Observations by David Robertson, 12/9/22

‘Tis the season - for market outlooks for the new year! While I am not a believer in the usefulness of market earnings and price forecasts, I do believe it is important to have a decent framework from which to evaluate the things that might come up. As a result, this issue will focus more than usual on some key themes I expect will drive the investment landscape in 2023. If you ever want to follow up on anything just let me know at drobertson@areteam.com.

Market observations

It was a tough start to the week for stocks which created essentially the mirror image of the week before. In the absence of significant news, and awaiting reports on CPI and from Fed chair Powell next week, stocks fell over 3% Mon through Wed before climbing back 75 bps Thursday. For the most part, this just wiped out the unusual gains from the end of last week.

The one area of continued excitement has been China. Over the last month the China ETF, KWEB lurched forward in two big moves to leave it up 31% (through 12/7/22). Anxious investors are taking signals of relaxed Covid policy at face value and betting on a more complete reopening imminently. While it would be bullish if these developments do come to fruition, China runs its own policy playbook and it is often subject to translation errors in the West.

Economy

Such a great illustration here by @Vincent Deluard. “Yes”, he follows up, “inflation and the economy are slowing, but nowhere near as fast as the Twitter doom crowd imagines”.

In other words, the evidence that the economy is slowing down is correct. However, the evidence that the economy is taking the express route to recession is incorrect. Jobs, earnings, and sales are all holding up better than that dire narrative would predict.

The main takeaway is there is nothing clean or easy about analyzing the economy in this landscape. Expect noisy data, multiple cross current and unclear trends. In such an environment it is best to rigorously interpret data, constantly formulate and test hypotheses, and hold opinions lightly.

Inflation

Immaculate Disinflation Hopes Dashed? ($)

https://theovershoot.co/p/immaculate-disinflation-hopes-dashed

The latest data from the U.S. suggest that inflation may be too entrenched to go away entirely on its own. While the headline rate of inflation probably peaked over the summer, underlying price pressures have proven remarkably stubborn despite the apparent normalization of the public health situation … The problem is that the rate of improvement (third derivative of prices with respect to time) seems to have stalled, making the prospects for a soft landing look worse than even a few weeks ago. Unless that changes, inflation net of temporary factors will probably persist around 4-5% a year.

Matt Klein is one of the more thorough and thoughtful economic analysts out there and as a result, his argument for transient inflation has been an important “sparring partner” to my view that inflation is more structural in nature and therefore will be more persistent.

In his recent piece, he has considerably softened his stance by acknowledging that the current trajectory for inflation appears to be “around 4-5% a year”. I don’t think this change in position detracts from Klein’s analysis, but it does highlight a challenge that is befuddling a lot of analysts right now. While Klein was mainly right about the purely economic issues, he did not seem to fully incorporate some important political and geopolitical considerations.

A person who has been very right on the inflation call is Russell Napier (mentioned here, here, here, here, here, here, and here). A big part of his success can be attributed to the fact he used a different starting point for his analysis: He started with history and politics rather than economics.

From a very high level, Napier saw that highly indebted governments needed to create inflation to manage excessive debt levels and that the combination of fiscal and monetary stimulus was the path to accomplish it. Getting too far into the economic weeds made it hard to see the most important drivers.

As more people like Klein eventually accept the drivers of inflation range beyond transient pandemic-related bottlenecks, expectations for higher sustained rates of inflation will rise. I fully expect this to be a major theme in 2023.

Politics

The end of benefit of the doubt for disruptive leaders

https://www.axios.com/2022/12/03/the-end-of-benefit-of-the-doubt

No. We're in no mood to give Elon Musk a break. Nor ByteDance. Nor Sam Bankman-Fried. Nor, for that matter, the entire crypto industry. There's a new vibe in town, and it's unforgiving.

When failure involves massive negative externalities — depositors losing their money, say, or Russia finding itself capable of influencing the 2016 U.S. presidential election — large upsides must be weighed against potentially devastating downsides.

Very interesting piece here from Axios. When I started Areté in 2008, I mainly wrote about subjects that I thought were underappreciated and yet very relevant for investors. I picked out things like abuses in pro forma accounting, excessive monetary policy, poor corporate governance, and bad business models among others.

The collective response was a big yawn. People were too busy getting over the GFC to start - and then too busy watching stocks go up after. They didn’t have the time, attention, or interest to investigate the incredibly weak foundations upon which those stock gains were being built. They were enthralled by “visionaries” and “big ideas”.

That mood seems to be changing dramatically. As more ventures are becoming widely recognized as unsustainable businesses and more entrepreneurs are becoming widely recognized as blowhards, if not outright frauds, the tolerance of bad behavior and crappy business ideas is rapidly evaporating.

