinese economy.” In short, the Chinese demand numbers look too high. Normalize those, and the supply/demand imbalance looks a lot more manageable.

There are offsets to all this, not least of which, the US economy is still humming along pretty well. Nonetheless, commodities are looking like a head fake to me here and I plan on waiting for a more compelling opportunity.

Inflation

The Case for "Higher for Longer": Prices are Disinflating, But Not Wages (Yet) ($)

https://theovershoot.co/p/the-case-for-higher-for-longer-prices

The main reason to worry is that nominal wages have consistently been rising about 5%-6% a year since last summer…Since consumer spending tracks wage growth better than anything else, real volumes of goods and services would have to rise about 3-4% a year for the current pace of wage increases to be consistent with 2% inflation. That would certainly be my preference, and there are good reasons to think that productivity might accelerate, but the likelier outcome is that underlying inflation is closer to 4% than 2%.

From Fed Chair Jerome Powell:

But I would say that wages are probably an important issue going forward. Labor market conditions broadly are going to be an important part of getting inflation back down and that’s why we think we need some further softening in labor market conditions.

One point here is wages are proving sticky and may well continue to be so. If this continues, which I expect it to, it will make inflation tougher to beat than current expectations indicate.

Another point is that the reason for all this is ultimately government policy. Increasingly labor-friendly practices benefit labor at the expense of capital. As such, government policy is working to boost wages (and therefore also inflation), regardless of what the Fed does. The key point is to look more to government policy than to monetary policy to get clues on future inflation.

Monetary policy

While the Treasury Borrowing Advisory Committee (TBAC) rarely makes headline news, its decisions fundamentally impact markets. Further, while these decisions technically do not comprise monetary policy, the subjects of how much debt to issue (to fund spending) and the composition of that issuance (i.e., bills vs. bonds) do affect monetary variables such as rates and currency.

The announcements this week certainly were newsworthy. The financing estimate for the third calendar quarter revealed a plan to borrow $1 trillion in the third quarter, which is $274 billion higher than the estimate made back in May.

The first point is $1 trillion is a LOT of money. The second point is the incremental increase represents an annualized error of over $1 trillion, which is also a LOT of money. Make no mistake, deficit financing is exploding.

What ultimately matters to the market is the quantity and type of extra supply (of government debt). All the talk of mortgaging our future is past; that future is here. One or the other (or both) of two bad things can happen. If more of the funding is done in bills, the currency will be most affected. If more of the funding is done in bonds, then such excess issuance will overwhelm demand at some point and cause yields to go up. In order to place those bonds, investors will need to sell other assets causing those to go down.

Based on the composition outlined on Wednesday, $177B in new bonds will be issued in the third quarter which is lower than expected. Offsetting that, the volume of bills is huge at $829B. In the fourth quarter, the story changes. New bond supply is set to be $339B and bills will go down to $513B.

Based upon the bond portion for both quarters being lighter than the portion in the aggregate debt composition, and the fact that bills are currently more expensive than bonds, it is clear Treasury is intentionally forestalling bigger bond issuance. What is not clear is exactly why. My best guess is it is trying to provide for the smoothest possible transition to higher bond issuance, and therefore higher bond yields, as possible. This could get really interesting in the fourth quarter.

Liquidity

The Great Liquidity Debate | Michael Howell & Andy Constan

Jack Farley did a great job getting two of the pre-eminent thinkers on liquidity together and posing thoughtful questions in order to get the most out of this “compare and contrast” session. I’m not a big fan of podcasts in general, but this one was terrific.

The main purpose of highlighting liquidity is to recognize it as an important determinant of asset prices, but it is also a concept that embodies a wide range of definitions. I highlighted a basic version of liquidity here and here and elaborated that it wasn’t quite so simple here. Howell and Constan built on those ideas.

While the basic version of liquidity had worked extremely well since 2020, it missed the strong run in stocks since October 2022. Part of this was the failure to capture activities of other major central banks, as Howell mentioned. In a broader sense, however, factors such as lower volatility, higher collateral values, lower oil prices, and greater repo funding (due to greater Treasury bill availability) were also contributing factors. As with so many things, what looked fairly simple at first was really pretty complicated.