The U-turn in social mood is tellingly captured by the fact that the “top-earning finance publication on Substack” is written by a small team of analysts that goes by the name of Doomberg (as in gloom and doom). Doomberg describes its ethos as “defensive pessimism” and uses the tagline, “Chicken Little Gets a Terminal.”

What I find extremely interesting is not only are people pushing back against the charlatans and frauds of the last fifteen years, but they are going further and actively seeking out smart, thoughtful ideas to solve big problems. This is just one small corner of the universe, but it is very encouraging.

Another political trend that is very interesting is the increasing desire for government to exert control in order to “solve problems”. Never mind the government probably had a major hand in creating those problems; people want something done. And, if people want something done, politicians will respond to those desires and do something.

While this sounds offensive and preposterous to those with a free market mindset, it is important to observe the political winds for what they are, not what we think they should be. The fact of the matter is that a lot of people want the government to “do something” about inflation. This means there is a very good chance the government will do something, even if that something is counterproductive and wildly inappropriate. Get used to it; it’s not likely to be pretty.

Oil

Russian Oil Price Cap Will Please the US, and No One Else ($)

The $60-a-barrel price cap on Russian crude took effect today. Don’t expect it to make anybody outside the US administration happy.

I’m sure Russia will retaliate. It could halt pipeline deliveries to Europe or stop seaborne supplies to Bulgaria, which can continue to import Russian crude by ship until the end of 2024. But it could have done that at any time in the past nine months.

News of the new oil price cap caused a lot of scuttlebutt and no small number of forecasts that the cap would make a tight oil market even tighter. While oil prices jumped a bit in anticipation, it has been nothing but a resumption of a selloff that began back in early June. It is looking like a case of “buy the rumor, sell the fact”.

That said, it is still very early days with the price cap and there are plenty of ways Russia can retaliate. The bottom line is the geopolitics surrounding the oil market have so many moving pieces that it is very hard to arrive at high conviction for moves in either direction.

Monetary policy

Zoltan Pozsar: Gold To Soar, Crush Western Banks When Putin Unveils Petrogold ($)

Zoltan Pozsar is out with another insightful note and there are three big takeaways from it. One is that the attention paid to bank reserves and repo funding, i.e., the areas that caused a “breakage” in 2019, are misdirected. Changes have been made, the landscape is different, and such concerns amount to fighting the last war.

That said, the dynamics of funding markets do provide a useful analogue for understanding commodity markets. For starters, oil markets are tight just like bank reserves were in 2019. In addition, with sanctions on Russian oil and tit-for-tat demands in reaction, this tightness may very well get expressed in a way that leaves gold and oil much higher in US dollar terms. This supports the longer-term bull case for oil in particular and commodities in general.

Finally, once again geopolitics is becoming an extremely important consideration for a lot of areas, including monetary policy. If gold rises materially as a function of being tied to oil transactions, that would clearly also affect the relationship between gold and the US dollar. Further, if gold became a critical currency for transacting oil, the need for banks to have sufficient supplies of physical gold to back paper transactions would increase significantly. Bottom line, if you overlook geopolitics, you are missing many of the key forces impinging upon the global monetary system.

Monetary policy II

As I have argued many times here, liquidity is the name of the game in an age of massively bloated central bank balance sheets. That means in order to understand the general direction of the market, you need to understand whether net liquidity is being provided or withdrawn.

One key part of the liquidity dynamic is the Fed’s Quantitative Tightening (QT) program. After a cautious start, QT is now humming along and pulling its targeted $95B of liquidity each and every month for the foreseeable future. This is the penance for overindulging in monetary stimulus after the pandemic hit.

If this were the only factor it would be very negative for markets and has been the basis for my bearish stance since the beginning of the year. Two other factors come into play, however: The Treasury’s General Account (TGA) and the Fed’s Reverse Repo Program (RRP).

The RRP has bounced around a bit but net/net hasn’t been a huge factor for liquidity in the short-term. It will be a consideration longer-term, however, as it holds over $2 trillion that will need to end up in Treasuries or something similar.

The bigger question mark has been the TGA. The Treasury said it was targeting a level of $700 billion by calendar year-end. As of the 12/6/22 report, it sat at $411B. A month ago it was $531B and two months ago it was $612B. Since early October, then, the TGA provided about $200B in additional liquidity that was not expected. It’s not too hard to draw a line between that phenomenon and the rebound in stocks over the same period.

Going forward, things get more challenging, however. One could argue the Treasury will forego its $700B target in order to keep liquidity available to get cleanly through the end of the year. Such a move would leave it vulnerable in the event Republicans decide to take a stand on the debt ceiling early next year. Either way, eventual replenishing of the TGA would cause a big additional draw on liquidity that would surely cause a chill wind in markets.

So, there are a number of moving parts in the liquidity dynamic and most signals point to a challenging start to the new year.

Investment landscape

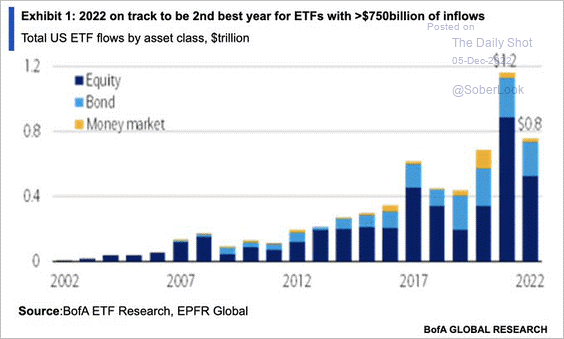

This illustration captures the effects of increasing passive penetration as well as any. In a year of terrible returns for both stocks and bonds, one that would normally send investors fleeing for the cover of safety, investors instead continue pumping money into ETFs in what is looking to be the second best year for inflows in history.

This paradox can be explained by the logic of the passive algorithm: If money comes in then buy; if money goes out then sell. It is no more complicated than that. Since very large chunks of investment funds like 401(k) plans receive automatic inflows (regular paycheck contributions) and since those pools are dominated by passive funds like ETFs and target date funds, the flows come in regardless of what the market is doing. There is no discretion exercised.

This is a point Mike Green at Simplify Asset Management has (rightly) been harping on for some time. One potential problem is that markets could be thrown into a tailspin if the regular inflows to ETFs were ever to subside - because there just wouldn’t be enough buyers to fill sell orders. Prices could fall dramatically if this happened.

Further, the scenario that could cause such a ruckus is not only possible, but to a large degree, probable. In the event unemployment goes up significantly, and lots of well-paying jobs are lost, the regular, automatic contributions to 401(k) plans that go along with those jobs would be lost too. Inflows to ETFs would slow down.

All this points to another potential problem. Just like polluting imposes a cost on a public good like a clean environment, so too does the proliferation of passive investing impose a cost on the public good of price discovery. This was an issue I addressed in a blog post last year.

In other words, the massive proliferation of passive investing has done great damage to price discovery. More plainly, the effect of so much money coming into stocks has been to push prices far beyond what fundamentals would dictate. Once those flows slow down, look out below.

To be sure, the vast majority of investors have not pursued passive investing with the evil intent of pushing stocks into a bubble. At the end of the day, though, what matters is not the intent (or lack thereof), but the fact of excessively valued securities. This is quite likely to get messy and passive investment vehicles will be right in the middle of it.

Implications for investment strategy

2022 has been the coming out year for inflation and rate increases to deal with it. I fully expect inflation to remain a nagging problem next year, but the particular way it gets manifested will depend on three main driving factors.

The first is geopolitics. Since national security takes precedence over other considerations, the three way scrum between US, China, and Russia will broadly dictate policy direction for each country. At very least, expect currencies, energy, commodities, and trade to be directly in the crossfire of this geopolitical shootout.

Second, while rising rates were the main cause for stocks to go down this year, next year the emphasis will shift to weak earnings. As inflation remains stubbornly high and economic growth slows down, record corporate profit margins will finally get hit. This phenomenon will surprise a lot of people in its magnitude and persistence.

The third driving factor for next year is going to be illiquid investments. When rates were stuck at ridiculously low levels, investors reached for yield in private equity, venture capital, real estate, and other “alternative” investments. The only problem is these investments are hard to liquidate: When investors want to cash out, it can take quite some time to do so, if it is allowed at all. This is already happening with the Blackstone funds BREIT and BCRED and is going to ripple through markets broadly next year. The key will be to stay very liquid while this wildfire runs its course.

Note

Sources marked with ($) are restricted by a paywall or in some other way. Sources not marked are not restricted and therefore widely accessible.

Disclosures

This commentary is designed to provide information which may be useful to investors in general and should not be taken as investment advice. It has been prepared without regard to any individual’s or organization's particular financial circumstances. As a result, any action you may take as a result of information contained on this commentary is ultimately your own responsibility. Areté will not accept liability for any loss or damage, including without limitation to any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

Some statements may be forward-looking. Forward-looking statements and other views expressed herein are as of the date such information was originally posted. Actual future results or occurrences may differ significantly from those anticipated in any forward-looking statements, and there is no guarantee that any predictions will come to pass. The views expressed herein are subject to change at any time, due to numerous market and other factors. Areté disclaims any obligation to update publicly or revise any forward-looking statements or views expressed herein.

This information is neither an offer to sell nor a solicitation of any offer to buy any securities. Past performance is not a guarantee of future results. Areté is not responsible for any third-party content that may be accessed through this commentary.

This material may not be reproduced in whole or in part without the express written permission of Areté Asset Management.