Looking ahead, one of the main points of agreement is that the inverted yield curve is sending a bad signal. Many investors are reading that signal as an indicator of recession, but both Howell and Constan highlight the unusually negative term premium on long-term bonds. In other words, after accounting for other factors, long-term bonds are really expensive. One way or another, this anomaly will resolve itself and when it does, look out for higher long-term rates and lower values for risk assets.

Japan

Almost Daily Grant’s, Monday, July 31, 2023

https://www.grantspub.com/resources/commentary.cfm

Time for a game reset in the Far East? The Bank of Japan furnished investors with a two-pronged policy surprise in recent days, announcing Friday that it will relax its grip over lynchpin 10-year government bond yields, allowing the securities to range to as high as 1% from its previous 0.5% ceiling.

Needless to say, the prospect of a protracted inflationary revival could loudly reverberate, as the BoJ has figuratively moved heaven and earth – more than quadrupling its balance sheet over the past decade to ¥736 trillion, equivalent to 135% of GDP, or four times the output-adjusted holdings of the Federal Reserve – in hopes of attaining just such an outcome.

The main point is it sure looks like the time is nigh for Japan to begin undoing its long running monetary policy experiment in yield curve control. The implications are big given that Japan has a lot of savings and its low domestic rates have forced that money to look for higher rates elsewhere.

With the prospect of higher rates at home, Japanese savers can be expected to start moving money out of foreign investments. This is likely to provide a headwind for risk assets in many global markets, especially US Treasuries.

Investment landscape

Fostering Reality in an Unreal World

https://www.epsilontheory.com/fostering-reality-in-an-unreal-world/

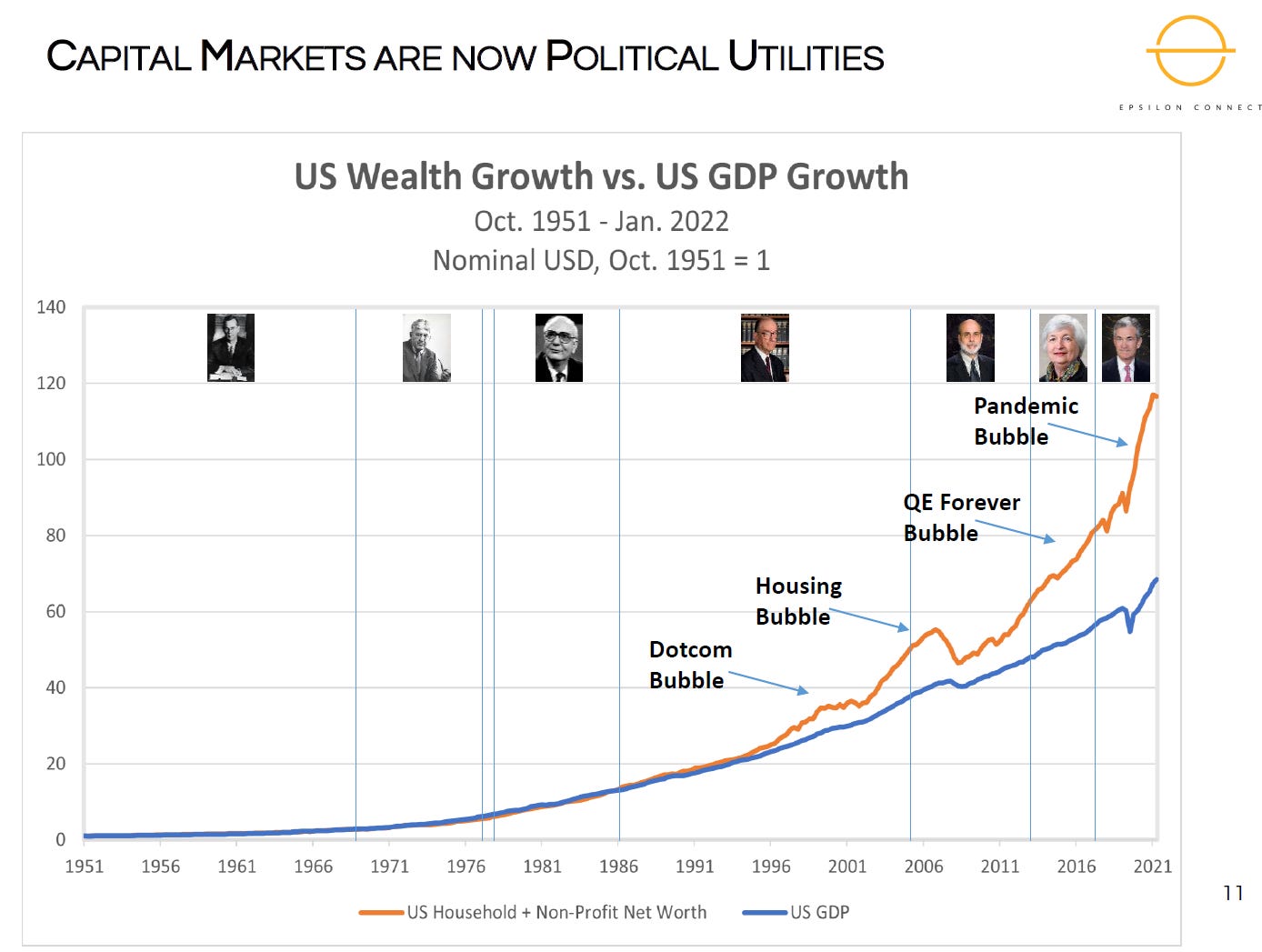

The first point to make is when analysts and commentators talk about markets “disconnecting from reality”, the chart above is what they are referring to. For most of history, markets were very closely related to economic activity. This makes sense because stocks are merely shares of cash flow generating capacity and cash flow generation is what comprises an economy.

Only since the mid 1990s have stocks and home values (i.e., the main components of net worth) accelerated far above underlying economic growth. While the proximate cause was lower interest rates, the ultimate cause was public policy. In other words, in the absence of strong growth, positive demographics, and capacity for pro-growth public policy measures, politicians decided to cheat. Instead of trying to get re-elected in a barely-growing economy, they decided to artificially inflate asset values to create the “appearance” of affluence. This is what Ben Hunt means when he calls capital markets “public utilities”.

The maintenance of capital markets as public utilities requires something of a propaganda effort and that is where “Point #2” comes in. When markets are public utilities, prices don’t matter. The only things that matter are stories designed to generate flow.

This helps explain a few things. A big one is why “value” hasn’t been working. Because price doesn’t matter. It also explains why downturns have been so few and far between. This is so because ever-increasing portions of the equity base are contributing flows regularly through 401(k) and other retirement plans. The vast majority of those funds are placed in products like target date funds which buy assets whenever money comes in and make no judgements on price or value.

As a result, there are very few truly discretionary managers who can sell. This makes it hard for prices to go down despite their vertiginous heights relative to economic output. But go down they eventually must. As Donnelly reports, “Eventually, a reset is necessary to reconnect capital markets to reality.” True that.

Investment landscape II

THE FOURTH TURNING IS HERE: What the Seasons of History Tell Us About How and When This Crisis Will End, by Neil Howe

Neil Howe is back with the widely anticipated update on his Fourth Turning thesis. The new book provides greater detail on past turnings and lessons that can be drawn from them. It also delves into much greater detail on existing generations and how each generational archetype plays a part in the progress through the cycle.

Indeed, viewing history as a cycle is probably one of the the biggest revelations for me. One of the most pervasive feelings I had reading through the book was that of relativism. For example, many characteristics I had once thought of as primarily personal, such as valuing competence and discerning truth from BS, happen to be widely applicable to Gen X. Most of us grew up in a fairly similar environment which favored pragmatism as a behavioral adaptation.

In a similar sense, what I had once considered as “good” things and “bad” things also take on a very different sense in the context of cyclical history. Take an issue like inequality. I can list a whole slew of reasons why lower inequality is better for a society. History makes clear, however, that inequality falls “Only during violent, traumatic, and (usually) deadly upheavals and the social reconstructions that inevitably follow them.” It doesn’t happen by itself or purely out of goodwill.

I recently watched the (excellent) documentary on Robert Oppenheimer and the Manhattan project in World War II. After the atom bomb was successfully developed there was little deliberation about whether or not to use it, a decision which often rankles today’s sensibilities. The rationale for doing so was in the name of the film, however: To End All War. The idea was that something absolutely catastrophic would be necessary to serve as a deterrent for posterity.

As a result, one begins to sense a yin and yang type of character to history. Certain extremes are necessary to serve as a catalyst to move society in a better direction. When that new direction becomes too extreme, then society swings back. As a result, periods in history are very much a function of the status of its generational archetypes at the time and not so much a “good” era or a “bad” one.

One of the most useful perspectives is gained by comparing prior Fourth Turnings to the current one. Howe writes, “Always occurring late in the Fourth Turning, the climax gathers energy from an accumulation of unmet needs, unpaid debts, and unresolved problems.” Sounds familiar, doesn’t it?

While the idea of a “reset” is fundamental to the construct of a Fourth Turning, and the reset is very difficult, it is also a very necessary process to compel society to find new ways to meet needs, pay debts, and resolve problems. Ultimately, I would argue, that is a good thing - and something to look forward to.

Implications

One of the important implications from the observations above is the government is in charge here. Whether the issue be inflation, wages, shape of the yield curve, what have you, the single most important causal factor is government policy: What are its biggest problems and what is it trying to accomplish?

Granted, those answers don’t come easily, but at least efforts to unravel them are productive. Following the priorities of industrial policy, largely at the expense of the financial sector, helped avoid significant losses in the first three quarters of 2022. While faith in the Fed failed in those three quarters, it worked pretty well in the fourth quarter of 2022 and the first two quarters of this year. The only problem is, there is no longer any compelling evidence the Fed wants to rescue markets or is prepared to do so.

On a different note, Ben Hunt’s notions that markets are public utilities makes things easier for long-term investors in an important sense. For those whose investment horizons are more than just a few years out, it makes no sense to risk a compression of the gap between net worth and GDP. For those whose investment horizons may be shorter, but are retired, it also makes no sense to take the risk. Those with short horizons are certainly free to speculate, but who wants to base their retirement on that?

This also ties in with Hunt’s point that investment stories are used to generate flows for Wall Street. Again, this characterization makes it easier in many ways for long-term investors. Simply assume the majority of stories you are told in regard to any investment opportunity are being told not to help you obtain better investment results, but for the purpose of generating flows. If you are unsure, ask for evidence the stories result in better performance. There almost never is any. As a result, listen to these stories if you wish, perhaps appreciate them for entertainment value, but be comfortable knowing they are not relevant to your situation.

A couple of implications also come out of the Fourth Turning thesis. One of the precursors of a Fourth Turning is a regeneracy, which Howe describes as “some important shift in issues along with a rearrangement of the constituencies arrayed on either side”. This is a big reason why I have been so interested in the few areas of bipartisan agreement such as support of labor (vs. capital) and opposition to corporate power. It’s not hard at all to imagine a “rearrangement of constituencies” based on these widely popular policies.

Finally, since a Fourth Turning involves a major reset and reconfiguration, it doesn’t make sense to take undue risks. As Howe puts it, it is best to “act like it is winter”. Specifically, “We should help our community prepare to be strong in the coming spring while allowing the least possible suffering so long as the storms rage.”

Well said. I would only emphasize that as difficult and unpleasant as a Fourth Turning is, it doesn’t last forever. It too shall pass and with it comes a “spring”.

Note

Sources marked with ($) are restricted by a paywall or in some other way. Sources not marked are not restricted and therefore widely accessible.

Disclosures

This commentary is designed to provide information which may be useful to investors in general and should not be taken as investment advice. It has been prepared without regard to any individual’s or organization's particular financial circumstances. As a result, any action you may take as a result of information contained on this commentary is ultimately your own responsibility. Areté will not accept liability for any loss or damage, including without limitation to any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

Some statements may be forward-looking. Forward-looking statements and other views expressed herein are as of the date such information was originally posted. Actual future results or occurrences may differ significantly from those anticipated in any forward-looking statements, and there is no guarantee that any predictions will come to pass. The views expressed herein are subject to change at any time, due to numerous market and other factors. Areté disclaims any obligation to update publicly or revise any forward-looking statements or views expressed herein.

This information is neither an offer to sell nor a solicitation of any offer to buy any securities. Past performance is not a guarantee of future results. Areté is not responsible for any third-party content that may be accessed through this commentary.

This material may not be reproduced in whole or in part without the express written permission of Areté Asset Management.